Professional investors only. Capital at risk.

Energy-hungry industrialisation has been good for humanity, lifting vast swathes of humanity out of poverty. This process is still ongoing with developing economies also undergoing their own industrialisation and push for better living standards. As a result, electricity demand is expected to surge by 76% in 2050 relative to 2021.¹

But the world faces a crisis, as the use of cheap fossil fuels threatens disastrous consequences in the form of climate change. Fossil fuels currently supply about 85% of the world’s energy.² The task, therefore, is to find a way to meet both the world’s current and future energy demands in ways that do not emit carbon.

As a result, it is projected that by 2025, renewables will constitute 35% of global power generation, up from 29% in 2022.³ Though wind, solar and hydroelectric power often symbolise renewable energy, unpredictable weather events can compromise their reliability.

Increasingly, nuclear energy is seen as the solution. The power source offers an efficient, reliable, safe and environmentally-friendly energy source that could be the answer for countries striving to achieve net-zero carbon emission targets and enhance energy security.

Why nuclear power?

Nuclear power plants have undergone significant advancements over the past few decades. Enhanced technology allows these plants to operate with greater efficiency and experience fewer, shorter disruptions in power delivery.

Compared to traditional and alternative energy sources, nuclear energy boasts the highest capacity factor, solidifying its position as the most reliable baseload power source. Moreover, the energy density of uranium surpasses other fuels, making it immensely potent.⁴

In terms of environmental impact, nuclear energy emits the least CO2 equivalent compared to other energy mediums and has the smallest full-cycle carbon footprint. Furthermore, the waste it generates is minimal. To illustrate, the accumulated spent nuclear fuel from the US over the past six decades could fit within the confines of an American football field, stacked less than 10 yards high.⁵

Notably, nuclear power stands out for its safety. Statistically, it is substantially safer than fossil fuels, with a lower mortality rate per TWh of electricity produced than wind, hydro, natural gas, oil and coal.⁶

Influence of global policy

Governments worldwide are recognising the indispensability of nuclear power in achieving their carbon-neutral and security objectives. This year has witnessed an unparalleled wave of announcements for nuclear power plant restarts, life extensions and new builds.⁷

Currently, 434 nuclear power plants operate worldwide, with 59 under construction and 111 more planned.⁸ Of these, China is constructing 23 new nuclear plants, augmenting its existing fleet of 55. China has set an ambitious target of achieving 400 gigawatts by 2060, intending to supply roughly 18% of its electricity demand.

In the US, President Biden’s heralded infrastructure bill, the Inflation Reduction Act (IRA), allocates over $10bn to bolster at-risk nuclear power plants and advanced nuclear energy initiatives.

Although France remains the leading figure in nuclear energy in Europe, “new nuclear” movements are gaining political traction in Sweden, Belgium, Finland and the Netherlands. The UK is also channelling funds toward nuclear power, primarily focusing on reactor life extensions and new infrastructure projects.

Uranium miners may be poised to generate higher revenues and potential profits as uranium mining production ramps up.

