I have one very obvious prediction about 2018 - Smart Beta will become increasingly important to not only institutional but also retail investors. Overall, I think smart beta is a force for good but as with all heavily-marketed products, I've become increasingly suspicious about the claims made for these index-tracking products.

A growing number of research studies have drawn attention to the many flaws of most smart beta strategies. Take overtrading. Just a few years ago analysts at SocGen ran the numbers on a wide range of factor-based index strategies and found worryingly high levels of trading and accompanying costs.

Smart beta products also have worrying side effects and sensitivities. Take value-based strategies for instance which have an increasingly obvious bias towards industries and sectors with a higher carbon footprint - the idea here is that less IP-driven industries tend to have lower valuation multiples which in turn forces most value types to buy into cyclical sectors.

These are just two examples of the growing debate about the effectiveness of smart beta as a mainstream alternative. Perhaps the biggest concern is that most investors - private or institutional - don't really understand what goes on inside the box that is the index. Perhaps more pertinently they don't entirely understand the differences between all the different flavours of smart beta.

Next week I'll outline a smart beta checklist that can be used by any investor looking to put money to work in smart beta. This week I want to concentrate instead on a much simpler objective - classifying the smart beta universe. I've spent the last few weeks trying to categorise the various flavours of factor investing, smart beta and thematic beta. Before I outline this I think it's important to understand that smart beta/thematic beta indices have gone through numerous iterations in recent years. The very first wave of smart beta indices focused on a small number of simple 'risk factors' or risk premia' i.e. fundamental indices that used value based ideas centred on the balance sheet or dividend payouts as a key measure.

Optimised strategies such as low or minimum variance represented the next generation of indices but even these relatively innovative products are now being over taken by multi factor models - where momentum and say low volatility measures are used to construct an index.

At the core of this revolution though is the acknowledgement that not all shares are created equally. Different shares are impacted by different factors, nearly all based around some measure of risk.

