The entire commodities sector performed rather disappointingly during 2023. Two of the few exceptions were oil and uranium. The former shined amid fears of production cuts by OPEC and new conflicts in the Middle East.

The latter was driven by an acceleration of nuclear programs by many countries around the world as well as geopolitical instability in some historically uranium-rich areas, such as Niger.

What was the cause of this negative performance?

At the macroeconomic level, there were a number of factors that probably influenced it. First and foremost, there were considerable investor expectations about China's post-Covid reopening. Expectations were largely disappointed with an underwhelming economic recovery. Hence, reduced demand for metals and other commodities. Second, commodities have historically provided protection from inflation, appreciating in periods of general price increases. In recent months, key consumer price indexes (CPI), including for example the much-followed US CPI, have declined with many observers already pointing to a disinflation process well underway.

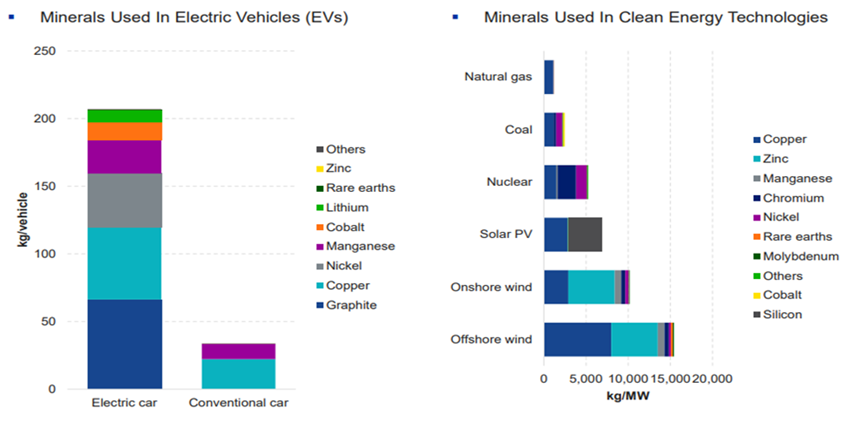

Despite these factors, we see much value in the commodity sector in light of long-term structural trends. In particular, we see that companies engaged in the extraction and processing of metals, the so-called miners, as particularly attractive. They may be the key players in the green revolution that will involve all sectors of our society. There is indeed a huge need for raw materials to be met; technologies such as wind, solar, electric vehicles but also the nuclear sector, require a large amount of input. Suffice it to say that an electric vehicle requires 60-83kg of copper to run while a traditional one requires only 15. Similarly, an offshore wind plant requires 13 times more minerals such as rare earths than a similar gas-fired plant¹. This underscores how miners are in an attractive position to play a strategic role in the energy transition and potentially benefit from a supply-demand imbalance.

Source: IEA, June 2021 data

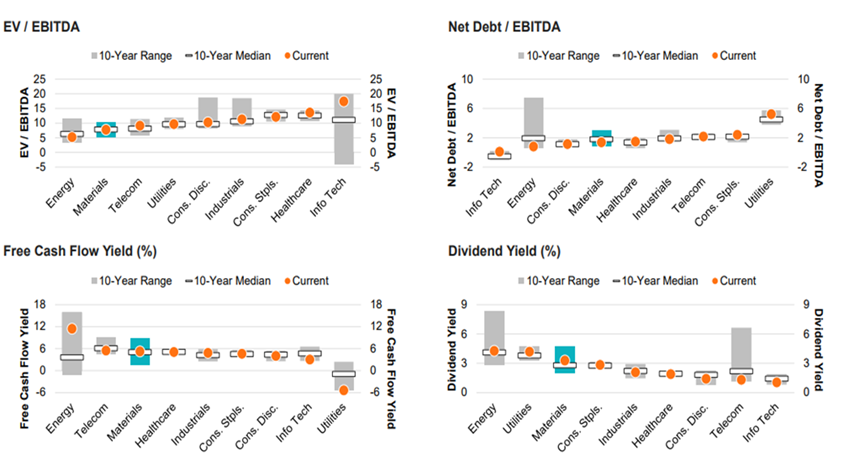

There are also other factors that speak in favour of miners rather than a direct investment in commodities. Traditionally, these are companies that distribute a large share of profits in the form of dividends. A consistent dividend return can help overcome phases in which the market moves sideways or downward, just like the current one. Valuations and balance sheets also appear solid at the moment, with averagely low debt levels and good cash flow generation.

However, investors need to pay attention to certain factors such as the cyclicality of the metal mining business. Indeed, these are businesses that are greatly affected by the general trend of the economy, suffering during periods of slowdown. It is also a sector subject to various risks at both geopolitical and regulatory levels.

Source: Bloomberg. September 2023 data. Energy, Materials, Utilities, Telecom, Healthcare, Consumer Staples, Consumer Discretionary, Industrials, and Information Technology represented by their respective sector indexes in the S&P Global 1200 Index (note: Financials and Real Estate sectors are excluded due to lack of historical data)

The graph above shows just how one valuation metric such as EV/EBITDA is at the level of the median of the last 10 years while others such as dividend yield are above this indicative level as well as those of many other sectors. This information indicates how the sector as a whole does not appear to be too "expensive" taking into account both historical averages and underlying fundamentals.

Looking ahead to 2024 and beyond, although inflation is currently decelerating, there is historical evidence of how difficult it is to eradicate once a certain threshold is crossed. Particularly, in the major developed countries, such as France, the UK, the Netherlands and the United States, once the 5% level is exceeded, it takes 18 years on average to return stably to 2%, which is the target of the major central banks.

It cannot therefore be ruled out that inflation could occur in cycles and be more difficult to eradicate than expected. An exposure to commodities can therefore potentially provide protection against this scenario, as well as significantly diversify a portfolio, given the low correlation with other asset classes. In our opinion, a diversified global mining ETF can be a way to participate in long-term trends, such as the energy transition, as well as to be prepared for unexpected events such as a new acceleration in inflation.

1. IEA, June 2021 data

Important information

This is a marketing communication. Please consult the UCITS prospectus and the Key Investor Information Document (KID) before making a final investment decision. This information is prepared by VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the management company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Authority for the Financial Markets (AFM) of the Netherlands. VanEck (Europe) GmbH with registered office at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the German Federal Financial Services Supervisory Authority (BaFin). The information contained herein is intended solely for the purpose of providing general and preliminary information to investors and in no way constitutes investment, legal or tax advice. VanEck (Europe) GmbH and its subsidiaries and affiliates (together "VanEck") accept no liability whatsoever for any investment, divestment or holding decisions taken by investors on the basis of this information. The opinions and views expressed are those of the authors, but do not necessarily reflect those of VanEck. Opinions are current as of the date of publication and subject to change based on market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements that do not reflect actual results. Information provided by third party sources is believed to be reliable and has not been independently verified for accuracy or completeness and therefore cannot be guaranteed. All indices mentioned are designed to measure common sectors and market performance.

All performance information is based on historical data and is not indicative of future returns. Investing exposes you to risks, including possible loss of capital. Before investing, you should read the Prospectus and the Key Investor Information Document (KID).

No part of this material may be reproduced in any form or quoted in another publication without the express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

1. IEA, June 2021 data