“Income is back in fixed income”. If there was a contest for the catchphrase of the year 2022, this one would certainly be a hopeful contender as it captures the essence of market evolution. The fixed income space has undergone a significant transformation and reallocation implications reverberate into 2023. Already now the ongoing repositioning resulted in the influx of over $250bn1 in new assets invested in fixed income ETFs.

In light of a benign outlook for fixed income assets in 2023, we recap how investors can leverage the passive toolkit. A holistic consideration of this toolkit should not only include an examination of fixed income assets most suitable, but also a consideration of the specifics of the investment vehicles utilised.

After all, the efficacy of ETFs as a means of accessing the fixed income markets can vary, and investors would be well-advised to uphold the principles they adopted in the past decade of ultra-low interest rates: Utilising the full breadth of the passive fixed income toolkit but always with a focus on efficient replication. In the following, we recap three essential dimensions investors should be mindful of: (i) a growing core, (ii) the role of innovative solutions and (iii) the metrics to watch in implementation.

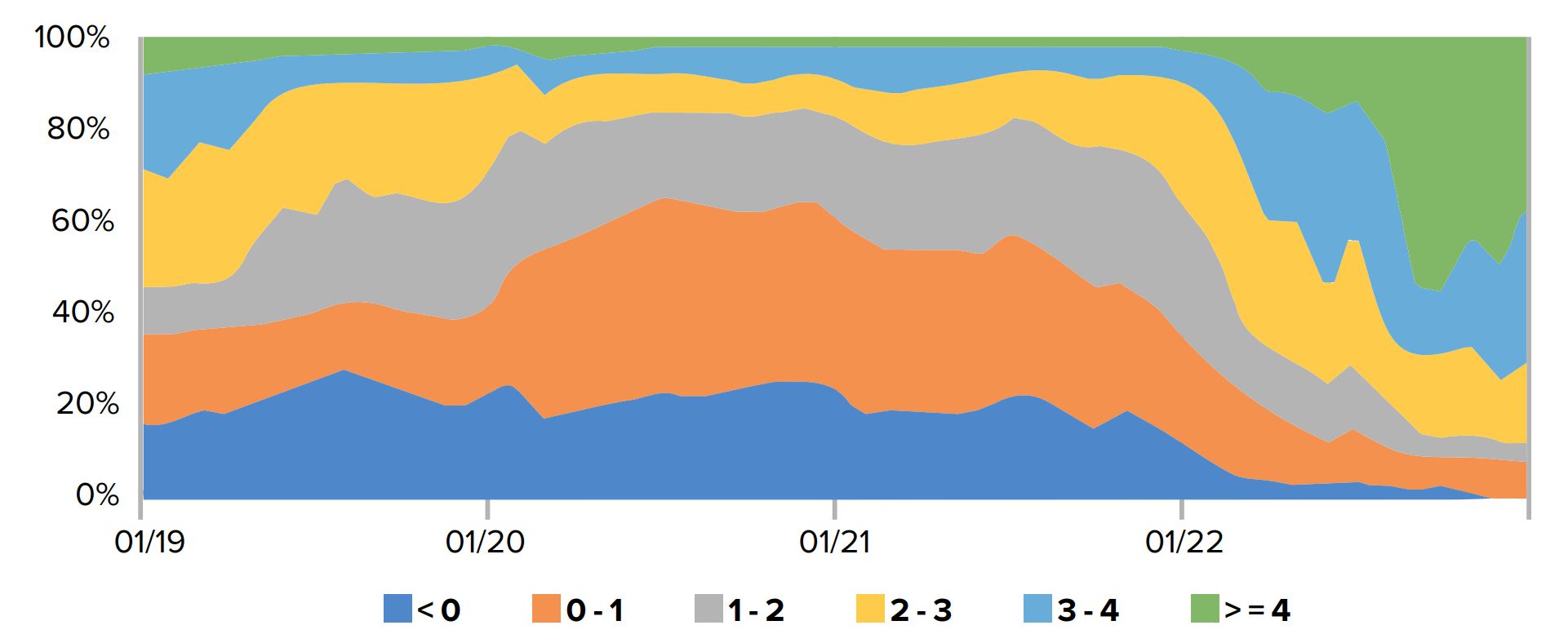

Figure 1: Income is back – yield distribution in global fixed income universe

Yield distribution in % based on the Bloomberg Global Aggregate Index. Sources: Bloomberg, DWS International GmbH, as of January 2023

The role of a green core for portfolio construction

The ESG investment landscape continues to experience significant growth and momentum, as evidenced by the proliferation of ESG-focused products in the European ETF market.

As investors increasingly shift away from traditional fixed income, they now have access to a wide range of ESG building blocks to choose from.

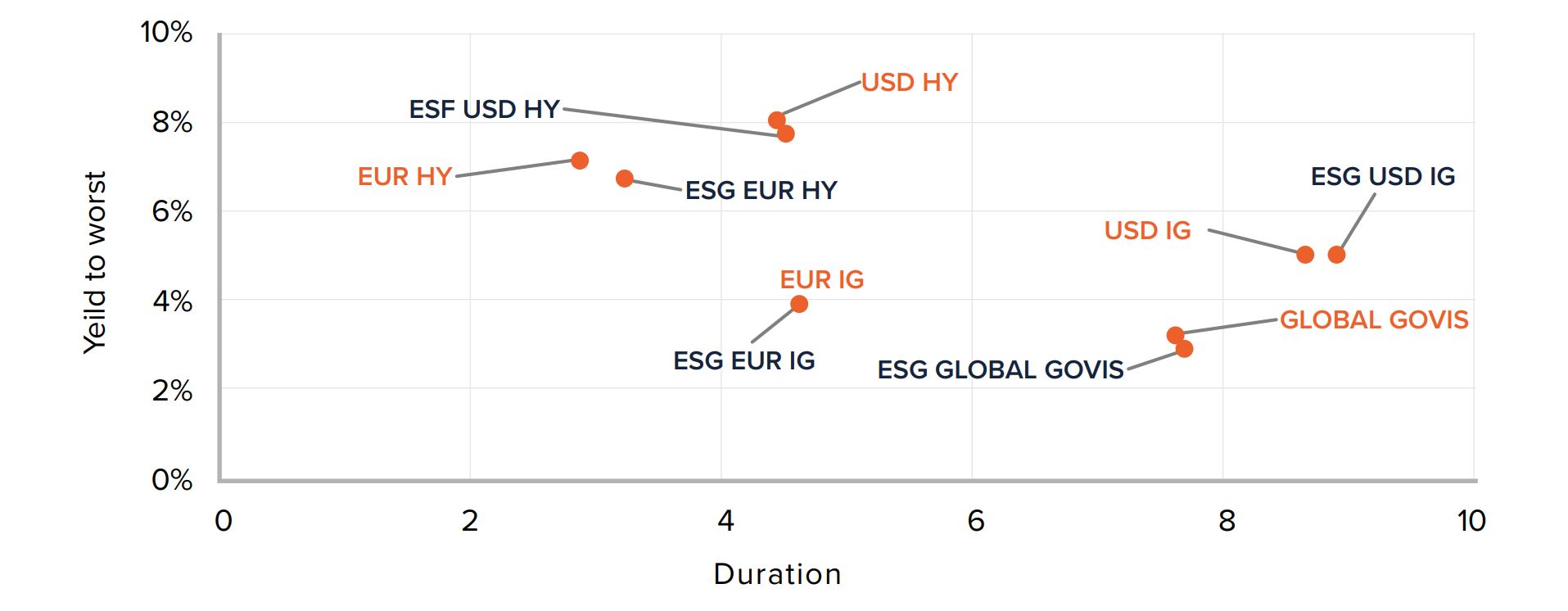

The shift towards ESG investments is driven by competitive and cost-efficient solutions that align with traditional investments in terms of yield, duration, and rating and reflects a change in investment attitudes as investors seek to align their portfolios with their values. The availability of compelling solutions allows them to do so while maintaining representative market exposure and achieving similar yields.

The role of fixed income innovation

As recent developments have demonstrated, with long-term sovereign bond yields surpassing 2.5% and 3.5% in the eurozone and US, respectively, even government bonds have emerged as a compelling investment alternative. However, while carry and yield to maturity are certainly important factors, it should not be the sole consideration in making fixed income allocation decisions. After all, a key role of fixed income in portfolio construction is to provide diversification, and here, traditional core exposures in government and investment grade bonds have struggled to deliver in 2022 – a record year for equity and bond correlation.

Figure 2: Yield to worst and duration of ESG solutions and their non-ESG counterparts

Sources: Bloomberg, DWS International GmbH, as of January 2023

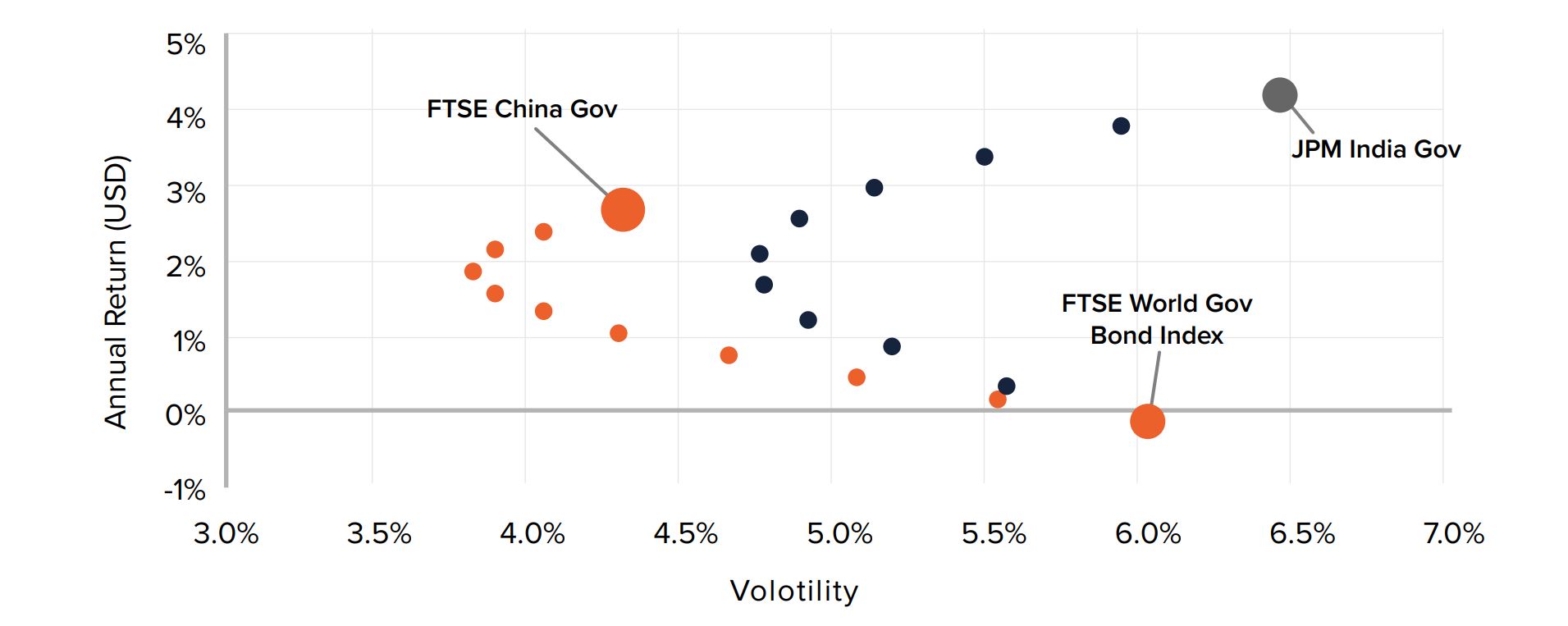

Allocation to non-core investments can provide meaningful diversification benefits. As recent events have highlighted, this is particularly true for emerging market government bonds, where countries like China and India have proven to be resilient sources of diversification, even in the face of global volatility. China government bonds have already established themselves as a cornerstone of fixed income portfolios, recently peaking at €15bn in assets in European UCITS ETFs2.

Meanwhile, India is fast becoming a compelling option for investors seeking a combination of yield and diversification, supported by a range of structural drivers.

In 2023, investors may also benefit from incorporating innovative fixed income solutions into their investment strategies, even in modest allocations, to further diversify existing portfolios and capitalise on long-term growth.

Figure 3: The role of China and India

Simulated 10% incremental introduction into a global government bond portfolio. Source: DWS International GmbH, Bloomberg, 31/12/15 - 30/01/23

The role of an efficient implementation

When selecting fixed income products, investors must consider two crucial factors: quality of replication and cost of implementation. Both factors are fundamental to the success of an investment strategy and warrant close examination.

In terms of quality of replication, two commonly used metrics are tracking difference and tracking error.

Tracking difference quantifies the deviation of a fund’s performance from its benchmark index while tracking error measures the stability of this deviation and is calculated as the standard deviation of the tracking difference. The tracking difference can be impacted by several factors, with the total expense ratio (TER) being a source of performance drag. Yet, in the fixed income space, it is worth analysing performance-enhancing features such as securities lending or primary-market participation in new issues.

If implemented correctly, these can contribute to significantly tighter tracking differences than TERs might suggest.

To judge the quality of portfolio management, however, tracking error might be the more important variable. A low tracking error is a sign that portfolio managers replicate the index closely while managing the sources of tracking difference consistently.

Since tracking errors can be large relative to tracking difference in fixed income, they warrant special attention. Take high yield ETFs as an example. The average EUR HY ETF has a tracking error of 27bps, which implies about a one-third chance that the ETF deviates by more than 27bps from the longer-term tracking difference path per year. However, not all ETFs are created equal, and some offerings feature single basis point tracking errors resulting in much lower implementation risks.

For investors with a shorter-term investment horizon, tracking error is therefore a highly relevant dimension, one that is often neglected when decision-making is driven by total cost of ownership considerations.

Overall, the fixed income market has undergone a significant transformation, with yields becoming increasingly competitive. Despite this investor’s principles of product selection should not change much.

Poor implementation, excessive costs, and undesirable asset allocations still negatively impact performance.

Investors are therefore well advised to maintain their disciplined selection approach to effectively leverage the full potential of the fixed income market in 2023.

Olivier Souliac is team lead product specialists Xtrackers and Lukas Ahnert is product specialist Xtrackers index strategy at DWS

This article was first published inFixed Income Unlocked: After The Storm, an ETF Stream report

1 Source: Bloomberg, 1Y flow as of January 2023 in global fixed income ETPs2 Source: Bloomberg, as of January 2023, based on UCITS ETF universe

Disclaimer

DWS is the brand name of DWS Group GmbH & Co. KGaA and its subsidiaries under which they do business. The DWS legal entities offering products or services are specified in the relevant documentation. DWS, through DWS Group GmbH & Co. KGaA, its affiliated companies and its officers and employees (collectively “DWS”) are communicating this document in good faith and on the following basis. This document is for information/discussion purposes only and does not constitute an offer, recommendation or solicitation to conclude a transaction and should not be treated as investment advice. This document is intended to be a marketing communication, not a financial analysis. Accordingly, it may not comply with legal obligations requiring the impartiality of financial analysis or prohibiting trading prior to the publication of a financial analysis. This document contains forward looking statements. Forward looking statements include, but are not limited to assumptions, estimates, projections, opinions, models and hypothetical performance analysis. No representation or warranty is made by DWS as to the reasonableness or completeness of such forward looking statements. Past performance is no guarantee of future results. The information contained in this document is obtained from sources believed to be reliable. DWS does not guarantee the accuracy, completeness or fairness of such information. All third party data is copyrighted by and proprietary to the provider. DWS has no obligation to update, modify or amend this document or to otherwise notify the recipient in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Investments are subject to various risks. Detailed information on risks is contained in the relevant offering documents. No liability for any error or omission is accepted by DWS. Opinions and estimates may be changed without notice and involve a number of assumptions which may not prove valid. DWS does not give taxation or legal advice.

This document may not be reproduced or circulated without DWS’s written authority. This document is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, including the United States, where such distribution, publication, availability or use would be contrary to law or regulation or which would subject DWS to any registration or licensing requirement within such jurisdiction not currently met within such jurisdiction. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions

In Hong Kong, this document is issued by DWS Investments Hong Kong Limited. The content of this document has not been reviewed by the Securities and Futures Commission.

© 2023 DWS Investments Hong Kong Limited

In Singapore, this document is issued by DWS Investments Singapore Limited. The content of this document has not been reviewed by the Monetary Authority of Singapore.

© 2023 DWS Investments Singapore Limited

In Australia, this document is issued by DWS Investments Australia Limited (ABN: 52 074 599 401) (AFSL 499640). The content of this document has not been reviewed by the Australian Securities and Investments Commission.

© 2023 DWS Investments Australia Limited.