Synthetic ETFs have lost ground to physical replication so far this year amid the rotation away from US equities into Europe and emerging market exposures.

Equity ETFs in Europe have seen €25.6bn inflows this year, as at 25 April, with synthetics across all asset classes accounting for just €4.3bn, according to data from Bloomberg Intelligence.

This pattern is even more pronounced over the trailing 12 months, with €77.2bn inflows for all physical and €8.9 outflows for all synthetic ETFs.

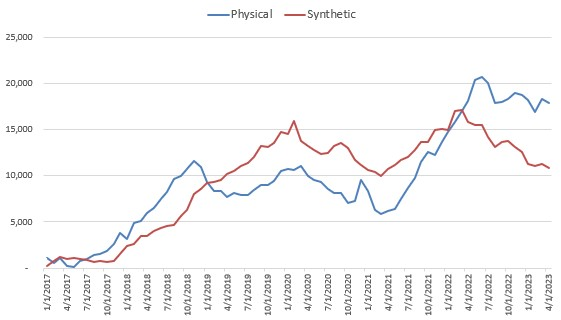

Chart 1: Physical vs synthetic ETF AUM

Source: Bloomberg Intelligence

Mirroring these trends, US equity UCITS ETFs – which dominate synthetic demand due to favourable withholding tax treatment – have seen €1.5bn outflows so far this year.

This includes a considerable €1.1bn outflow from the synthetic $4.5bn Xtrackers S&P 500 Swap UCITS ETF (D5BM), the second-largest exodus from any ETF in Europe so far in 2023.

Meanwhile, European equity is back in vogue with the product class – predominantly physical ETFs – amassing €5bn net new assets in 2023.

The exposure has also enjoyed strong returns, with Europe sector, factor and vanilla ETFs such as the $438 iShares MSCI Europe Consumer Discretionary Sector UCITS ETF (ESIC), $182m iShares Euro Total Stock Market Growth Large UCITS ETF (IDJG) and $530m HSBC Euro Stoxx 50 UCITS ETF (H50E) enjoying some of the strongest performance this year, returning 26.1%, 22.2% and 20.7% in 2023, respectively.

It has been a similar story in emerging market ETFs, with the $3.4bn Amundi MSCI Emerging Markets UCITS ETF (AUEM) and $16.9bn iShares Core MSCI EM IMI UCITS ETF (EIMI) among the ETFs with the highest inflows – $1.7bn and $1.1bn, respectively – in Q1.

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, commented: "International outperformance has led to a greater portion of flows leaving US exposure for those.

"As a consequence, synthetic ETFs, popular in Europe thanks to a tax loophole, have been losing ground.”

Christopher Mellor, head of EMEA equity ETF product management at Invesco, which operates an S&P 500 ETF in Europe, explained synthetic US equity ETFs domiciled in Ireland are able to pass through the total dividend paid to an investor with zero withholding tax due to the introduction of the HIRE Act in 2017.

Mellor previously told ETF Stream: “The best physically replicating funds domiciled in Ireland are able to reduce the impact of WHT from 30% to 15% due to tax treaties between the US and Ireland.

“The WHT advantage offered by the synthetic structure means that our ETF has outperformed its benchmark by 0.43% over the past year, 0.23% better than the largest physical funds. Over the past five years the gap between synthetic and physical is 1.25%.”

With European equities looking more reasonably priced and less concentrated in a handful of large caps than their US counterparts, synthetic ETFs have lost ground in line with investors’ new exposure preferences.