The practice of securities lending has been part of the landscape for institutional investors for several decades, and for certain asset owners is a critical tool in delivering additional alpha to their portfolios, offsetting fund expenses, and providing new sources of liquidity.

This is increasingly the case for ETF providers, which, alongside traditional mutual fund providers, account for nearly 50% of the global supply of available inventory to the securities lending marketplace.

As the European ETF market continues to grow, and with an ever-rising number of active and thematic products launching, we look at how ETF providers can enhance securities lending revenues, improve performance, and address the increasingly important integration of ESG requirements into their securities lending programmes through a process of active engagement with their service providers.

The securities lending industry sits at an interesting juncture. The implementation of the SFTR reporting regime sits firmly in the rear-view mirror, whereas CSDR still feels current. ESG considerations sit front and centre of all market participants’ agendas, and more than ever before the cost of regulatory capital, capital restrictions, and RWA impact are driving agent bank and borrower behaviours, which are not always aligned with asset owners’ best interests.

Against this background, how can ETF providers optimise their securities lending programmes? We look below at three important aspects of how we manage securities lending programmes at eSecLending, and how small changes can produce material improvements for clients under the right circumstances.

Programme infrastructure: Pooled vs segregated

It is common practice for securities lending agents to pool their client assets together, and subsequently allocate individual loans across each holder of a security on a pro-rata basis, thereby giving each client a small share of the revenue attributable to each loan depending on where they sit in a queue, and over time providing each client with market average returns.

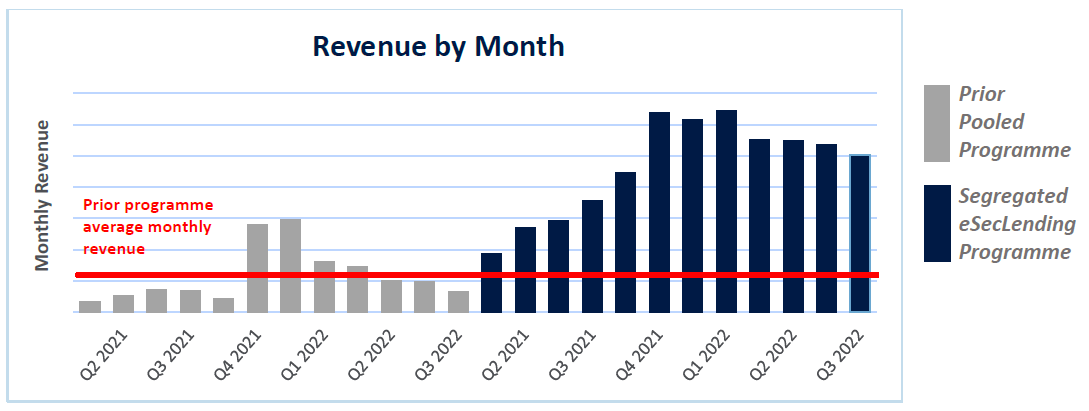

But for those investors that do not want to pool their assets and subsidise other institutions, and don’t want average returns? Lending assets on a fully segregated basis, where there is no queue, and the lender can maximise their participation in each loan opportunity, can deliver materially higher returns for certain assets, as demonstrated in the chart below.

This lender historically participated in a pooled lending programme before transitioning to a fully segregated programme. Balances immediately increased, as did revenue, and in the first 12 months of their new programme, overall performance improved over 300% YoY utilising the same client programme parameters and guidelines.

Trading strategy; discretionary or exclusive?

Most loans that are executed today are termed ‘discretionary’ trades, where the securities lending agent will negotiate trade size, fee, collateral, and loan duration, at point of trade for every loan they execute.

