Thematic ETF investors suffer from return gaps of up to 500 to 600 basis points (bps) higher versus mutual funds due to poorly timed trades, Morningstar research has found.

In its latest research on the thematic landscape, The Big Shortfall, Morningstar said ETFs’ concentrated bets and intraday trading capabilities led investors to larger return shortfalls than their open-ended peers.

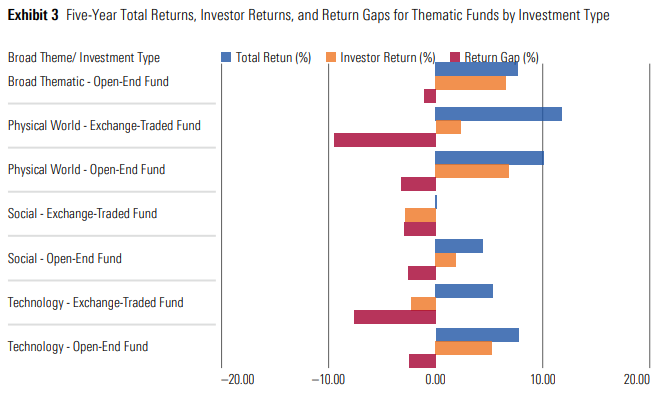

Morningstar found thematic products – ETFs and mutual funds – recorded 7.3% annualised returns over five years to June 2023, of which investors booked only 2.4%, leaving an annual return shortfall of over two-thirds due to mistimed purchases and sales.

However, the return shortfall for ETFs is much higher in some areas due to their use in tactical asset allocation.

For themes such as physical world – funds that facilitate the transition to a low carbon economy – ETFs saw return gaps of over 9% versus almost 4% for mutual funds tracking the same theme.

Highlighting this, the return gap for thematic ETF poster child, the iShares Clean Energy UCITS ETF (INRG), was 23% over the period. The ETF returned 17.6% in the five years to June 2023 while annualised investor returns totalled -5.5%.

INRG saw inflows of $5.8bn between November 2020 and January 2021, more than all of the months in the trailing five-year period combined.

“The strategy has since lost close to half its value, leaving those who bought in this period with heavy losses,” Lamont said.

“These investments did not benefit from the large performance gains registered in the preceding months and were exposed to the subsequent 40% drop in value since inflows peaked in January 2021.”

Technology ETFs also faired much worse, with return shortfalls of 8% versus 3% for mutual funds.

Source: Morningstar

“Thematic ETFs, which can be traded on exchange throughout the day and tend to invest in more focused baskets of stocks, are often favoured as tools for making tactical bets and can attract large flows,” Kenneth Lamont, senior manager research analyst at Morningstar and author of the report, said.

“ETFs’ greater concentration also results in higher levels of volatility.”

He added investors across the board have proved themselves to be poor market timers, particularly when purchasing more targeted volatile funds such as thematics.

The research noted the return gap was much smaller for ‘broad thematic’ ETFs – at around 1.1% – which tend to be more diversified, hold more stocks and invest across a range of themes.

“Our research advocates for a more patient and disciplined buy-and-hold strategy when it comes to thematics, emphasising that this approach is likely to deliver superior investment outcomes for most,” Lamont said.

“The volatile return profiles of many thematic funds, coupled with low- or no-commission trading and the intraday trading capabilities of thematic ETFs, can encourage the worst type of investor behaviour and ultimately result in poor investment outcomes.”