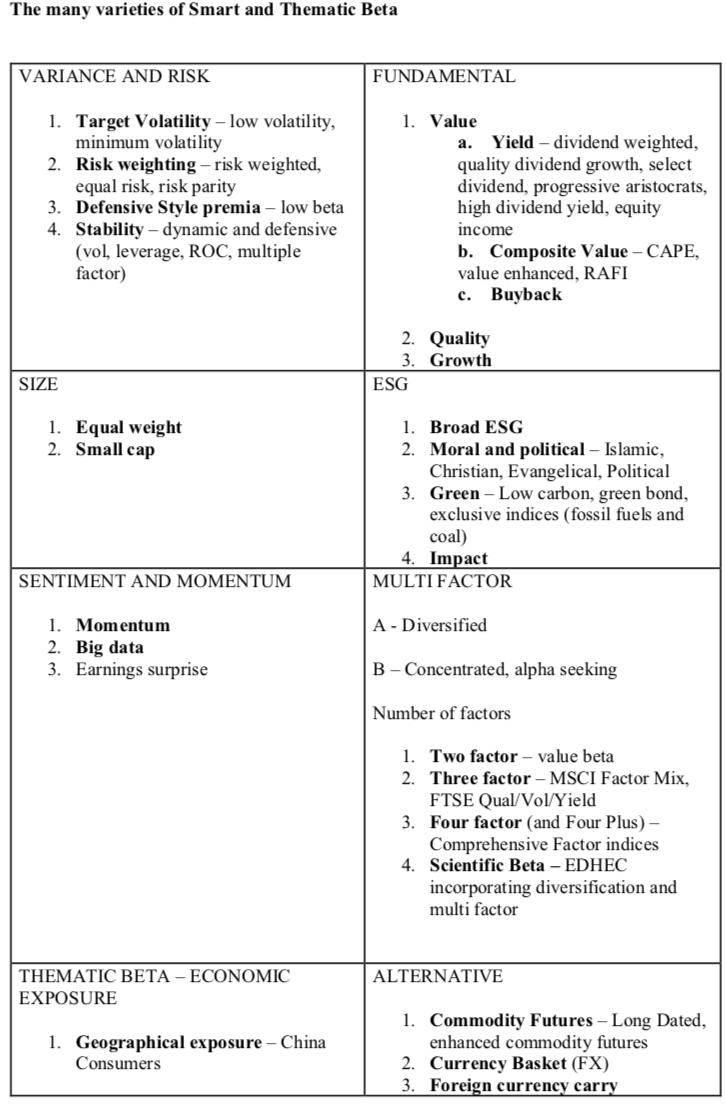

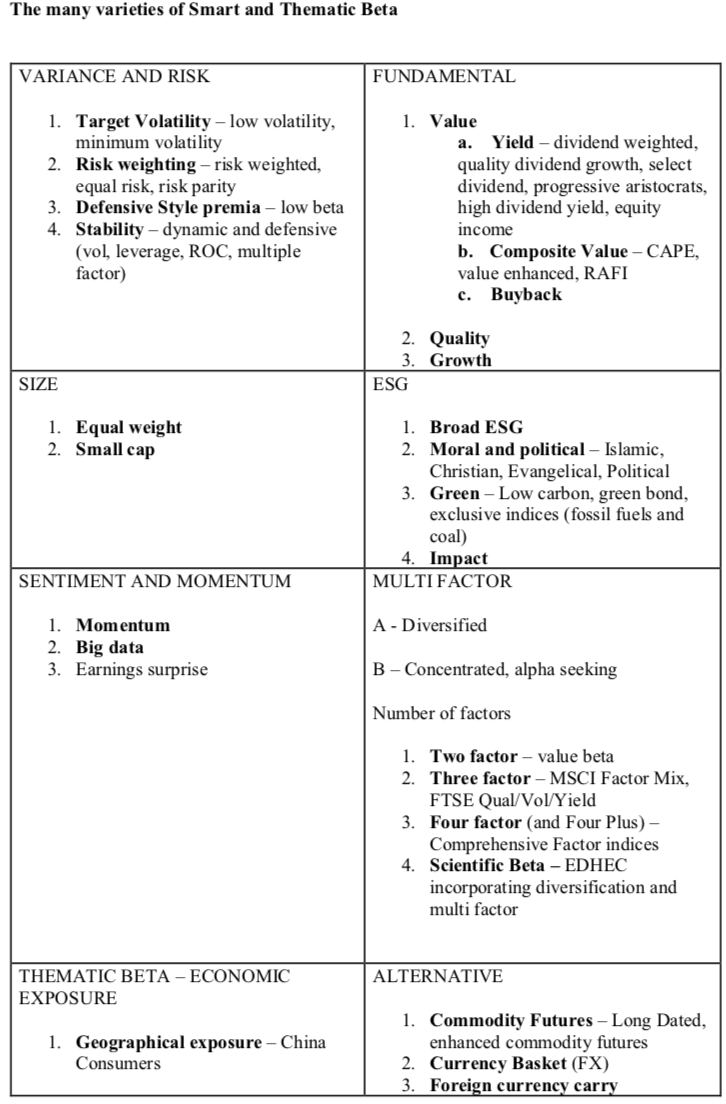

At ETF Stream we've tried to get to grips with the dizzying variety of different smart beta strategies available. The final result of our head scratching is in the table below - our classification of the weird and wonderful worlds of smart and thematic beta. The latter term - thematic beta - is another iteration of the stock screening idea, focusing on selecting stocks based on a key theme or idea such as robotics or businesses that sell to China.

We've identified EIGHT sub categories of smart and thematic beta, all used by ETF issuers. The two biggest belong in the first two boxes. FUNDAMENTAL factors include many of the ideas identified by the stock screening experts mentioned earlier. Here we see a real focus on what are fundamental measures of a stocks attractiveness, with dividend yield or the value of the biggest focus. But this fundamental category also includes factors and measures which identify fast growing stocks, measured by say advancing earnings growth.

Another huge sub category of smart beta centres on VARIANCE and RISK. In this category we find a focus on screening through a stockmarket searching for stocks that don't move up or down as much on a daily basis (low variance or volatility) . The key insight here is that boring stocks, with low variability or volatility, can end up producing better long term returns.

Our next sub category of smart beta measures centres on the size effect, a factor we've already encountered. In simple terms, smaller businesses in terms of market capitalisation can be riskier but over time they tend to outperform their larger peers. This could mean focusing solely on small cap companies or it could mean building an index where all the stocks included are 'equally weighted' - which has the immediate effect of boosting the weighting of small cap stocks.

Indices built around environmental, social and corporate governance based measures (ESG) are hugely popular at the moment and represent a real focus for many index developers. ESG indices based around religious and moral ideas have been around for most of the last decade - Islamic indices were the first to appear - but in recent years we've seen an explosion of new ideas, many of them based around global warming and sustainable business practises. The only slight challenge for this large universe of indices is that most ESG indices tend to underperform the broader indices.

A small number of index developers and smart beta experts have latched on to the idea of popular shares and taken it to the extreme - they've used TECHNICAL and MOMENTUM based measures to select a shortlist of shares. The most popular variant of this is to focus on stocks with strong momentum behind them as measured by the relative strength measure versus the broader market. In simple terms, for much of the time during a stock market boom, simply selecting only those stocks with positive price momentum (defined as superior relative strength versus the market over 20 and 200 days) will produce superior returns. Unfortunately, this strategy of chasing momentum also has a nasty tendency of 'blowing up' and making huge losses when a bull market turns sour.

MULTI FACTOR strategies do what they say on the 'tin' - they select a bunch of different factors including say fundamental and momentum based measures and then combine them in one index. In reality this tends to take different forms. One is a small selection of factors which concentrate on a smaller number of stocks (or bonds), in order to produce extra returns. A second variant looks to build multi-factor indices with the broadest possible diversification, thus producing a better risk adjusted return.

Our last two boxes or sub categories represent the 'cutting edge' of index construction. THEMATIC BETA is popular with index developers and involves what is essentially super sectors i.e groups of stocks in a bunch of sectors which all respond to a big structural driver. This 'driver' could be growth in China or an aging population. ALTERNATIVE beta strategies represent a collage of strategies designed to focus on more alternative assets such as commodity futures or FX (foreign exchange). In this box we've also included more bond (and FX) focused strategies looking at exposure to changing interest rates.