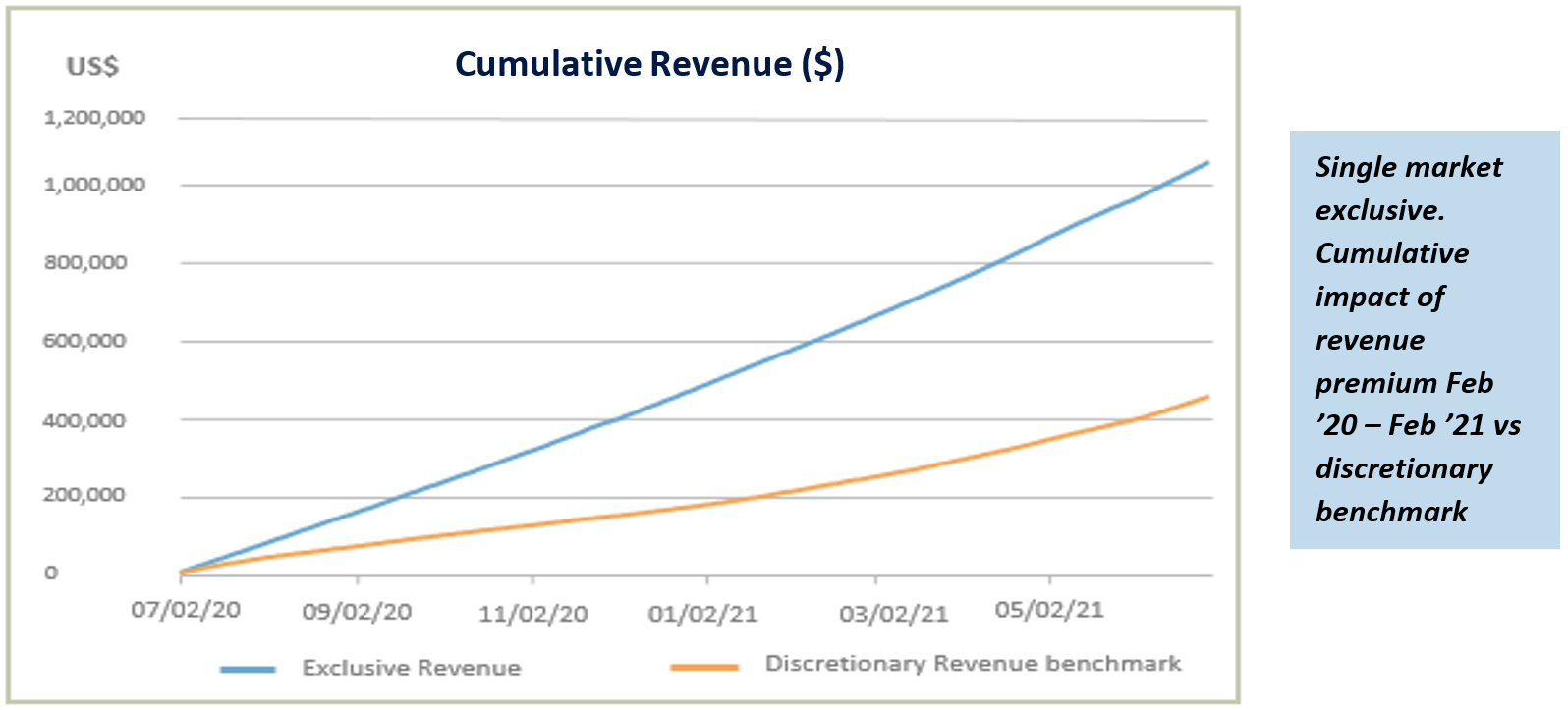

When considering performance at a portfolio, fund, or market level it is important to note that typically revenue is concentrated in a small number of in-demand securities, and equally, many securities may have minimal demand and limited revenue. In an exclusive arrangement however the dynamic changes such that the borrower pays a fixed, guaranteed fee, for the exclusive right – but not obligation – to borrow from the whole portfolio, or designated sub-set of a portfolio. Exclusives are usually negotiated as part of an auction process used to solicit bids across multiple competing borrower counterparties.

Why might an ETF provider consider lending their assets on an exclusive basis? Very simply, to increase revenues. For the most in-demand securities (eg, small and mid-cap equities, thematic products, emerging market bonds and equities, high yield bonds) borrowers will pay a material premium for exclusive access rights, paying for benefits above and beyond the intrinsic value of the underlying securities. For the client, this translates into improved performance, as well as a dependable, guaranteed revenue stream. The chart below illustrates the cumulative effect of revenue received for an exclusive trade we executed on behalf of one of our clients, compared to the industry benchmark for those same securities, which delivered a premium of c 150%.

