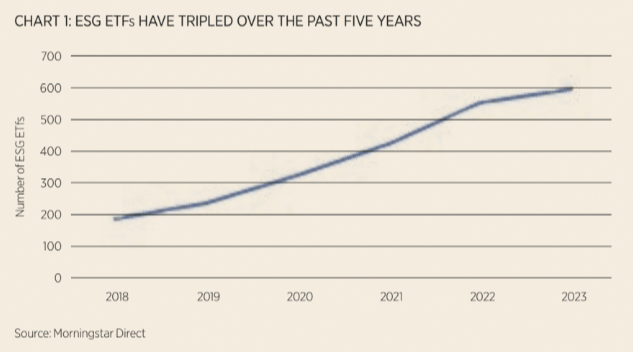

The unstoppable rise of ESG ETFs has continued almost unabated in Europe despite a challenging 18 months for the market hit by several headwinds.

Flows have remained resilient – continuing to grow beyond their market share – while launches of ETFs labelled Article 8 and 9 under the Sustain-able Finance Disclosure Regulation (SFDR) have outpaced their ‘non-ESG’ Article 6 counterparts in the first nine months of the year.

Despite this, there are signs investors are growing weary of the ever-increasing product offering and complex reporting requirements that risk turning them off sustainable investment altogether.

James McManus, CIO of Nutmeg, said there is a risk to growing complexity, particularly for retail investors, with too much ESG product choicein the market. “The problem when you have multiple providers offering similar index products is they have all got completely different thresholds, the nuances of which become very difficult for retail investors to understand,” he said.

As well as creating confusion for the end investor, it also creates challenges from a portfolio construction perspective as exclusionary metrics evolve to discard more and more stocks relative to the parent index.

A race to the bottom

While the market is growing at a significant speed it is important to note the differences between equities and fixed income, with the latter offering significantly less choice.

Within equities, the proliferation of products over the past few years has developed a “race to the bottom”, as index providers such as MSCI and S&P Dow Jones In-dices (SPDJI) exclude a higher number of stocks relative to their parent index as ESG metrics and data evolves.

Lukas Ahnert, senior product specialist for Xtrackers core indexing at DWS, said this has both positives and negatives for ESG investors. “This choice is still highly attractive and makes fund selection simpler, because there are a lot of products out there that follow the same index, taking out minor nuances that issuers put on top.

“The disadvantage is from a portfolio construction perspective, reducing an MSCI world index from 1600 names down to 300 is interfering with your starting universe, you start to get idiosyncratic risks that will blow up and your ESG attribution becomes a lot more difficult.”

However, McManus said the race to the bottom is putting more pressure on clients: “Consistency is a key appeal of ESG index products, but we currently publish four sets of screens to demonstrate to clients the different levels of exclusionary metrics in similarly named indices.

“That just puts pressure on our clients’ understanding of ESG index products and can appear unnecessarily complex to the average retail investor.”

The growth in ESG ETFs is, at least in part, due to the supermarket approach offered by asset managers such as DWS and Amundi. Both have seen their ESG ranges expand hugely over the past couple of years through either launching new products or switching the indices on existing ETFs.

Amundi is targeting 40% of its product range to be ESG by the end of 2025 as it looks to offer an ESG ETF for every client allocation need.

“Clients have different needs in terms of their ESG assertiveness and risks,” Frederic Hoogveld head of investment specialists and market strategy at Amundi, said. “They have to balance thisrisk compared to their benchmark, so we offerthem products that suit their needs.”

Jack Turner, head of ESG portfolio management at 7IM, said this approach has been helpful to portfolio construction by “making it possible to build a portfolio of assets that are bespoke to whatever underlying objective you are trying to achieve”.

“The race to the bottom is good for fund selectors, it gives us lots of options and is keeping active managers on their toes,” he said. “You still have to be careful of what you find in the indices, what sort of tracking error are you exposed to and what factor tilts you have.”

Andrew Limberis, investment director atOmba Advisory & Investments, agreed choice was indeed a positive but added the complexity around comparing products meant certain ESG considerations could get lost in the mire.

“The choice aspect of ESG ETFs makes it very difficult to navigate,” he said. “Comparing the different approaches from issuers and index providers, particularly when you add different ESG providers, is certainly challenging.

“You will start using weighting other factors such as cost, securities lending and liquidity more heavily because you can just get lost in the ESG considerations.”

This is often compounded by products that are repackaged as ESG but look very similar to the parent index.

“There are a whole host of ESG-related indices and ETFs that are called something but have 99%overlap with the parent index and filter out five stocks, which is very poor,” Simon McConnell, senior portfolio manager and head of portfolio construction at Netwealth, said.

“It is up to the investment manager to do the research, but the client is at risk of misunderstanding or being overawed by the amount of choice in the market.”

Consolidation or standardisation?

Beyond regulatory developments such as SFDR in Europe, which many predict will not be fully operational until 2026, it is difficult to see how the landscape will become clearer for investors.

Some have suggested ESG ETFs could see consolidation in the future, delivering a clearer picture for fund selectors.

Limberis said he would like to see more standardisation in the space: “SFDR was an attempt at creating standardisation, but you need the next level where the industry starts accepting different buckets of ESG,” he said. “It is about getting the right balance of standardisation and competition that will aid investor choice.”

Hoogveld added: “ETF issuers do not have exactly the same product exposure but philosophy speaking what they offer is a bit similar. I do not know if there will be consolidation, ESG is complex because different investors have different values.

“The non-successful ESG ETFs will ultimately disappear, but this is the same for non-ESG ETFs also.”

Turner believes we could ultimately see some consolidation in the future, however, it will remain the investment manager’s role to do the correct due diligence.

“There is a lot of complexity because there are so many ETFs to look through,” he said. “The industry does potentially need some consolidation, but as a fund selector it is our job to do the due diligence.”

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.