The principle of diversification is as old as investment itself. The 13th century Babylonian Talmud counselled the wise investor to divide their assets between real estate, merchandise and money. Shakespeare’s Antonio – transporting his goods in multiple ships – neatly encapsulated the principle in The Merchant of Venice: “My ventures are not in one bottom trusted/Nor to one place, nor is my whole estate/Upon the fortune of this present year/Therefore my merchandise makes me not sad.”

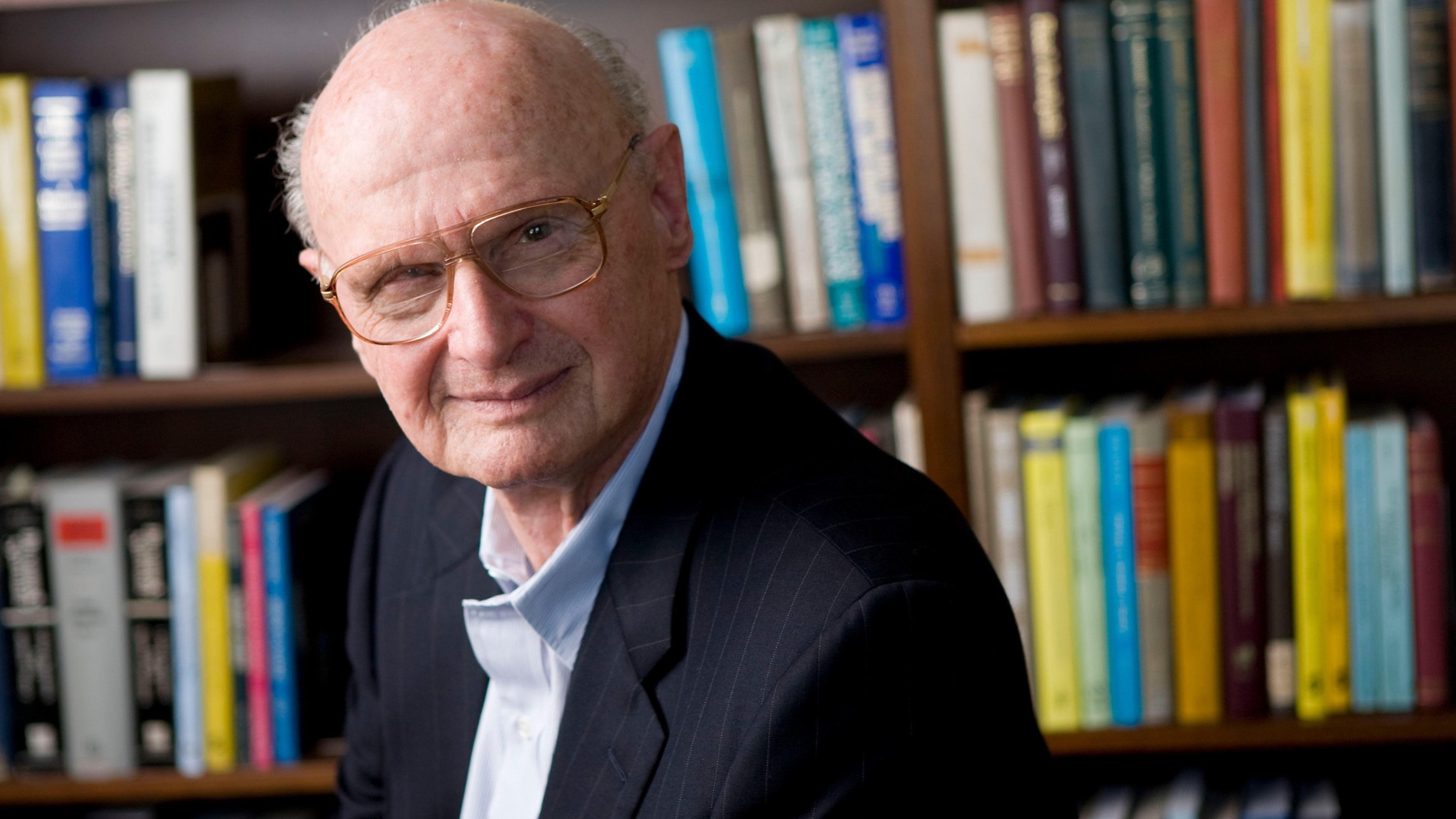

But it took the genius of Chicago economist Harry Markowitz, who died in June, to formalise diversification into a methodology, and thereby lay the foundations for modern portfolio theory...

Justin Reynolds is a freelance journalist and editor of The Patient Investor blog

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full article, click here.