A stock is said to be crowded when positions held by market participants are significantly large, relative to the liquidity of the underlying assets.

The risk that comes with this is if investors look to sell off their investments in tandem with participants having a large holding.

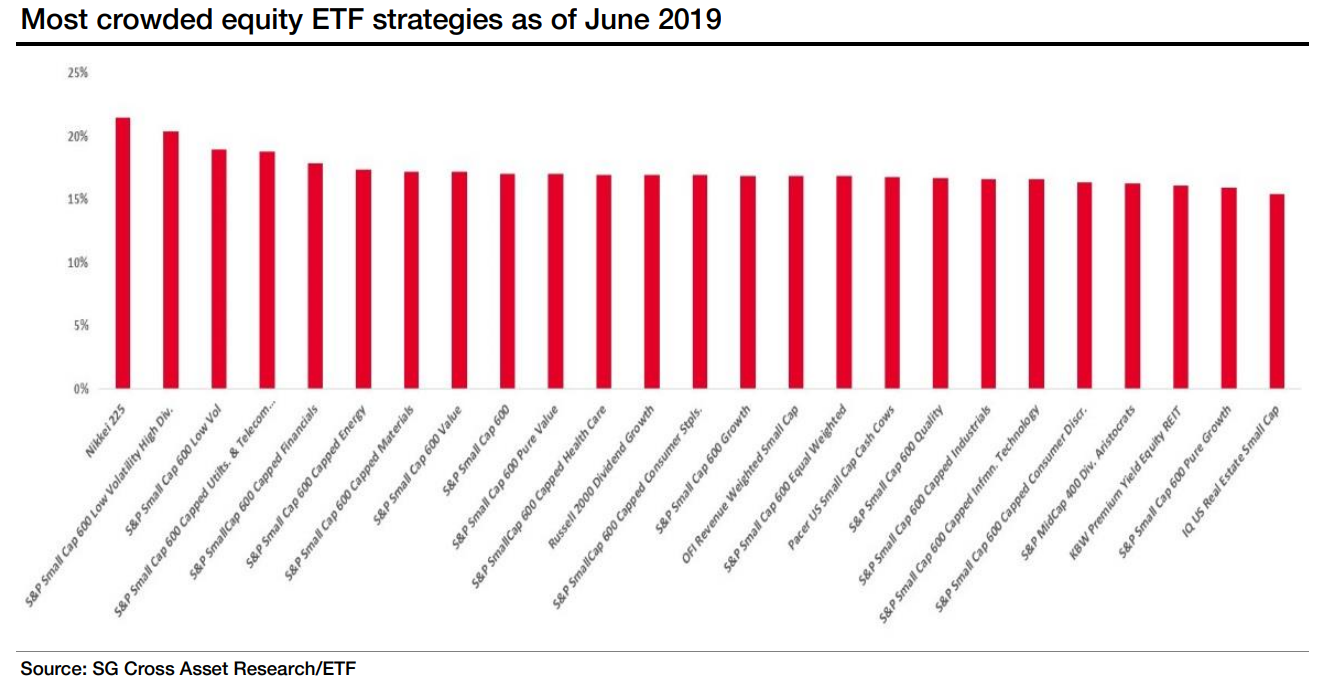

A recent report from Societe Generale (SG) highlights concerns regarding overcrowding within the ETF strategies as a result of accelerated growth in assets and expansion in non-traditional benchmarks and less liquid market segments.

From April 2018 to June 2019, the ETF industry grew 12.6% from $3.8trn to $4.4trn. Over the same period, SG calculates stock crowding fell slightly from 5% to 4.5% but there is an increased number of stocks with crowding scores greater than 2%.

In fact, the number of stocks that are 20% owned or more increased over the period, from 84 to 144 stocks.

SocGen targets sophisticated investors in the UK with ETP tsunami

From the 144 stocks owned 20% or more through ETFs, a large portion are either US small caps or are constituents of the Nikkei 225, the Japanese equity index.

It is not only ETFs holding a large proportion of shares in a company which makes the stock overcrowded. Two other conditions which must be met are index overlapping and alternative index weighting.

Index overlapping is the inclusion of component in numerous indices tracked by several large ETFs. This is commonly seen in US small cap strategies.

Alternative index weighting is the assignment of a higher weighting to constituents which have a relatively low market cap in comparison.

This is common within the price-weighted Nikkei 225 strategies. One factor for this can be equal-weighted indexes which assigns the same weighting for a company with the smallest market cap as the company with the largest, however, this has proven to be a strong performing strategy.

While the number of stocks owned 20% or more through ETFs has nearly doubled to 144 in the last 14 months, this figure still represents less than 1% of the total number of stocks.