There is a stark contrast between the synthetically replicated ETFs of today compared to 10 years ago, according to a report from Morningstar, as the structure begins to see investor demand once again after a decade in the wilderness.

The report, entitled Spotlight on synthetic ETFs in Europe: A review of management practices, said there has been a “major improvement in transparency” over the past decade with ETF issuers now disclosing the full contents of substitute baskets and employing a multi-swap counterparty model to mitigate the risks of swap exposure.

Synthetic ETFs were the structure of choice for investors prior to the Global Financial Crisis, however, this changed dramatically in the years following with regulators such as the International Monetary Fund (IMF) and the Bank for International Settlements (BIS) warning about the potential risks involved.

They were fiercely supported by adopters of physically replicated ETFs which “engaged in open PR warfare” to damage the reputation of synthetic ETFs, the report said.

Leading the charge was BlackRock with CEO and chairman Larry Fink warning about the counterparty risk and extra complexities.

“If you buy a Lyxor product, you are an unsecured creditor of SocGen,” Fink said in 2011.

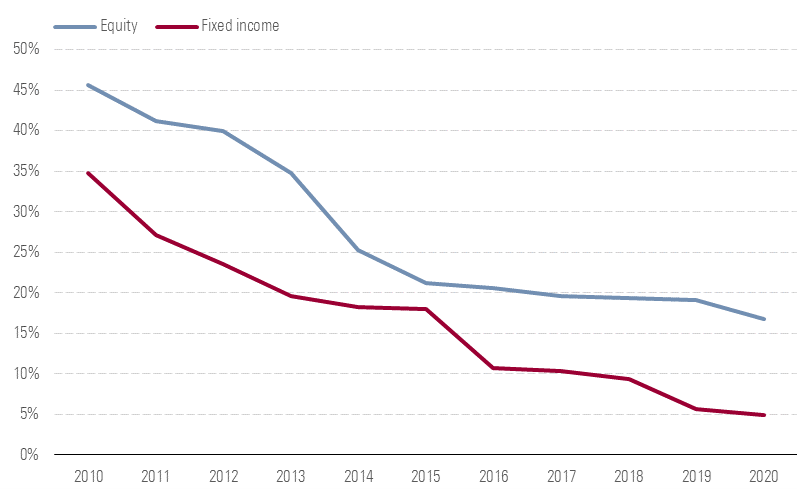

Demand for synthetic ETFs fell off a cliff the number of assets held in equity falling from 46% in 2010 to 17% by the end of 2020 while fixed income dropped from 35% to 5%, according to Morningstar.

Source: Morningstar

As a result, ETF issuers with large synthetic offerings have been forced to adapt with DWS, Lyxor and Amundi – the three leading issuers of synthetic ETFs – converting and launching many physical ETFs.

“Synthetic replication came out badly bruised from that period and investors decisively shifted in favour of physical ETFs,” Jose Garcia-Zarate, associate director, passive strategies research, Europe, at Morningstar, and co-author of the report, said: “This had a significant effect in the way some of the major ETF providers in Europe conducted their business.”

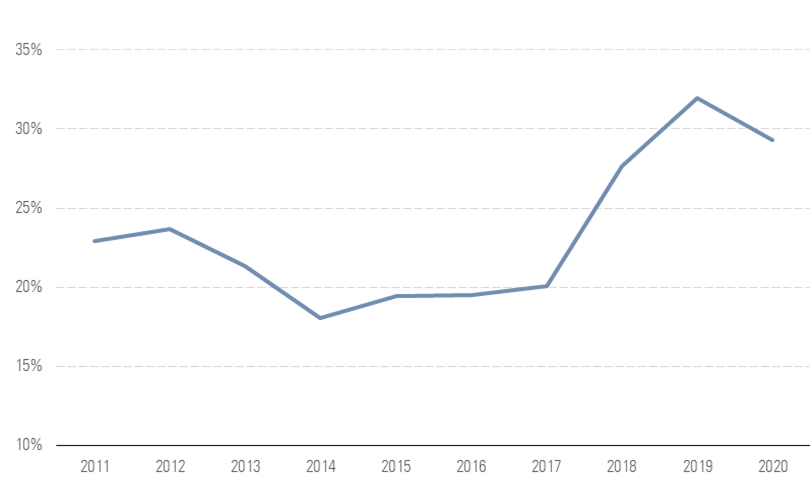

However, over the past few years, synthetically replicated US equity ETFs have been making a comeback due to the tax advantages on offer.

Synthetic ETFs do not pay withholding tax on dividends as the substitute basket of the ETF is restricted to non-dividend paying stocks while physical ETFs domiciled in Luxembourg pay 30% withholding tax on US equity dividends while Irish-domiciled ETFs pay 15%.

This advantage even led physical replication stalwart BlackRock to launch the iShares S&P 500 Swap UCITS ETF (I500) last September, ETF Stream revealed, a clear signal of investor demand for synthetic US equity ETFs.

Source: Morningstar

Along with the tax advantages, ETF issuers have introduced a number of measures to improve the structure including multi-swap counterparties.

Previously, ETF issuers used a single counterparty – typically was their own parent investment bank – which left investors potentially uneasy about the counterparty risk involved especially immediately after the GFC.

This has now changed though with the majority of ETF issuers, barring Amundi, employing a multi-swap counterparty model, according to Morningstar.

“The more common use of multiple swap counterparties is a welcome risk-mitigation development in the management of synthetic ETFs,” Garcia-Zarate said.

Physical ETFs are safer than synthetic ETFs – a misconception?

The report added ETF issuers now disclose the full contents of the collateral baskets which is another step in the improvement of transparency.

However, Garcia-Zarate stressed the need for further transparency around swap costs as they are not typically included in an synthetic ETF’s ongoing charges figure (OCF).

“Though not always, swap counterparties can charge a spread, which will have an impact on the tracking difference of the fund,” he continued. “This swap spread depends on various factors: the cost for the swap provider to gain access to the reference index in order to hedge its exposure, any revenue generated (for example from tax optimisation) and the costs of collateral.”