Academics continue to debate whether a small cap premium exists. But for ETFs the results are quite clear: small cap trackers typically outperform.

Small cap ETFs outperform in every major industrial country, except Canada and Australia -- our analysis has found. The longer the time horizon used, the larger the outperformance tends to be.

USA - small caps supreme

The small cap premium was discovered by US academics, looking at the US stock market. And if there is one market where small cap ETFs have provided clear outperformance, it's been in the US. Below compares iShares two major large cap and small cap trackers: IVV and IJR, which are listed and cross-listed on global exchanges.

The standard refrain is that small caps are more domestically focussed. Another common refrain is that small cap indexes are typically higher beta, meaning they swing more each way the market moves.

… however it depends on which index you track

Small cap ETF outperformance in the US may however hinge substantially on which index you track. As we can see, when one swaps over to the Russell 2000 index, the outperformance is real, but less sharp than for the S&P indexes. Below shows IWB versus IWM.

Some have argued that the small cap premium only emerges in the US when a quality filter is used.

UK - smaller companies crush it

The UK has been something of a poster child for smaller company outperformance, particularly in the aftermath of Brexit. The UK has the largest market for small companies in Europe by far.

Below compares the performance of two London Stock Exchange listed UK small cap trackers: iShares Core FTSE 100 UCITS ETF (CUKX) and iShares MSCI UK Small Cap UCITS ETF (CUKS). Both use pound sterling as their functional currency and both funds are accumulating.

As we can see, the outperformance is robust to the higher fees and transaction costs incurred by the small cap tracker. The MSCI UK Small Cap Index is a bit of a funny one and includes six companies in the FTSE 100. But we retried the test using the iShares FTSE 250 tracker and found the same result.

Top small cap performers include Blue Prism, Fever Tree and Ocado. Closed ended funds, (investment trusts and investment companies) have also helped.

Japan - small cap ETFs win

Japan is a really interesting place to put your money, for small caps as much as anything else.

Japanese small caps typically receive little analyst coverage in the west. Many of the small caps are listed on what's called the "Tokyo Stock Exchange Second Section", which has the reputation for being a place for lost souls. According to one review, the majority of small caps on TSE2 receive zero analyst coverage.

Yet it's this island of misfit toys that has seen so much growth in recent years. In an interesting research piece, WisdomTree found that Japanese small caps have greater free cash flow and dividend growth than large caps. Perhaps that's part of the reason that Japanese small caps have outperformed so strongly.

Below compares the performance of two Tokyo-listed funds from Nomura. One tracks the Topix. The other tracks Russell/Nomura Small Cap Core Index, which represents the smallest 15% of Japanese companies.

Some worry that the bull run has been driven by uniformed retail investors.

Germany - small caps wins

Germany has the second largest market for small caps in Europe after the UK. And in Germany small caps have outperformed too.

The chart below compares two Berlin-listed German ETFs: the ComStage DAX TR UCITS ETF (C001), which tracks the large caps via the DAX, and the ComStage SDAX TR UCITS ETF (C005) which tracks the small cap version of the DAX. As we see, the small cap tracker takes the cake.

Germany is culturally slightly different to the US in that many companies remain private rather than going public. Small caps in Germany tend to drive and get driven by the Mittelstand and be highly specialised. Their specialisation and localisation may make them harder to disrupt.

