The sharp correction in mega-cap tech stocks so far this year created some tricky asset allocation decisions, with inflation and heightened tensions in Europe weighing heavy on investors’ minds.

Broad-beta ETFs have failed to cut the mustard in 2022, with the S&P 500 9.3% down, as at 21 February. As a result, where are investors turning to boost their portfolio returns?

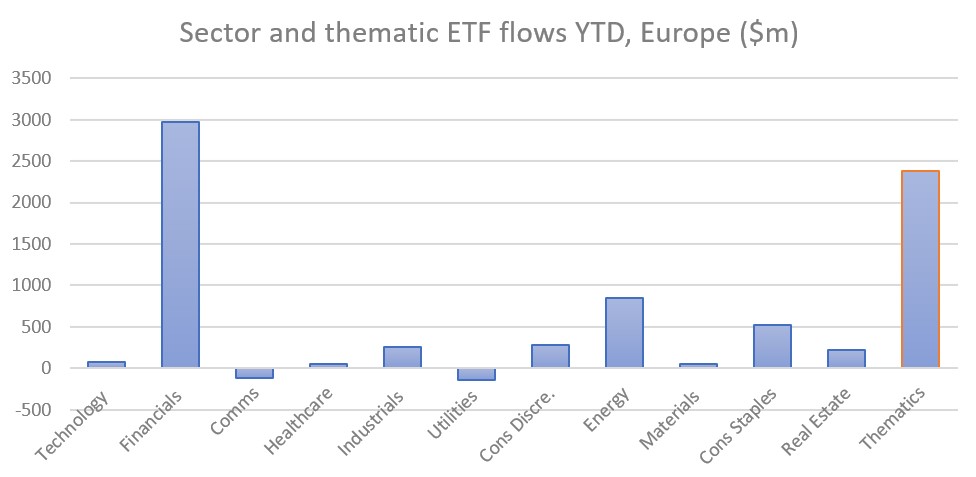

Flows this year have pointed to one trend in particular – sector ETFs. Investors piled almost $5bn into sector ETFs, as at 4 February, according to data from State Street Global Advisors (SSGA), more than double the flows into more expensive thematic counterparts ($2.3bn).

Despite being heavily skewed towards financials ($2.9bn), it is a sign investors are taking a more granular approach, and issuers have taken note. Earlier this month, Invesco slashed its fees on 18 European sector ETFs on the view that investors are increasingly looking to tailor their exposure following a volatile start to the year.

Source: SSGA, Bloomberg

According to Jonathan Prout, chief investment officer at The Private Investment Office, this could be a more structural shift, as the end of the pre-COVID-19 “everything up environment” underpinned by rampant money printing and low levels of inflation begins to unravel.

He said: “In the post-coronavirus world, we are seeing much more dispersion between and within asset classes compared to the quantitative easing environment of the last 10 years where practically everything went up in lockstep as interest rates fell.”

Highlighting this, the dispersion between the best and worst-performing sectors is stark. The MSCI Europe Energy 20/25 Capped index has returned 18.1% versus -15.4% for the MSCI Europe Technology 20/35 Capped index.

Playing catch up

Sector ETFs in the US have long been established – the Energy Select Sector SPDR ETF (XLE) has $35.4bn assets under management (AUM) having launched in 1998 – but Prout said he believes European investors are catching up as they start to realise the potential of more differentiated products.

“In the US, they are used by pension schemes, retail clients, advisors and even hedge funds,” he continued. “Historically, they have not been very widely used in Europe but we tend to get the sense that this is changing.”

Prout said investors are becoming more sophisticated in their approach while market dispersion forced their hand in the hunt for alpha. So much so that the wealth manager, which started to invest in sector ETFs last year, plans to up its allocation to sector ETFs over the next 12 months.

“We have had success and generated a lot of outperformance for our clients, so this year we are planning this year to increase our use,” Prout said.

He added the market is “overly complacent” on inflation and will therefore plans to allocate more to energy, basic materials, finance and industrials, versus interest rate sensitive areas such as utilities, technology and real estate.

A tailored approach

Echoing his views, Matthew Tagliani, head of ETF EMEA ETF product at Invesco, said certain trends have emerged from the pandemic while the drawdown in US tech stocks has pushed investors to have a more specific view on the market.

“There is a lot of rotation leading to some underperformance in the large-cap tech bucket and investors have been playing that in progressively more granular ways,” he said. “They have either just reduced their exposure to US equities or have chosen a specific sector if it's just it is just the tech names they are concerned about.”

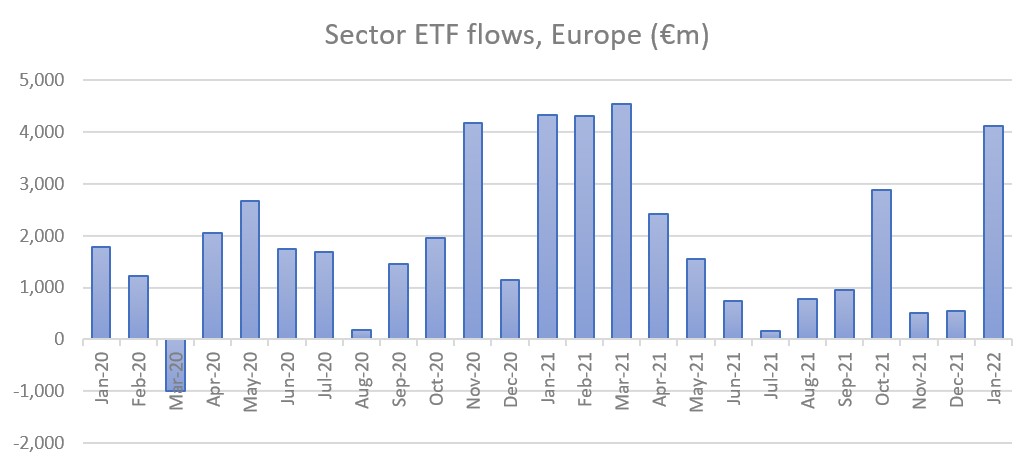

While sectors have started the year hot, it is worth noting they also had a strong start to 2021 driven again by financials but also technology as economies plotted their lockdown exits and cyclical sectors came back in vogue.

Source: Morningstar

Briegel Leitao, associate analyst, passive strategies, at Morningstar, said: “These plays began in November 2020 as global economies left the opening phases of lockdown behind and markets continued recovery after their 2020 Q1 drawdowns.

“Increasingly, as winners and losers defined themselves, the case for investors making allocations in more granular, targeted ways has strengthened. Sector and thematic ETFs offer investors targeted solutions that aim to capture these themes through focused portfolios.”

Away from being a long-term structural shift to sectors, Tagliani said this is because of a combination of early year flows, a more uncertain market and a change in mindset towards ETFs in general.

“Some 10 years ago, there was a relatively smaller group of investors who would go down to the sector level as people tended to do more broad buckets,” he said.

“As more investors get familiar with ETFs, the step beyond beta buckets in equities is sectors, so is quite natural and we have seen a big increase in sector ETF AUM over the last few years. However, it is investors expressing more specific views at the sector level, rather than picking specific as the winner for the next X number of years.”

Related articles