Calls about the death of the 60/40 model have grown louder over the past few years with many investors warning bonds no longer act as a significant diversifier to equities during market selloffs, however, it is too early to write off the asset class altogether.

Since the Global Financial Crisis in 2008 and the beginning of quantitative easing programmes, investors have expressed concern about the role of bonds as a traditional diversifier within multi-asset portfolios. With the traditional 60/40 in a highly correlated downward spiral and real yields remaining firmly in negative territory, one of the oldest debates in asset allocation has reared its head as market volatility shows little sign of abating.

At the core of the argument is a simple idea: a 60% equity and 40% bond portfolio consistently provides investors with attractive risk-adjusted returns, with bonds performing their hedging role during equity downturns in deflationary periods.

The problem is the current downturn is running alongside 40-year-high inflation – and this is something bonds do not have an answer for. In fact, according to Edward McQuarrie, professor emeritus at the Leavey School of Business at Santa Clara University, the 60% S&P 500/40% investment grade bond portfolio is currently on pace to book its worst annual returns since 1938 and fifth worst in the full span of his data, going back to 1793.

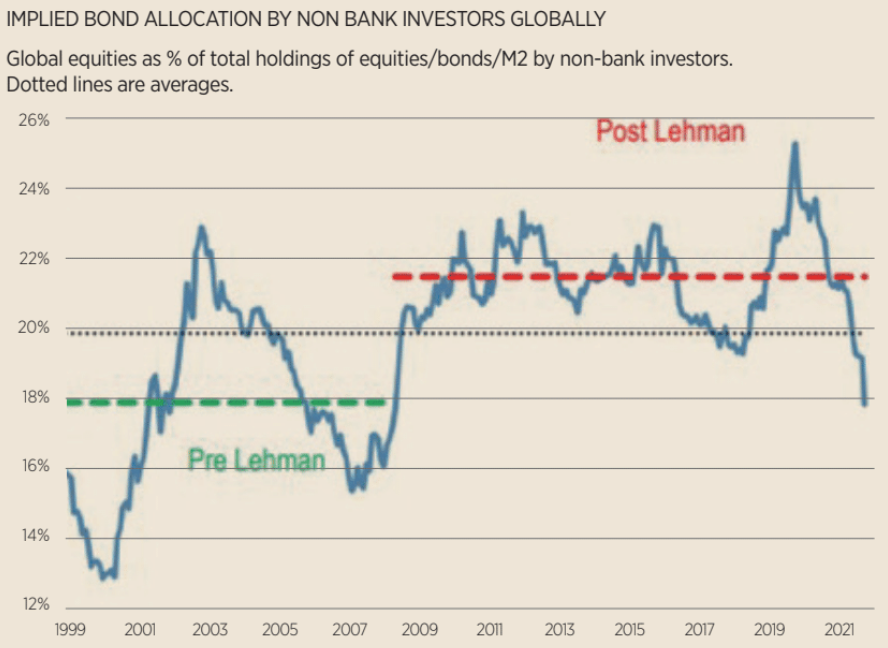

Going into this challenging period, bonds were already out of favour. According to a study by the Thinking Ahead Institute, pension funds allocated 30% to bonds, while JP Morgan’s Global Markets Strategy report in March estimated bonds made up just 18% of the average non-bank investor portfolio, the lowest level since 2008.

