STOXX, the administrator of the EURO STOXX 50 and DAX, turned 25 this year, marking the passage of a quarter century that coincided with a radical transformation of financial markets and investment possibilities.

The index provider started operations in 1998 with the launch of the iconic Eurozone benchmark, as electronic trading of equities and derivatives was gathering pace and the introduction of the euro was still nearly a year away.

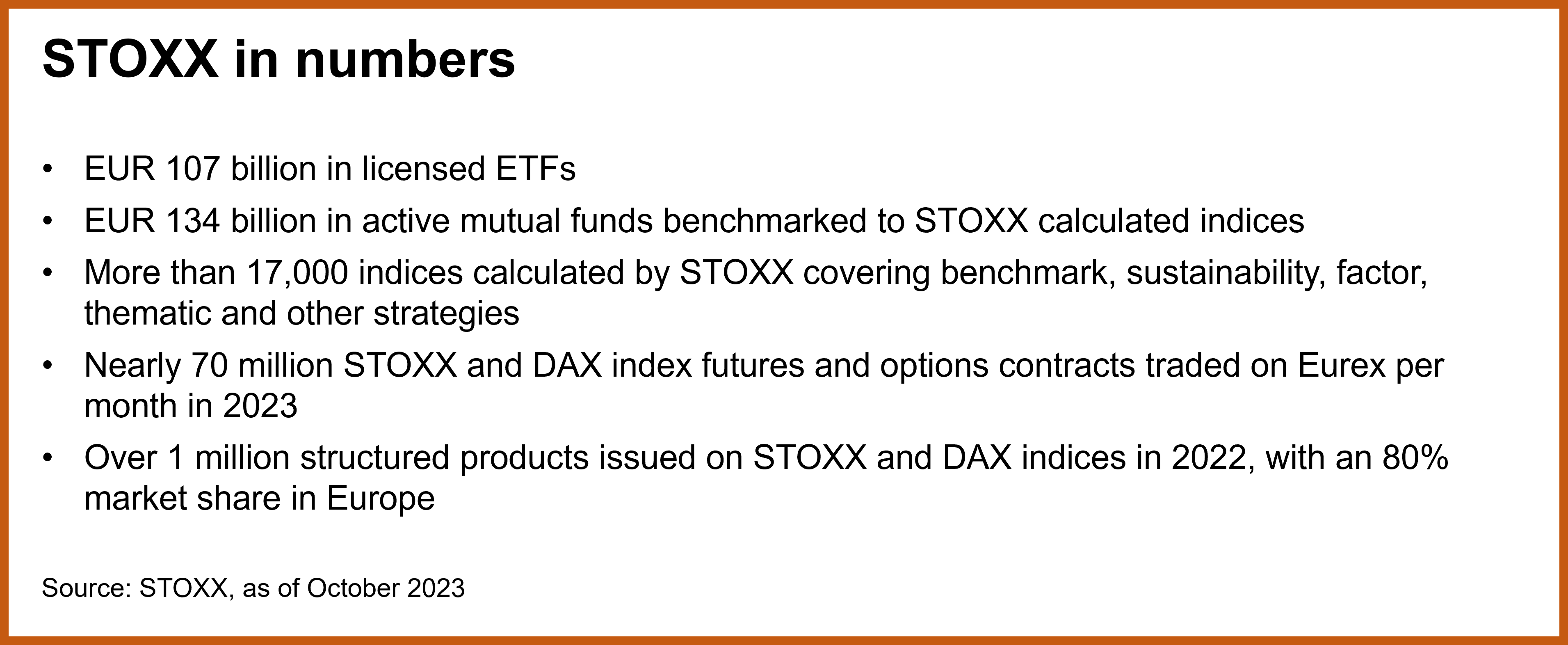

Since then, STOXX has become a hub of smart index-based strategies with a global reach. Its more than 17,000 rules-based and transparent indices under the STOXX and DAX brands span the entire spectrum of investment strategies.

In November, STOXX merged with Institutional Shareholder Services (ISS), a leading provider of ESG data, analytics and insight.

This was a great occasion to speak with Axel Lomholt, general manager at STOXX, to get his impressions on the growth trajectory of his company and ask him what lies ahead for an indexing industry immersed in full transformation.

What are some of the key developments within STOXX since its first index launched 25 years ago?

