Performance across growth and value ETFs has diverged significantly so far in 2023 following the rebalancing of the S&P Dow Jones Indices (SPDJI) range.

The energy sector’s outperformance and the tech stock crash in 2022 led to a big rotation of companies such as the addition of ExxonMobil into SPDJI’s growth indices while stocks like Meta Platforms migrated to value indices, according to CFRA research.

As a result, energy accounts for 30.5% of the S&P 500 Pure Growth index at 30.5% following the December rebalance, up from just 6.1% a year earlier.

The swing was felt particularly hard by SPDJI indices due to the momentum factor accounting for one-third of the SPDJI’s growth factor definitions, which has led to significant performance dispersion across growth and value-orientated ETFs tracking different indices since the turn of the year.

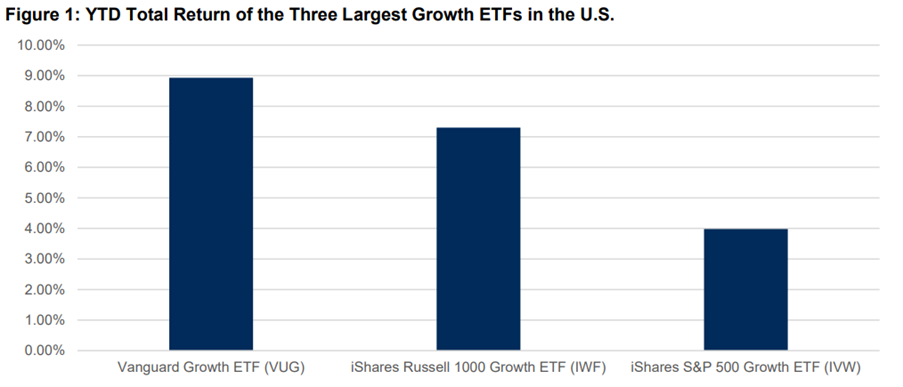

For example, the Vanguard Growth ETF (VUG), which tracks the CRSP US Large Cap index, has returned 8.93% so far this year, as at 27 February, versus 3.98% for the iShares S&P 500 Growth ETF (IVW).

Source: CFRA ETF Database

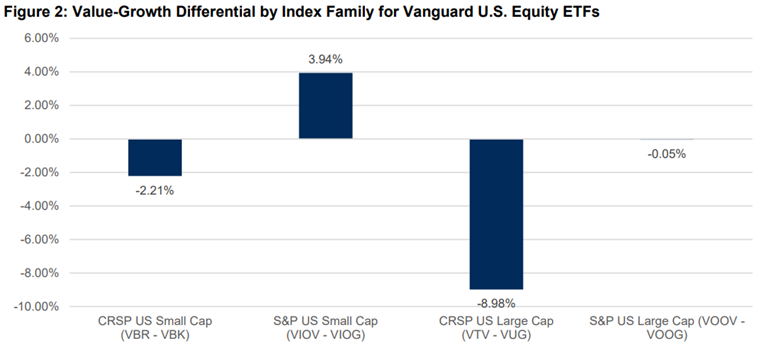

Meanwhile, US-small cap growth ETFs tracking CRSP indices outperformed value by 2.2%. This rose to nearly 4% across small-cap ETFs tracking SPDJI indices.

Source: CFRA ETF Database

The findings shine a light on the importance of assessing the underlying methodology of indices before selecting an ETF.

CRSP and SPDJI indices use similar metrics including three-year historical earnings per share growth, however, SPDJI also uses the momentum factor, the 12-month percent price change.

Energy was the stand-out performer of 2022, with the S&P 500 Energy sector returning 66% last year. The sector fell from 10.4% to 4.6% in the S&P Pure Value index while tech more than doubled from 3.9% to 8.4%.

However, the energy sector also makes up 8% of the market-cap weighted S&P 500 Growth index, up from 1.4% before the rebalance, its largest upward reweighting since 2009.