Supply-demand dynamics

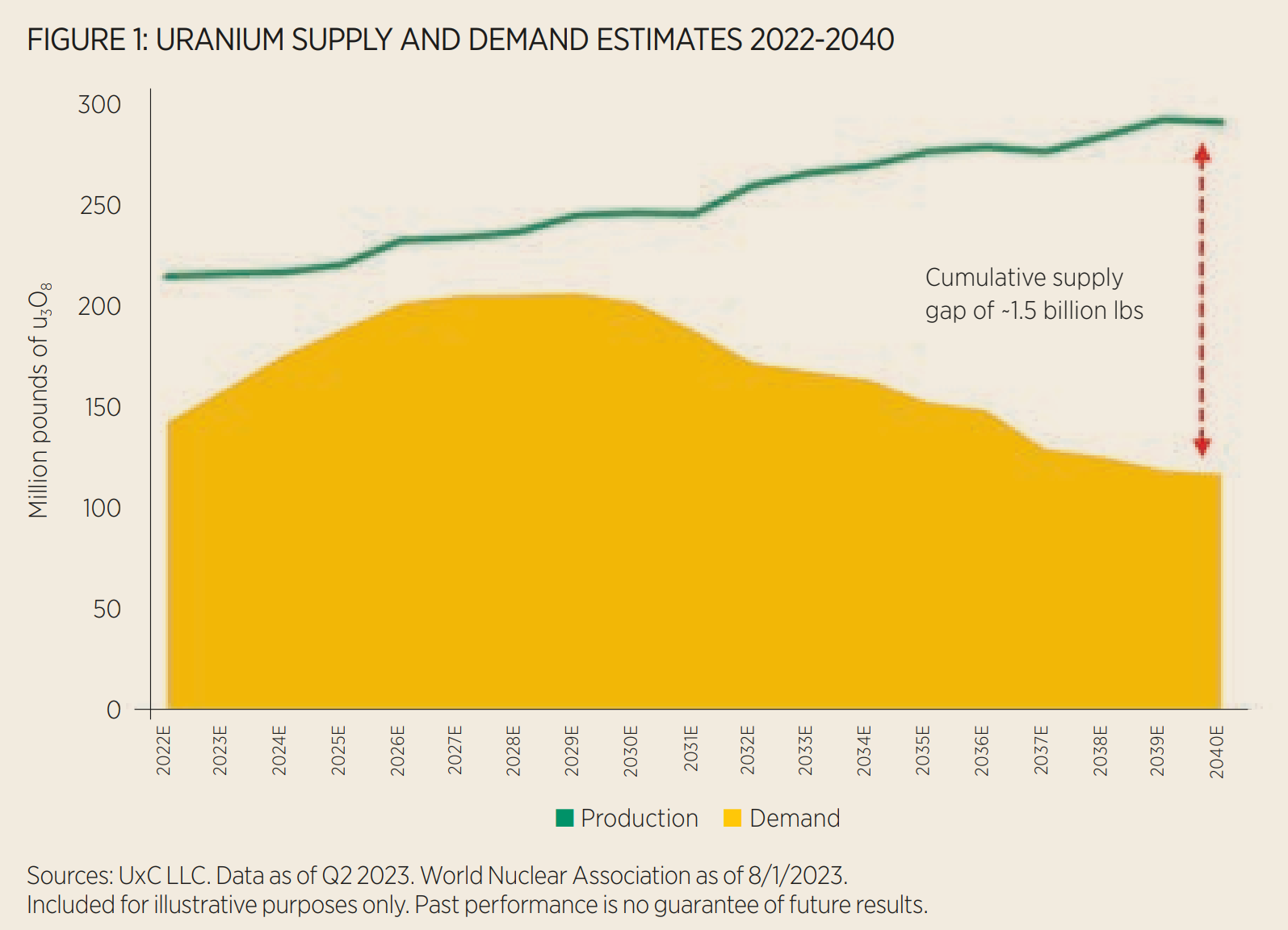

Primary uranium mine supply is significantly trailing demand, with a cumulative forecasted supply shortfall of approximately 1.5 billion pounds by 2040 (see Figure 1). Even with tapping into secondary sources like recycled materials, decommissioned military weapons and the re-enrichment of depleted uranium, the supply will likely still fall short of demand. The nuclear power industry is recognising the need for more uranium mining.

Given growing positive sentiment and worldwide investment into nuclear builds, restarts and expansions, the nuclear renaissance is poised to face a major supply challenge. Although this may support uranium prices, we believe the supply-demand gap will continue to pose challenges and that demand will likely outstrip supply for the foreseeable future.

Opportunity for uranium miners

This growing reliance on nuclear energy is increasing demand for uranium, and we believe this provides attractive investment opportunities for uranium miners. After decades of overproducing, uranium miners can no longer meet the demand from existing nuclear reactors,⁹ and the uranium production/demand imbalance may widen well into the next decade.¹⁰

Concern about future uranium supplies has utilities purchasing uranium in quantities not seen for a decade. Cameco, the world’s largest publicly traded uranium miner, has contracted to sell 118 million pounds of uranium this year, which compares to 125 million pounds for all of 2022. Uranium spot prices are beginning to present an incentive for certain miners to expand their uranium production.

In the emerging uranium bull market, spot prices are starting to approach incentive ranges that make developing greenfield projects (new exploration on unmined terrain) economically viable. Uranium miners may be poised to generate higher revenues and potential profits when mining production ramps up.

