US investor responses to September’s swiftly steepening yield curve after months of sustained fears over flatlining or inverted yield curve are the likeliest reason for the rebound in the value factor in September, according to recent analysts from Style Research.

In the Style Analytics quarterly review, the analysis team pointed out that up to the end of August it looked like the third quarter would be a repeat of the second quarter with value down and momentum up.

However, September saw a “major rotation” into value stocks which outperformed strongly while momentum stocks dropped in equal measure. Indeed, Style Analytics said that the data showed that the value rally made up all the ground from value’s poor year-to-date figures.

However, while momentum did suffer in September, the mini-crash was not enough to push momentum into negative territory for the quarter.

“There was a fair amount of talk that the value rally and momentum crash were driven by technical short covered trades and the unwinding of overcrowded growth stocks,” the team noted.

“In our opinion, it seems that investors were rather responding swiftly to a steepening yield curve after months of a flattening and even inverted yield curve, resulting in profit taking on stretched valuations of momentum stocks and some potentially defensive movements toward cheaper value stocks.”

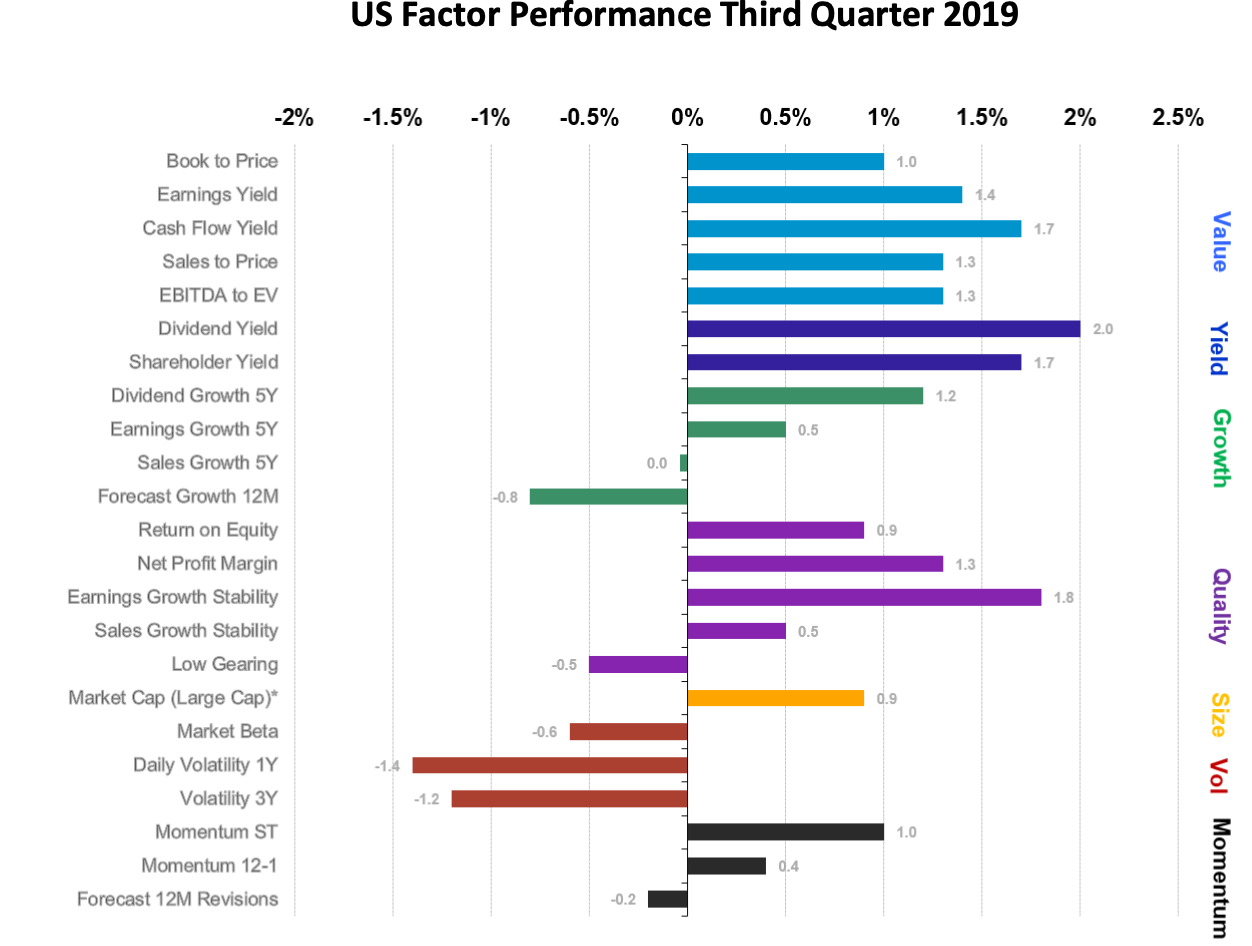

Breaking down the factor performance, the analysts showed that high-yielding stocks strongly outperformed over the third quarter as did quality stocks.

“We also saw low volatility and large cap stocks outperform. So while there appeared to be movement toward ‘risk-on’ through the Value strength, there were also indications of some defensive undertones.”

However, the analysts are far from sure that the value rebound will be sustained and would require significant economic recovery coupled with an acceleration in corporate profits.

“While there are bullish investors who expect such a scenario, without a rise in US economic growth and profit growth we believe value stocks will continue to struggle,” they added. “We anticipate continued investment interest in defensive themes such as high quality, low volatility, and high dividend yield.”

Indeed, as the team point out at the end of the third quarter, there was evidence of negative sentiment on US equities despite the unified central bank easing of interest rates.

“We’ve already seen market declines since quarter-end and we’re back to inverting yield curve talk and heightened recession fears, negative sentiment, and dampened expectations for US corporate profitability.”

While many beaten-down value investors “came out of their shelters in September to catch some much needed sun,” the team suggested that they may well have to "scurry back for yet more days in the dark before they see the light again".

Europe incoherent

In comparison to this relatively straightforward analysis for the US, Europe remained more vexed.

“Specifically we saw mixed and also fairly muted signals for value, quality, and growth although at the margin perhaps a slight leaning towards value and away from growth.

Those stocks with high forecast earnings were weak with signs of defensive positioning through outperformance from companies with a high dividend yield, high net-profit margins and stable revenue growth. The outperformance in high yield over the quarter came from a range of French stocks including EssilorLuxottica, and Sanofi, and from the Swiss stocks including Roche and Zurich Insurance.

“A big question remains as to whether the European Central bank is reaching the end of its monetary policy runway with negative interest rates already in play and a re-start of quantitative easing,” the analysts wrote. “With a decrease in business confidence and a looming recession, we expect to see continued weakness in value and continued strength in both growth and defensive factors.”

Finally, in emerging markets, the Style Analytics prognosis is that while there are some overall defensive aspects in the third quarter, “we believe that weakness in value reflects pessimism in terms of earnings growth expectations.”

“Overall, we saw three quite different factor pictures across the three regions in the third quarter: value strength in the US, mixed signals in Europe, and clear value weakness in emerging markets. But we also saw some consistent strength in defensive factors across the regions: certainly in low volatility and also somewhat in quality. With the exception of emerging markets, high yield also outperformed.”