Our index business has evolved drastically since 1998 and has been at centre stage of the transformation of the investment industry. Since day one, our indices have gained rapid adoption due to their strictly rules-based and reliable methodologies. We have built a robust legacy with the most widely traded European benchmarks, whose unique and extensive ecosystem of funds, listed derivatives and structured products helps investors efficiently manage portfolios. Our indices are used for benchmarking purposes by the world’s largest investment institutions, they underlie some of the most liquid futures and options and they are the top choice for issuers of structured products.

From our strength in European benchmarks — including the EURO STOXX 50, STOXX Europe 600 and DAX — we have constructed a global footprint and grown our offering of index strategies, including sustainability, thematic and factor-based products. That journey is paved with lots of ‘industry-firsts’. To name only two of those, STOXX introduced the market’s first decrement index in 2015 and in 2019, we were part of the process to launch the first pan-European ESG futures, tracking the Europe 600 ESG-X index.

There has been an explosion in alternative data that few imagined 25 years ago — and systematic and quantitative investing has grown as a result. Innovation has broadened our possibilities, enabling ‘smart’ indices that fit bespoke mandates. With open access to the most nuanced data from leading providers and deep risk and factor exposure analysis, we enable users to optimise their indexed portfolios — controlling for risk, returns and sustainable impact.

Yet our mission has not changed: to design powerful products, partnering with investors to tackle with precision their specific challenges and opportunities in an ever-interconnected global economy.

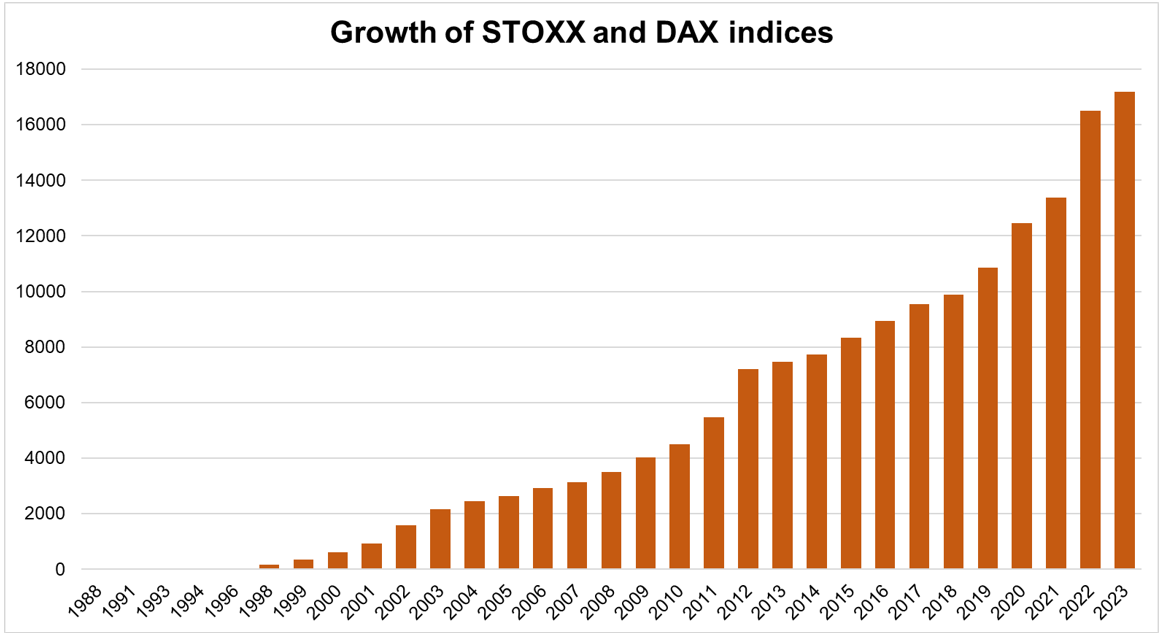

Figure 1: Number of STOXX and DAX indices (1998 – 2023)

Source: STOXX, as of 31 October 2023, includes all STOXX, DAX and white label indices calculated by STOXX Ltd

How will the merger with ISS shape future strategy and product development at STOXX?

The newly combined ISS STOXX is part of the new Investment Management Solutions segment at Deutsche Börse. STOXX and ISS have been close partners for many years and the combination of sophisticated index know-how and construction, leading market intelligence and robust ESG and governance data is a perfect fit that will significantly strengthen the overall offering of solutions and enhance the possibilities for clients.