Source: Bloomberg / JP Morgan

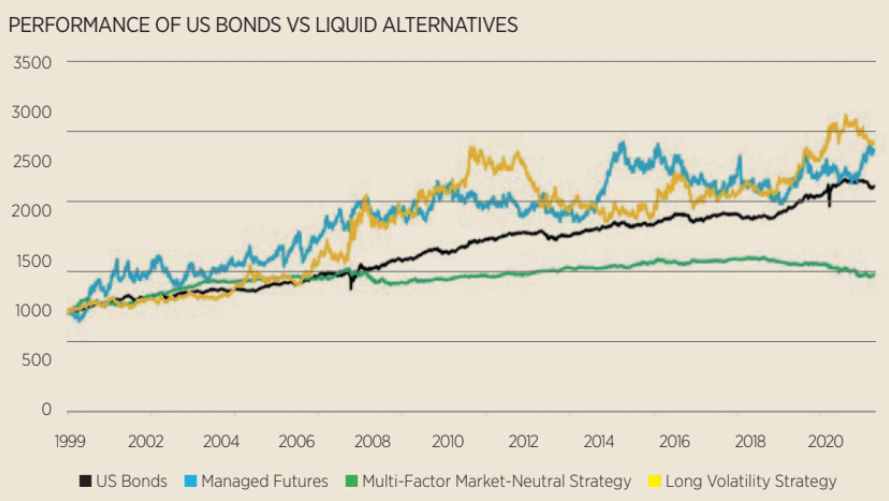

An unexpectedly high recent core price inflation reading in the US and divisive tax cuts in the UK perhaps suggest policymakers have and will continue to struggle to manage inflation. It now falls to investors to decide whether to stay the course or seek out hedging opportunities such as managed futures, multi-factor market-neutral and long volatility strategies. An example of the former, the AQR Managed Futures Fund (AQMIX), has returned 40.7%year-to-date, as at 27 September, versus -17.1% for the S&P 500 Investment Grade Corporate Bond index.

Speaking on fixed income alternatives, John Leiper, CIO at Titan Asset Management, told ETF Stream: “We moved away from the 60/40 model a while ago, primarily when we implemented our commodity carve-out during COVID-19 volatility in April 2020.

“At the end of last year and into this year, you can see with equity and bond correlations going through the roof, yields spiking and equities falling, everything was down, meaning there were no diversification benefits from holding equities and bonds.”

Leiper said the firm’s Acumen 7 Portfolio currently ranks in the top 10% of IA Sector funds owing to its diversification into commodities. He added the firm looks at other diversifiers such as long-short strategies, infrastructure and real estate investment trusts.

Four golden decades and one year of correlation.

However, in finance, times of market stress are often accompanied by the cliché that we are living through an ‘unprecedented event’. It just so happens that this description rings somewhat true given markets have not seen a stagflationary event of this manner since the 1970s.

David Henry, investment manager at Quilter Cheviot, previously noted the MSCI World index and UK gilts have only booked negative quarterly returns in tandem nine times since 1986 and only one of those instances was over consecutive quarters – this year. It may be wise, therefore, not to write off an entire asset class because of an outlier moment.

Even more reason not to write o bonds is because of what happens after both parts of a 60/40 post negative returns. According to Henry, only one instance of downturn since 1986 was not followed by returns exceeding 5% for the following year. Supporting this, professor McQuarrie found all years since 1793 where the 60/40 portfolio fell by more than20% were followed by five years of annualised returns averaging 13%.

Source: Bloomberg

Even in their current predicament, bonds continue to boast income and defensive qualities. Wayne Nutland, head of managed index solutions at Premier Miton, suggested: “Negative momentum in bond returns could persists inflation remains elevated and markets speculate over where central bank rates will peak and settle.

However, for the long-term investor, bond yields offer significantly improved expected returns compared to a year ago and depending on longer-term central bank rates, may provide scope for capital appreciation in the scenario of a deflationary economic shock.”

Mark Northway, investment manager at Sparrows Capital, added: “We concluded last year that bonds remain a diversifier, that they were relevant for calibrating volatility to an investor’s risk tolerance, and they were the ‘least worst’ alternative. The first conclusion has been challenged but the others remain valid.”

He added there is a case to be made for a systematic approach using bonds, rather than chasing returns in other diversifiers.

“Our allocations are fixed, whether in our bespoke portfolios or in our MPS,” Northway said. “There is a wealth of academic evidence showing that well intentioned intervention –whether by DFMs, consultants, advisers or end clients – tends to erode value.

“We limit ourselves to a rule-based rebalancing process which effectively involves selling out of outperforming allocations and buying into underperformers; this ensures that portfolio risk remains as intended, while benefiting from mean reversion over time.”

Deflation and recession a reminder of bonds’ worth

Looking ahead, Leiper argued there is a possibility equities have only been through one round of downturns, with a second round of risk aversion potentially on the way based on downward revisions of corporate profit margins and bot-tom-up earnings per share (EPS) through the rest of the year.

Should this play out alongside central banks continuing to raise rates, Leiper said a deflationary recession scenario could be on the cards, with bonds currently priced at “attractive levels”.

While still not following the 60/40 model, he argued: “Looking ahead six months, there may well come a point – given how far yields have backed up and if this recessionary narrative picks up on particularly poor Q3 and Q4 earnings seasons for corporates – the role of a bond in a traditional portfolio might re-establish itself in a way that had been weakened over the past year or so given the diversification benefits have not been there.

“The 60/40 has not done anyone any favours recently whereas alternatives have played an important role over this period but that does not mean we might not rotate back into a scenario where the role of bonds to diversify comes back into its own. That will be consistent with both the recessionary and peaking inflation narratives playing out.”

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles