Markets evolve constantly but they rarely change structurally. When they do, it is usually either due to new policies or products. Regulations tend to have a more immediate effect, for example, when decimalisation was introduced by the SEC in 2001.

Product innovations like ETFs can change markets, but their impact is typically spread out across time. The one constant is likely investors as it is questionable if they change at all. Given the technological advancements, today’s investors are the most informed ever. But fear and greed still seem to drive many markets.

However, we should differentiate between retail and professional investors, where the latter are assumed to act more rationally and less emotionally than the former. It is interesting to analyse if this thesis holds and whether markets have changed due to the rise of professional money management over the last few decades.

Most professional investors rely on models to justify buy and sell decisions. If a stock becomes too expensive, it is sold. If it trades too cheaply, it is bought. In contrast, retail investors primarily chase performance. A market dominated by professional investors should feature mean-reversion while a retail-dominated one should exhibit momentum.

In this research note, we will analyse various markets by contrasting their momentum versus mean-reversion characteristics.

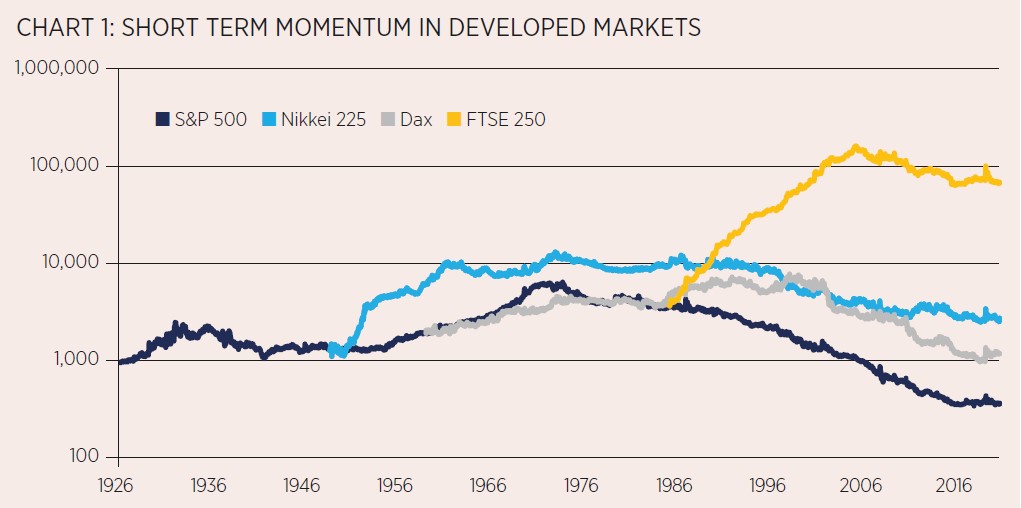

Momentum in developed markets

We begin our analysis by analysing the short-term momentum characteristics of developed stock markets. Momentum is defined as measuring the stock markets’ return last week, and if positive, then go long, while if negative, then go short. The trade signal is delayed by one day and portfolios are created each day to achieve an implementable and robust trading strategy.

However, we excluded trading costs, which would have lowered the realised returns.We observe the short-term momentum dominated the US, Japanese and German stock markets between 1926 and the 1980s. Furthermore, the trends were often similar across markets highlighting synchronous global equities trading.

However, short-term momentum stopped working in the US and Japan in the late 1970s, in Germany in the 2000s, and in the UK around 2005. Since then, all four developed stock markets were dominated by mean-reversion, i.e. if the market fell last week, then go long this week.

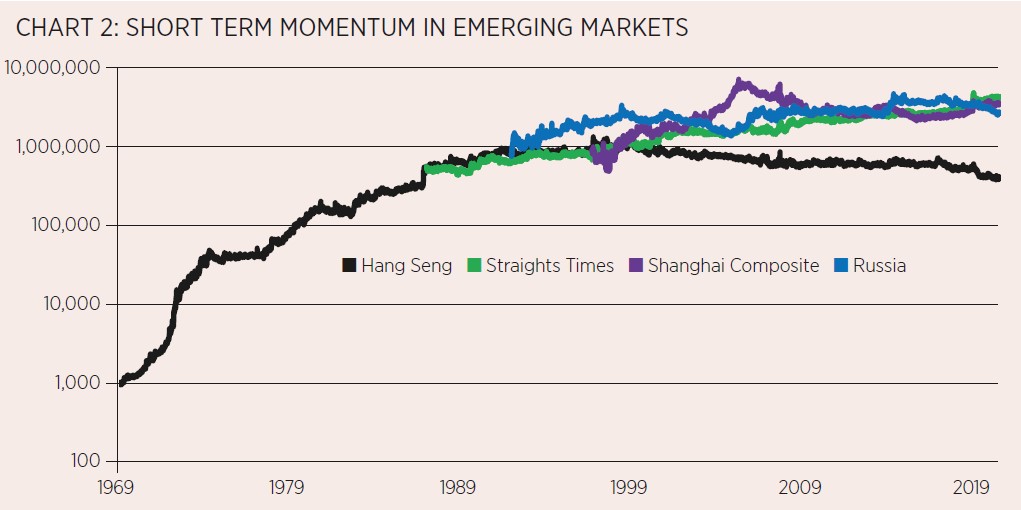

Momentum in emerging markets

Although we observe permanent changes in the market structure of developed stock markets, these are not easy to explain. The shift from momentum to mean-reversion in the US could be attributed to the rise of professional money management in the 1970s and 1980s. But why would that have occurred in the UK only around 2005? The country contains some of the oldest and largest asset management companies on the planet.