Under the ISS STOXX umbrella, STOXX will sit alongside ISS’ four existing business lines: ISS Governance, ISS ESG, ISS Corporate Solutions and ISS Market Intelligence. We are extremely well-positioned to offer robust solutions in the context of evolving needs in customisation, sustainability and diversification.

What have been some main changes in dynamics within indexing products?

Without a doubt, sustainability is a megatrend that is fundamentally changing the indexing business. We launched our first sustainability index back in 2001 – and now have a 1,500-strong ESG and sustainability family of indices that cater to diverse objectives. Sustainability indices and analytics are crucial catalysts for investors to transition from ‘brown’ to ‘green’ portfolios and this trend will continue as regulators, investors and pension trustees raise the bar on issues from biodiversity to human rights and datasets become ever-more sophisticated.

Innovation has also lifted the thematics space to new levels. STOXX introduced its thematic offering in 2013 and today we count over two dozen indices, which target transformative megatrends across three broad categories: future technology, socio-demographics and the environment. We aim to be leaders in thematic investing research. We have the means and the expertise to analyse and determine what defines a theme; whether it has a long life and solid growth prospects; whether it is investable; and which method and data source are best to harness the theme’s potential.

Finally, the market landscape has moved towards more regulation, which in turn leads to increased securitisation and enhanced standardisation. Investors want transparent, liquid and cost-efficient alternatives for investments. Despite breathtaking advances in index construction, all of our indices keep the guiding principles of transparency, representativity and investability. And this, in the light of increasing regulation, is more important than ever.

How is the growth of ETFs influencing index providers?

ETFs have been a cornerstone in the modernisation of markets in recent years, bringing investors an abundance of benefits with them. Advances in index construction have played a key role in that transformation.

The indexing boom has blurred the lines between active and passive investing and investors can now access the most differentiated and targeted strategies through systematic and increasingly customised, index-based approaches. The expanding functionality of such indices is likely to keep lifting the ETF universe to greater trading volumes and assets. Whatever new products emerge, STOXX will be at the front line of change.

What are the key megatrends STOXX is mindful of?

The investment landscape is undergoing a significant departure from the past two decades. At the heart of this transformation are remarkable technological advancements. A key focal point in this evolutionary journey is the exponential growth of digital data globally. Here, it is essential to recognise that technologies like machine learning only yield substantial benefits when complemented by a well-structured strategy that can ensure the effective utilisation and management of this invaluable resource.

One outcome of this data revolution is index customisation. There is a discernible preference for tailor-made indices over off-the-shelf solutions and as a result customisation has become our ‘secret sauce'. The mass customisation wave owes much to a quantum leap in capital markets technology, which has advanced trading, deepened liquidity pools and improved hedging options. Most of our new solutions were born out of a client need and of close cooperation — which increasingly means co-developing indices with them. As our clients’ goals and requirements change, I see the index business as a facilitator as well as risk manager.

A second significant trend centers around how our clients are adapting to a rapidly decarbonising world. Regulators, governments and the broader society are placing increased emphasis on the need for transparency in sustainability-related actions. Benchmarking and standardisation are on the rise to counter greenwashing, while legal and regulatory pressures are reinforcing accountability. At STOXX, we anticipate a heavier regulatory burden, especially in terms of climate-related disclosures and actions. However, building climate-aware portfolios that are forward-looking will only be as good as the data that goes into them and deep specialisation is needed to understand the impacts of decarbonisation on index construction. The new ISS STOXX will be in a formidable position to assist our clients in navigating the profound implications of ‘greening’ portfolios.

Finally, we are witnessing the ongoing, secular trend of portfolio diversification. Our clients are reaching out beyond the traditional equities and bonds spectrum, with a noticeable increase in appetite for innovation. With advancements in technology and the new focus on sustainable value creation, the profile and constitution of investment portfolios will look very different to the way they did one or two decades ago.

With so many drivers, what is the growth outlook for the industry?

It is indeed an industry undergoing truly significant expansion. Beyond the broader active-to-passive trend, there are the drivers described earlier, plus new product segments including fixed income, private markets and digital assets. At the same time, there is a massive transfer of wealth to a younger, tech-savvy and sustainability-conscious generation that has grown with ETFs and indexed products. It truly is a multi-faceted growth story.

The index industry has had a front-row seat in the radical transformation of financial markets over the last 25 years. I very much look forward to what lies ahead.