FOR PROFESSIONAL CLIENTS ONLY Capital at risk. The value of investments and the income from them can fall as well as rise and is not guaranteed. Investors may not get back the amount originally invested.

Fixed income ETF adoption accelerated in 2022 as markets entered a new regime of greater macro-led market volatility while underlying bond market liquidity deteriorated

Following the yield surge in 2022, we believe investors must re-design their portfolios to reflect the role fixed income can play yet again in offering income

As multi-asset investors rebuild their portfolios into 2023, they can benefit from the breadth and granularity of indexed exposures, while the flexibility of ETFs can help navigate volatile markets

Rising inflation, rate hikes and geopolitical turmoil led to a volatile 2022. As global central banks embarked on an aggressive tightening cycle to curb inflation, bond yields and spreads rose to multi-year highs while underlying bond market liquidity deteriorated.

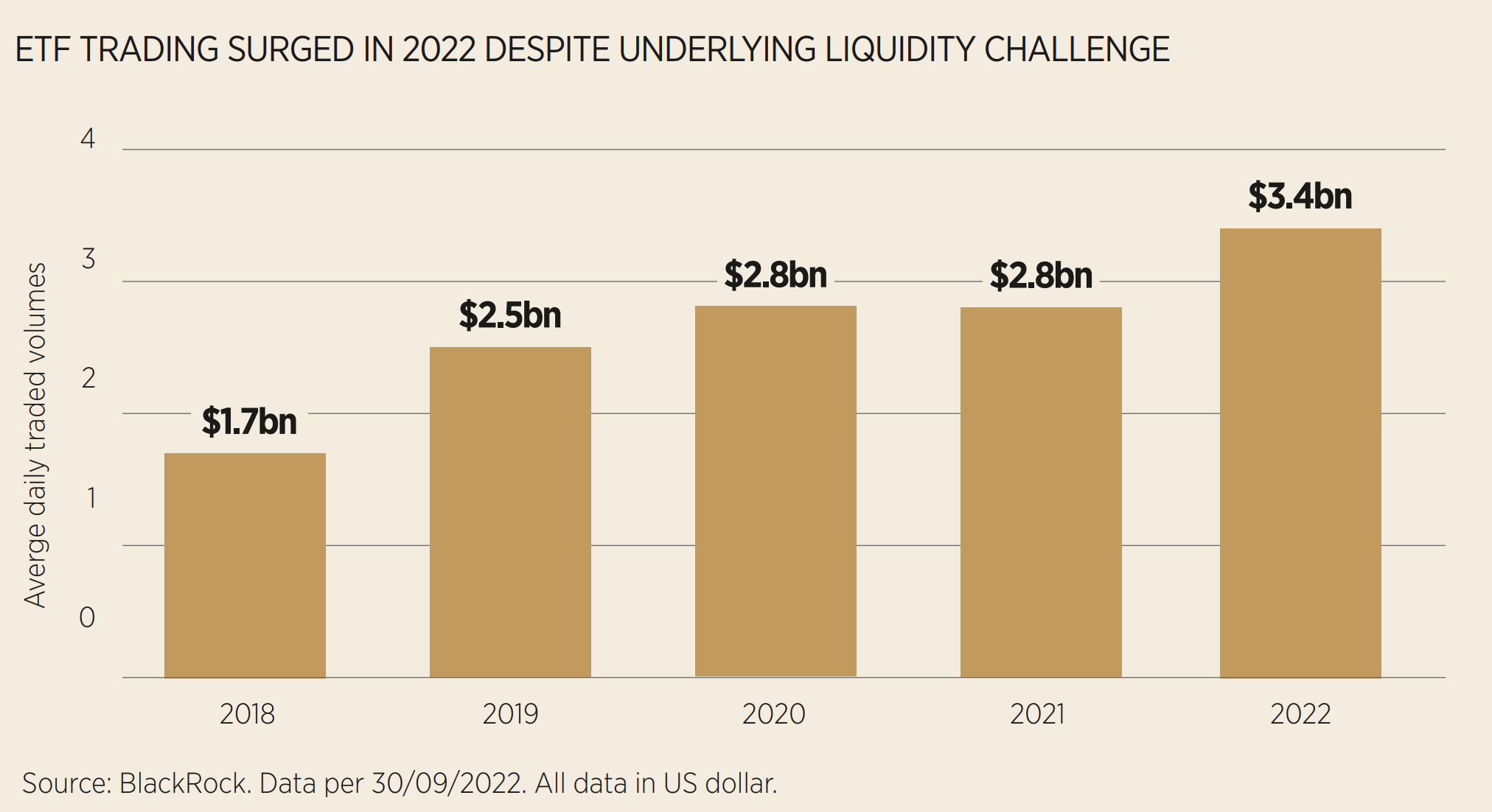

Against the backdrop of this new regime of greater macro volatility, the adoption of fixed income ETFs has continued, as investors use them for access, liquidity and managing risks in their bond portfolios.

BlackRock predicts global fixed income ETF AUM will reach $5trn globally by 2030¹, powered by changes in portfolio construction, with investors using them to generate active returns and create highly customised portfolios. Fixed income ETFs are modernising the bond market itself by driving electronification, algorithmic bond pricing and portfolio-oriented trading.

Last year was one of the most challenging 12 months for investors across asset classes. The $34bn inflows² into UCITS fixed income ETFs by the end of 2022 were characterised by a flight to quality, with government bonds and investment grade (IG) credit in favour. As market sentiment turned in Q4, investors used ETFs to add risk in portfolios, by allocating to IG and moderately to high yield (HY) credit, and lengthening duration.

Underlying bond market liquidity has been challenged for years, driven in part by the reduction in dealer corporate bond inventory levels since the Global Financial Crisis (GFC), combined with central bank intervention. In 2022, higher costs of funding for corporates led to reductions in new bond issuance – often considered as an important source of liquidity for investors.

Challenging liquidity in bond markets supported the shift towards alternative liquidity pools and trading strategies, such as index products including ETFs, and portfolio trades. ETFs have become an integral trading tool for fixed income investors.

Trading volumes across euro-denominated IG and HY credit ETFs rose 33% versus 2021³ while underlying bond volumes were flat. While ETF bid/ask spreads widened during periods of market volatility in line with elevated costs to trade, they continued to provide savings relative to comparable baskets of bonds.

As the ETF market continues to develop, the future scope of these products will see a more diversified investor base and further utilisation of ETFs as long and short instruments. Demand to borrow UCITS fixed income ETFs has grown, while volumes traded in options on UCITS fixed income ETFs more than doubled in 2022, with investors using these derivatives for volatility strategies, yield enhancement and downside risk management.

Looking into 2023 and beyond, we believe multi-asset investors will have to re-design their asset allocation to reflect the role of bonds as a source of income. Following the surge in yields, the case for high quality fixed income has brightened, particularly in the shorter end of the curve, while long-end bonds look more challenged.

As investors re-build their fixed income portfolios, the breadth and granularity of indexed exposures available can enable them to navigate new investment challenges. With higher market volatility likely to be a permanent feature of this new regime, flexibility within portfolios will be important. Against this backdrop, we believe fixed income ETFs will play an even greater role in the way investors access fixed income markets in the future.

Vasiliki Pachatouridi is head of iShares fixed income product strategy EMEA and Natacha Blackman is a fixed income product strategist for iShares in EMEA at BlackRock

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full magazine, click here.

¹ Source: BlackRock, “All systems go: Bond ETFs and the path to $5 trillion,” May 2022 ² Source: BlackRock, GBI ³ Source: BlackRock, TRAX, as at 30 September 2022

This document is marketing material: Before investing please read the Prospectus and the PRIIPs KID available on www.ishares.com/it, which contain a summary of investors’ rights.

Risk Warnings

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Important Information

This material is for distribution to Professional Clients (as defined by the Financial Conduct Authority or MiFID Rules) only and should not be relied upon by any other persons.

In the UK and Non-European Economic Area (EEA) countries: this is Issued by BlackRock Advisors (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL, Tel: +44 (0)20 7743 3000. Registered in England and Wales No. 00796793. For your protection, calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

In the European Economic Area (EEA): this is Issued by BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded. For information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-right available in Italian.

Dubai DIFC issuing: Blackrock Advisors (UK) Limited -Dubai Branch is a DIFC Foreign Recognised Company registered with the DIFC Registrar of Companies (DIFC Registered Number 546), with its office at Unit L15 - 01A, ICD Brookfield Place, Dubai International Financial Centre, PO Box 506661, Dubai, UAE, and is regulated by the DFSA to engage in the regulated activities of ‘Advising on Financial Products’ and ‘Arranging Deals in Investments’ in or from the DIFC, both of which are limited to units in a collective investment fund (DFSA Reference Number F000738).

For investors in Israel: BlackRock Investment Management (UK) Limited is not licenced under Israel's Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”), nor does it carry insurance thereunder.

For investors in South Africa: Please be advised that BlackRock Investment Management (UK) Limited is an authorised Financial Services provider with the South African Financial Services Conduct Authority, FSP No. 43288.

For Investors in Switzerland: For Qualified Investors only. This document is marketing material.

This document shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services ("FinSA").

For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa.

© 2023 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, and iSHARES are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.