Collateral; risk, reward…and ESG

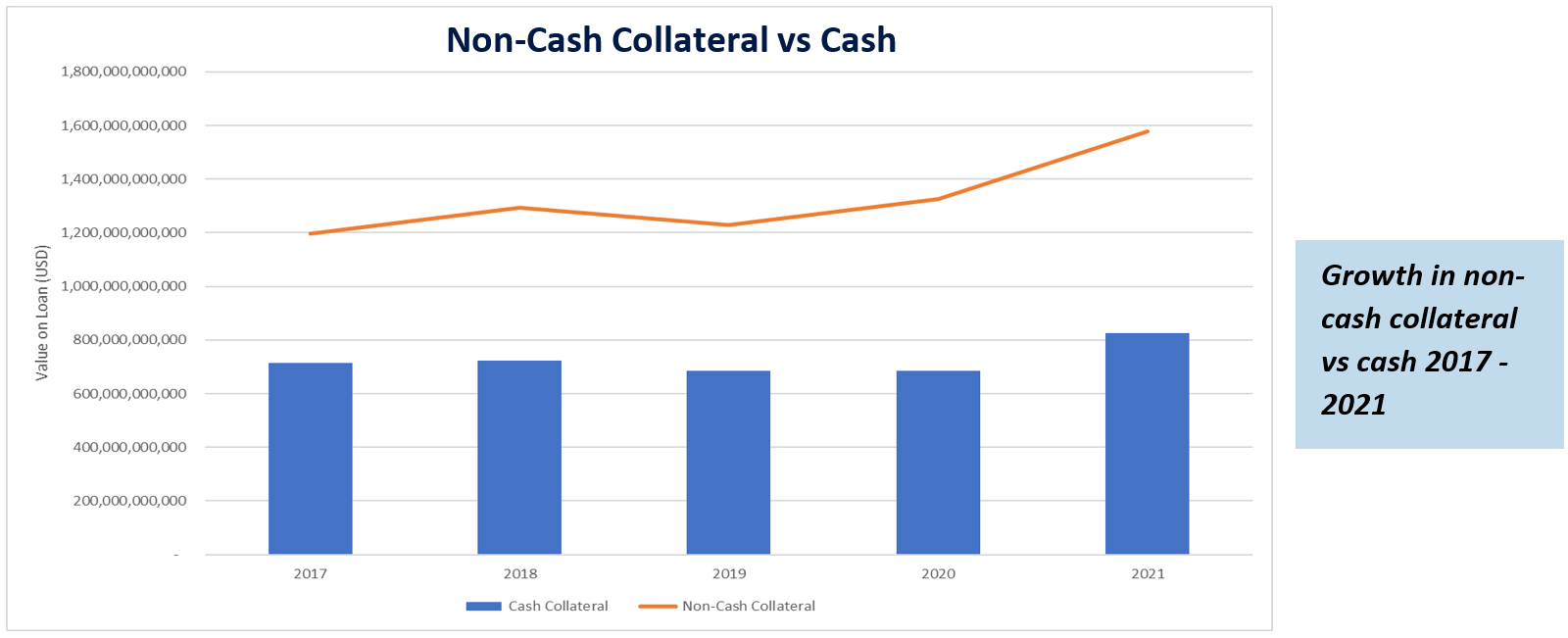

Historically, collateral was seen primarily as a tool to mitigate against counterparty default risk, cash was king, and non-cash options were limited to government bonds. Now ‘collateral flexibility’ is firmly in the securities lending lexicon, with borrowers pledging main index equity and ETFs as collateral, together with an expanded list of fixed income instruments. This is being driven by the increasing regulatory capital demands borrowers must contend with, forcing more creative measures to manage the RWA impact of collateral financing.

Why should this matter to ETF providers? Simply put, opportunity cost–flexibility is a two-way street, and the reality of the securities lending marketplace today is that lenders that can be flexible in the types of collateral they accept will avail themselves to more lending opportunities than those which cannot. This translates into higher returns and better performance on a relative basis.

ETF providers should therefore recognise the potential for new securities lending opportunities that may exist in the context of their acceptable collateral, at the same time remaining mindful of risk management and ESG requirements, such that the securities that lenders hold as collateral are aligned for ESG with the securities they hold in the portfolio

The securities lending marketplace rarely stands still for long, be that due to changing regulatory environment, macroeconomic factors, or product innovation, but one truism remains; lenders which actively engage in their programme will outperform those that do not. ETF providers that lend today can influence programme performance and should engage with their providers to discuss the tools available to them to achieve this.

Simon is managing director and head of business development for the EMEA and APAC regions at eSecLending