To say the introduction of the Central Securities Depositories Regime (CSDR) has been less than smooth sailing would be an understatement. The wide-ranging regulation was designed to harmonise settlement standards and improve efficiency across the European market – placing an emphasis on settling equity, bond and ETF trades on time – with fines for firms that fail to do so.

The idea was to create a common set of requirements for central securities depositories (CSDs) such as Clearstream, Euroclear and SIX, which cover most of the European market, and reduce the fragmentation that defines the region. This is particularly important for ETFs, which are prone to late settlement due to the connection between the primary and secondary markets.

Following two delays, perhaps an early indication of what was ahead, CSDR was implemented in February with many keenly anticipating its impact. However, in its early days, the regulation has so far created more problems than solutions.

Seven months in and it is still no clearer as to its impact on settlement times. The current industry prognosis is it is “still too early to tell” whether CSDR is having a positive impact on settlement behaviours, and while this may be true, it is a symptom of the issues that plague CSDR in its early days.

Problems around the reporting and enforcement of penalties for settlement delays have been the cause of major headaches for CDs and market participants alike, leaving intermediaries in challenging positions. Furthermore, concerns the fines are leading to wider bid-ask spreads for ETF investors are still prevalent, as market makers price in the risk of having to settle on time.

All the while, the deeply unpopular mandatory buy-in regime, which would contractually require authorised participants to source securities elsewhere in the event of a settlement fail, continues to cast a shadow over the entire industry. Market volatility in the first quarter of 2022 has not aided a smooth implementation of CSR, while international trading restrictions following the Russian invasion of Ukraine have also put a strain on CSDs.

The CSDs themselves have pointed to the need to “inform and educate” market participants which are still getting used to the rules.

Up until now, much of the industry has been tight-lipped on the issues facing CSDR. While many are yet to be resolved, it is clear the ETF ecosystem has been doing its part in absorbing some of the pain felt by market makers and authorised participants because of the regulation.

‘Scattershot’ implementation

One of the most fundamental problems from the onset of the regime has been the reporting of penalties for late settlement. Currently, CDs are responsible for issuing the data on a daily and monthly basis, a key barometer in determining whether settlement times are improving.

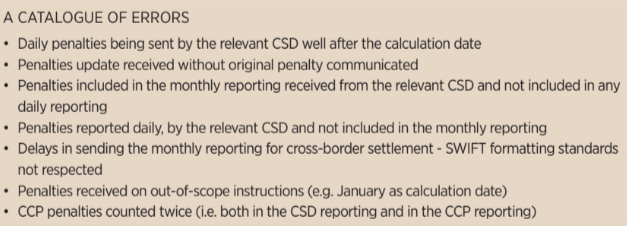

However, a document seen by ETF Stream from one prominent custodian bank highlights several key issues with the daily and monthly reporting of penalties by CSDs, including discrepancies between the daily and monthly reports, penalties being sent well after the calculation date and penalties being received without being reported in the first place.

The document reads: “Over the past five months, we experienced unexpected inefficiencies, at market level, putting intermediaries in a challenging situation. With many actors involved and the penalties process being complex, we faced several issues.”

Chris Barrett, EMEA operations manager at Virtu Invest, said some of the difficulties have been down to the diverging approaches from the CSDs. “It has been a very scattershot implementation,” he said. “Each CSD has been charged with bringing CSDR into place but each CSD has done slightly differently. In some cases, CSDs have been performing less well than was expected.”

This has even played out in the nonuniform formatting of the penalty reports published by CSDs, despite being a requirement of the regulation.

Clearstream and Euroclear declined to comment on the issues. SIX said it has not experienced any of the issues raised and went as far as saying it had been “congratulated” for its soft implementation of CSDR in Spain.

A statement from Iberclear, which covers the Spanish market, said: “We have not had any major incident or problem caused by our internal software. As far as BME CSD, Iberclear, is concerned, the discipline regime implementation has been very smooth and without relevant incidents for BME participants.

