US Treasury Secretary Janet Yellen’s warning of a “constitutional crisis” if Congress does not raise the federal debt ceiling has brought the issue of US defaulting into sharp focus, with implications of structural importance for the country’s future borrowing and fiscal spending.

Yellen started the month with a letter to Congress warning the US government could hit its $31.4trn debt ceiling as soon as 1 June, at which point the Treasury would be unable to pay the government’s bills covering everything from US Treasury bond pay-outs, civil staff salaries and social security without the cap being raised.

On Sunday, Yellen then appeared on ABC’s This Week and said: “If Congress fails to meet its responsibility, there are simply no good options.”

She added the US “should not get to the point where we need to consider whether the president can go on issuing debt. This would be a constitutional crisis.”

Ahead of the meeting between President Joe Biden and Republican Speaker of the House Kevin McCarthy to discuss raising the debt ceiling, Yellen said failure to reach an agreement would create “an economic and financial catastrophe that will be of our own making”.

It is worth noting the US debt ceiling has been suspended seven times since 2013 but the context of the current juncture is significant.

The Biden administration has committed to unprecedented levels of fiscal spending through packages such as the $1.2trn Infrastructure Investment and Jobs Act in 2021 and the $500bn Inflation Reduction Act Last year.

The current uncertainty created by a string of bank failures and the nature of Yellen’s comments themselves are also impactful – and go some way to explaining why US one-year credit default swap spreads recently spiked to their highest level since 2011.

An unlikely event of US default would cause a 10% hit to US GDP and the loss of up to eight million jobs, according to Eddie Donmez, global markets analyst at Finimize.

While there are very long odds on such a scenario playing out, question marks over the ‘safe haven’ status of US debt securities have already begun to have a material impact on the short end of the yield curve.

Yields on one-month US Treasuries have surged 274 basis points (bps) - to 5.79% - since 21 April, marking a steeper hike in a month than during the Global Financial Crisis (GFC).

Source: MarketWatch

Tom Roseen, head of research services at Refintiv Lipper, said: “The asset considered by global markets to be the standard risk-free rate is suddenly being impacted by credit risk because of the uncertainty of those negotiations and the Treasury’s possible inability to service the government’s obligations in a timely manner.”

Jim Reid, head of credit strategy at Deutsche Bank, added: “Bear in mind that as recently as April 21, the one-month yield closed at 3.26%, since investors were pouring into one-month bills as a way of avoiding any default risk.

“But given the plausible X-date is now within a one-month horizon, we have seen the reverse effect take place as investors seek to offload securities with any default risk.”

Aside from yields climbing as investors look to hedge default risk, other traditional safe havens have begun to prosper amid growing uncertainty.

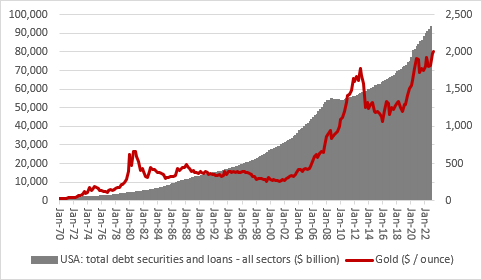

Gold, for instance, has held firm above a price of $2,000 an ounce as investors navigate an uncertain monetary policy backdrop, cracks in the banking system, the possibility of recession and now the spectre of US default.

Russ Mould, investment director at AJ Bell, said: “While the US will not default, it will keep raising the debt ceiling and possibly have to print more money so it can do so, especially as interest bills on the borrowing are going up. More debt ultimately begets more debt.

“Gold bugs will be on the lookout for any signs of higher spending and higher deficits as justification for their faith in the precious metal as a store of value at a time of fiscal incontinence and after an extended period of money printing.”

Source: AJ Bell, St. Louis Fed, Refinitiv

Even in a scenario where the US debt ceiling is raised, there are notable implications to consider.

Yellen warned a decision on new legislation needs to be made before the eleventh hour to avoid the “fiscal cliff” scenario witnessed in 2011, which saw S&P Global downgrade the US’s triple-A credit rating, signalling decreased credit quality and increased borrowing costs.

Talks held between Biden and McCarthy on Tuesday also signalled Republicans would only agree to raise the debt ceiling by $1.5trn with concessions being made such as cuts to unspent COVID-19 funding.

Such terms were set out in the Debt Ceiling Bill which passed through the House of Representatives last week, with other conditions including cuts or tighter requirements on government support including food stamps and Medicaid, abandoning plans to cancel some student loans and reforms to energy spending.

Most significantly for thematic and sector ETFs, the Republicans are calling for an end to many of the renewable energy tax breaks Biden signed into law last year while boosting fossil fuel production. If included in the final terms for increasing the debt ceiling, such a move could prove disastrous for clean energy ETFs in the medium-term.