Next, we analyse emerging markets and observe momentum generated attractive returns in Hong Kong between 1969 to 2000, but then stopped while mean-reversion started working. In contrast, markets like Singapore, China or Russia still exhibit momentum characteristics today, albeit at various levels of consistency.

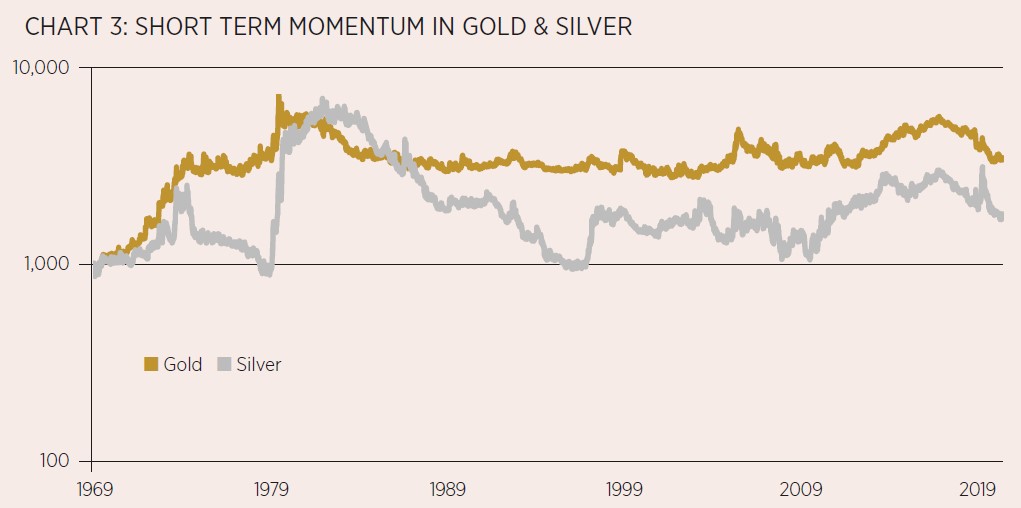

Momentum in gold and silver

There is a long body of academic research that supports trend-following strategies in the commodity space, which is also reflected in the name of managers pursuing such strategies including commodity trading advisors (CTAs). However, most of these measure momentum over long and not short-term periods.

Taking gold and silver as case studies highlights neither short-term momentum nor mean-reversion characteristics. These results are perhaps explained by a less strong shift of ownership and trading from retail to fund managers, as well as the challenges of valuing commodities with fundamentals models. Determining the fair value of gold seems an impossible task.

Momentum in crypto

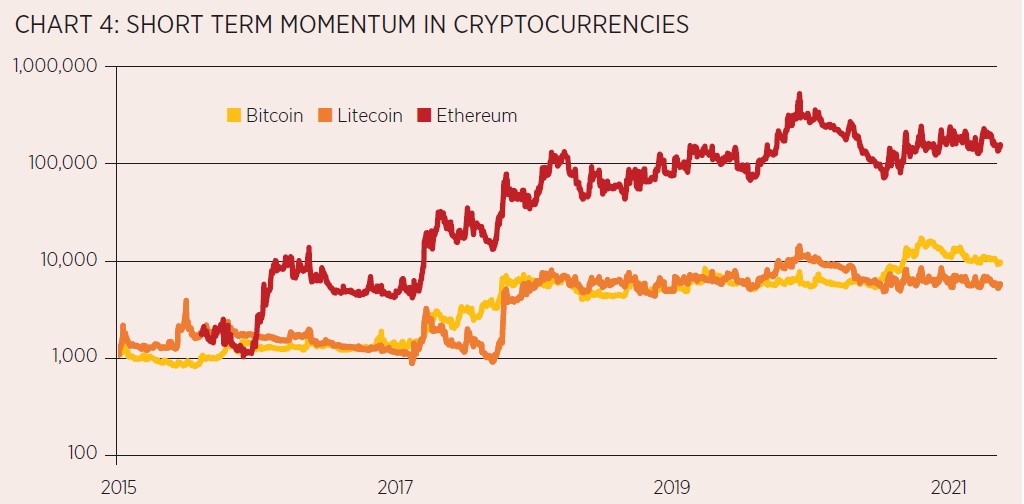

Considering a list of markets dominated by momentum would likely feature cryptocurrencies on top given the age and nature of the asset class.And indeed, we observe that bitcoin, litecoin and ethereum exhibited momentum characteristics in the period from 2015 to 2021.

However, although the performance of momentum in ethereum is attractive, it was far less so for bitcoin and litecoin. Momentum in these two was essentially flat, aside from large increases during the crypto bull market of 2017.

As institutional money is flowing into the asset class we could speculate that mean-reversion should start appearing, but valuing (crypto)currencies is as challenging as commodities,so that might not occur.

Further thoughts

The most interesting aspect of this analysis is that markets undergo structural changes.

Unfortunately, this also highlights the risks of active management regardless if practised discretionary or systematically. A fund manager might have established a long track record based on trading momentum signals, until these stopped generating profits one day.

It would be almost impossible for fund managers, or their investors, to realise that the market has changed forever given their track record and the glacial speed of change.

Although “this time is different” is said to be the four most dangerous words in investing, sometimes it is true.

Nicolas Rabener is founder and CEO of FactorResearch

This article first appeared in ETF Insider, ETF Stream's new monthly ETF magazine for professional investors in Europe. To access the full issue, click here.