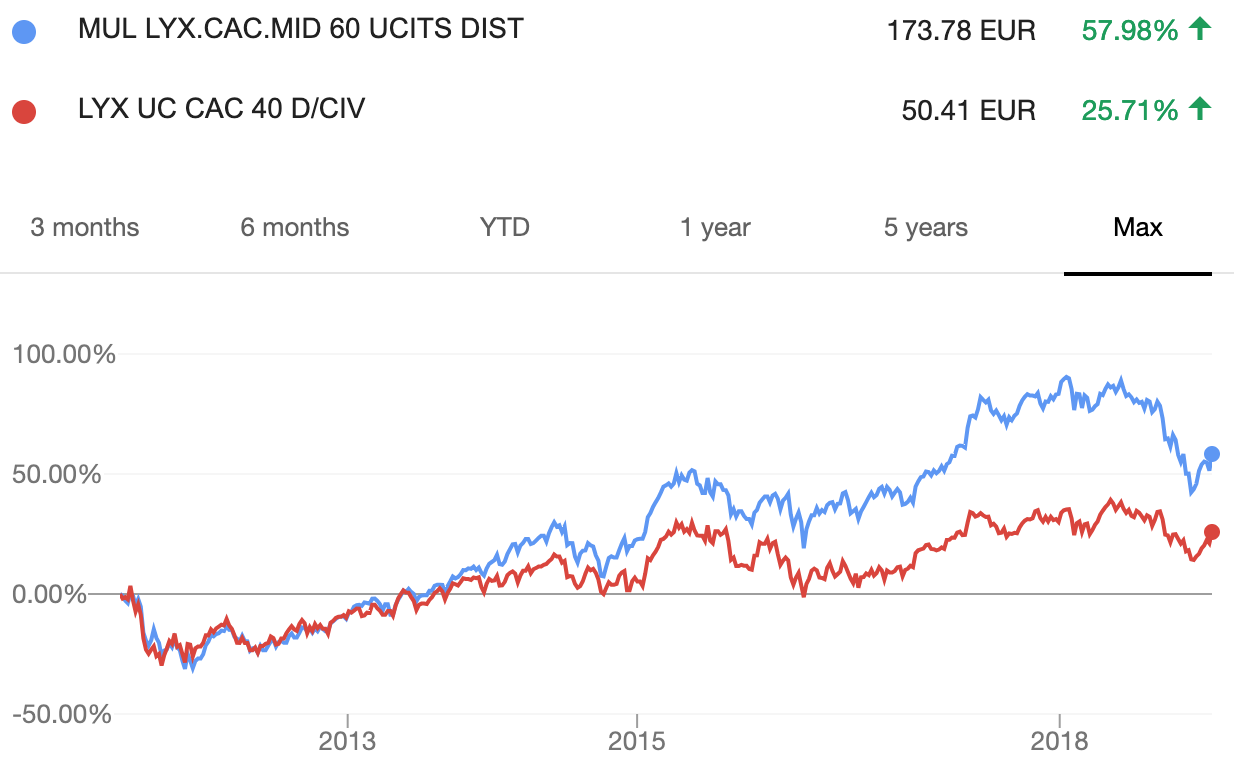

France - mid caps are what you want

We couldn't quite find a Paris-listed small cap tracker (i.e. a CAC small ETF). What we could find however was a mid cap tracker: the Lyxor CAC MID 60 UCITS ETF D-EUR (CACM:FP), which we compared to the Lxyor CAC 40 fund (CAC).

Switzerland - same as France

As with France, we couldn't find a small cap tracker listed on the SIX Swiss exchange. We could only find a mid cap tracker. But as with France, the ETF that tracks the smaller companies has provided the higher returns.

The below compares two iShares ETFs: a SMI tracker (CSSMI:SW) and an SMI Mid tracker (CSSMIM).

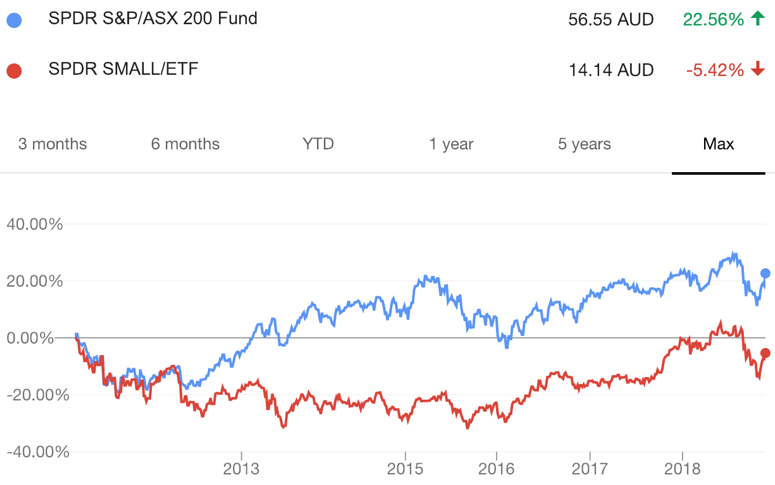

Australia - large caps win

In Australia, small caps tend to be the province of active managers, who have provided solid outperformance versus the total market over the past 10 years. Their outperformance owes partly, some observers believe, to

. For this reason, most investors and allocators stick with active management when exploring this space.

As for indexing, academic opinion remains divided in Australia as to whether the small cap premium is robust to transaction costs. But as for Aussie ETFs, small cappers have lagged considerably.

Canada - large caps win

Canadian small caps seem to have had the same rough ride that Australian small caps have. And for what might be the same reason: many Canadian small caps are resource and energy companies, which have had a hard time the past decade.