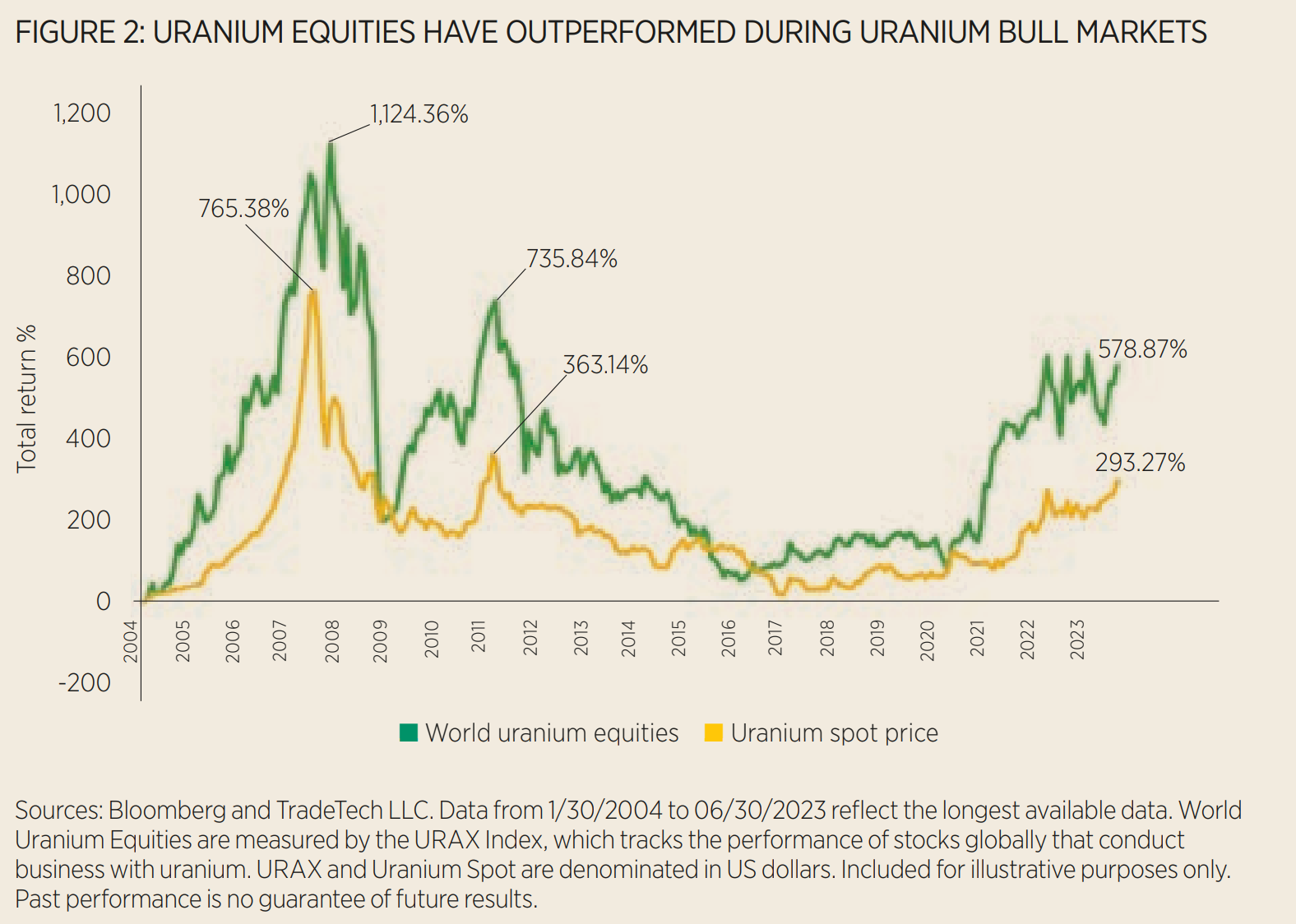

As shown in Figure 2, uranium mining stocks have historically performed better than the underlying uranium spot price in advancing markets.

How to gain exposure?

The Sprott Uranium Miners UCITS ETF (URNM) seeks to provide investors with a way to invest in the growth of nuclear power through exposure to uranium miners. This comprises companies involved in the uranium industry, spanning the mining, exploration, development and production of uranium.

URNM is also permitted to invest in entities that hold physical uranium. Around 18% of URNM’s holdings are entities providing exposure to the spot price of physical uranium. This allows the investor to gain exposure to both mining equities and the commodity.

Since its launch in May 2022, the ETF has surpassed $150m AUM. The ETF was launched by HANetf in partnership with Sprott Asset Management, leaders in the mining, metals and uranium investing.

HANetf and Sprott Asset Management have also partnered to launch the Sprott Energy Transition Materials UCITS ETF (SETM), providing exposure to the critical materials needed for decarbonisation.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full magazine, click here.

1 IEA World Energy Outlook 2022 Stated Policies. 2 https://environment.co/percentage-of-fossil-fuels-used-in-the-world/ 3 IEA Electricity Market Report 2023. 4 US Energy Information Administration and energy.gov. Data as of 12/31/2022 5 https://www.energy.gov/ne/articles/3-reasons-why-nuclear-clean-and-sustainable 6 https://ourworldindata.org/nuclear-energy 7 World Nuclear Association as of 8/1/2023. 8 World Nuclear Association as of 8/1/2023 9 OECD-NEA/IAEA, World Nuclear Association as of 12/31/2022 10 UxC LLC. Data as of Q2 2021

When you trade ETFs your capital is at risk.

The content in this document is issued by HANetf Limited (“HANetf”) and approved by Privium Fund Management (UK) Limited (“Privium”). HANetf are an appointed representative of Privium, which is authorised and regulated by the Financial Conduct Authority.). HANetf is registered in England and Wales with registration number 10697042.

Past performance is not a reliable indicator of future performance.

The content of this document is for information purposes, and does not constitute an investment advice, recommendation, investment research or an offer for sale nor a solicitation of an offer to buy any Product or make any investment.