“We have been contacted by international players and they have congratulated us as the Spanish market has had a soft implementation of the new SDR, especially when comparing it with other CSDs.”

Gavin Haran, head of policy for asset management at Macfarlanes, said the issues were entirely predictable. “It was a foreseeable problem given the proportion of trades which fail because of mismatched information, so you could see that reporting on failed trades might also have a problem with mismatched information,” he said.

“It is a surmountable problem and cash penalties do not seem to be causing massive havoc throughout the industry.”

This, in part, could be because clients have been insulated by their custodian banks which have been absorbing much of the pain upstream.

One custodian bank said: “Despite these challenges and the huge volumes that we are managing on a day-to-day basis, we have been able to constantly adapt our process and development plans, sending a timely, complete and harmonised reporting to our clients across all the impacted markets.

“From a practical point of view, this allowed us to shield you [the client] from the market complexity and CSDs not harmonised behaviours.”

Since highlighting the issues, the European Securities Market Authority (ESMA) and other industry bodies have moved to propose a way forward. In July, four task forces were created led by the Association for Financial Markets in Europe (AFME) and the European Central Securities Depository Association (ECSDA) to focus on developing a market standard document for managing data, a new penalties calendar and common rules for managing data discrepancies.

Furthermore, ESMA recently launched an industry consultation over a possible amendment to the cash penalty process. Under the new proposals, CSDs would assume responsibility from central counterparties for collecting and distributing all types of penalties including those for settlement fails related to cleared transactions.

Highlighting the scale of the problem, ESMA told ETF Stream it will not be able to publish its annual report on settlement efficiency until the end of 2023, almost two years after implementation.

The settlement balancing act

During the early days of CSDR, industry commentators have been cautious about drawing concrete conclusions too early. The challenge has not helped provide a clear picture of its impact on settlement times but the market is moving to a point where some patterns can be seen and the impact on spreads understood.

According to Frank Mohr, global head of ETF sales trading at Société Générale, there was a sharp decrease in fail rates at the very beginning of CSDR, as traders prepared themselves to meet the regulation, before market makers adjusted their behaviour, with settlement failures edging up, once the cost of settling on time began to bite.

Market makers often do not own the full basket of securities when pricing ETFs, meaning there is a risk they will not be able to deliver on time. Having to cover the inventory more promptly and via more costly routes means there will be a likely impact on spreads.

“We saw a dramatic decrease in fail rates right at the beginning but after two or three months failure rates went up again,” Mohr said. “In the beginning, everybody wanted to be compliant so traders increased their inventory to settle on time. However, over time, they looked at the penalty costs fails and compared them to the costs to create the new product.

“Market makers are waiting another day or two before creating because they know they will get another trade from somebody else tomorrow who will sell. It is something they need to consider because these costs will be reflected in the spreads.”

Haran said it could be an option to calibrate the penalties to base them on the reporting data in a bid to avoid market makers choosing between purposely delaying settlement and meeting CSDR requirements.

“When they fail, about two-thirds to three-quarters of trades are due to mismatched information so the intention would be that you somehow calibrate the penalties,” he said. “It means you will probably have a couple of years of quite messy implementation.”

Mohr agreed CSDR may not have necessarily decreased settlement fails but that it could have led to an overall reduction in the time until settlement. “We have reduced the time until settlement. There were still failures but time until they settle was reduced. Maybe that is an outcome of CSDR,” he said.

Haran added as the industry gets accustomed to the regulation, settlement fail rates are naturally going to decrease. “You could look at the data in the long term and say, well, the failed settlements are going down. That could be because people are getting used to the requirements and solving difficulties they could not solve before.”

There are signs this is playing out across the ecosystem. Paolo Giulianini, head of ETFs at Vantage Capital Markets, said in some cases, ETF issuers are helping authorised participants with the new requirements. “I have seen some issuers providing sell extensions or a reduction in a number of shares for creation or redemption, giving some leeway to help the overall improvement settlements,” he said.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles