Silently but steadily, over the last 20 years, the investment industry has undergone a paradigm shift. Beyond the typical discussion of active versus passive management, what has undoubtedly changed is the industry’s shift of focus from the discovery and exploitation of knowledge inefficiencies to the uncovering and resolution of operational inefficiencies.

Technology has been the main driver of this transformation, and we are only seeing the beginning of it. Technology has not only largely reduced the subjectivity and emotionality of decision making in capital markets but has enabled many opportunities to extract value by simply being more efficient and scalable than the neighbouring firm.

When I started my career at a large investment consulting firm, I remember constantly wondering the reasons why large institutional investors were spending so much money and time in selecting and controlling investment managers, transitioning portfolios from one manager to another, when they could have simply slimmed down the overhead and invest passively via cost-efficient ETFs. The realisation that an index made more sense as an investment strategy than as a mere benchmark, and that indexing as an industry was only starting to live up to its potential was what brought me into the indexing space.

It was a similar epiphany, 10 years later and this time around the growth of hyper-customisation in investments, which drove me out of a large exchange group and got me into the challenge of building an infrastructure play.

The words “scalability” and “customisation” are, more often than not, in contradiction. Generally, scalability is driven by standardisation of processes and workflows. Without technology leaps – think on the internet and the emergence of companies like Amazon or Netflix – it is almost impossible to break the trade-off between both concepts. Large companies will always have a challenging time when it comes to adopting and integrating new technology, because changing infrastructure is always riskier and complicated than building from the ground.

This is exactly why I started BITA five years ago. Not because I believed that we would always have better ideas and research than some of the leading organisations in indexing and investment software, but because I believed that we could build the infrastructure necessary to marry the trade-off between scalability and customisation faster and with a more flexible setup than any of the incumbents.

But our vision is not to build infrastructure solely to gain a competitive advantage against incumbents and newcomers. While we are the first user of every single one of our infrastructure and systems, our vision is to be the “rails and roads” where much of that hyper-customisation and scalable implementation takes place.

In only five years since its foundation, BITA’s infrastructure is already powering innovation at clients and competitors alike.

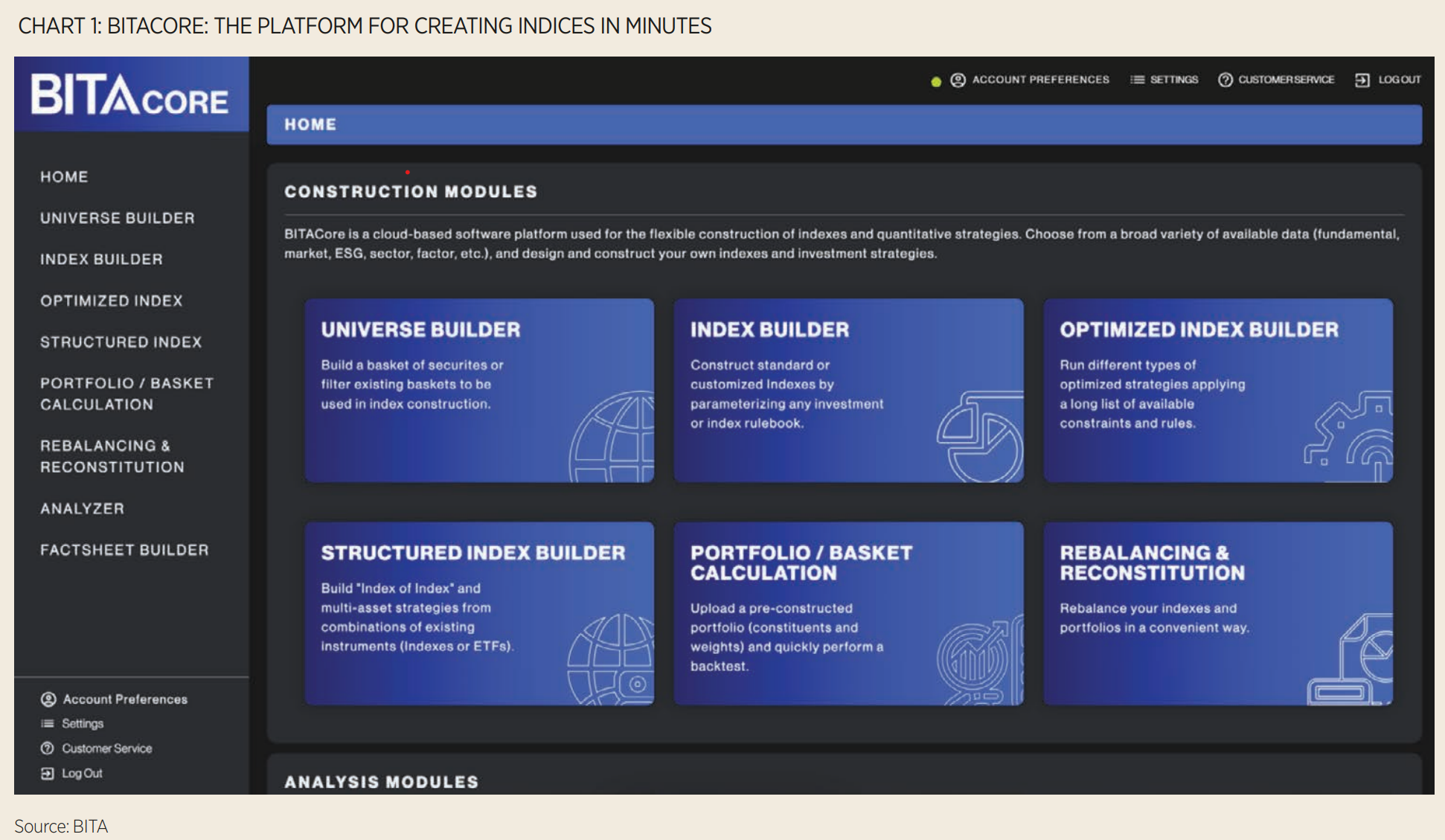

Currently consumed via the web or via APIs, our infrastructure is enabling ETF sponsors to iterate over new ideas in record time, allowing asset managers to better understand the underlying exposures and risks of their portfolios and empowering fintechs and vendors to provide seamless direct indexing solutions. Whether it is about the need for beautifully designed, user-centric, apps to create indices, the automation of the portfolio construction process, the scaling of the prototyping function by building hundreds of portfolios in parallel or analytics and reports created on-the-fly, we can provide a set of applications and APIs catering to each of those use cases.

Our objective over the next few years is to see advisers, asset managers, index providers and even retail individuals, customising and analysing their investments, sometimes without even realising they are running on top of BITA’s infrastructure. I am thoroughly convinced that investment management will become more transparent, more objective, and more open from an architecture perspective. It is therefore necessary to put all the data and the infrastructure directly in the hands of the professionals who need it.

Some 15 years ago, after completing my Economics degree at the Universidad Central de Venezuela, my Alma-Mater and a prestigious public university back in my home country, I dreamed about having the chance to eventually pay back the opportunity by donating a “financial lab” where students had access to the top financial terminals and tools. Maybe that dream will now include a bunch of free BITACore licenses.

Victor Hugo Gomez is CEO at BITA

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full magazine, click here.