Traders are becoming more selective about who they trade ETFs with.

As ETFs become more established and popular, traders are becoming pickier about how ETFs are traded, how expensive the trade is and who the trade is done with, a new survey by Jane Street has found.

And traders will only get pickier as ETFs tracking less liquid and more volatile assets become widespread, the survey said.

"As institutions increase their use of ETFs, they have also grown more discerning with whom they trade and how these trades are executed," it said.

The surging popularity of emerging market equities and junk debts were contributing to traders' pickiness, with EM and junk debt traders showing the most sensitivity to how trades are made.

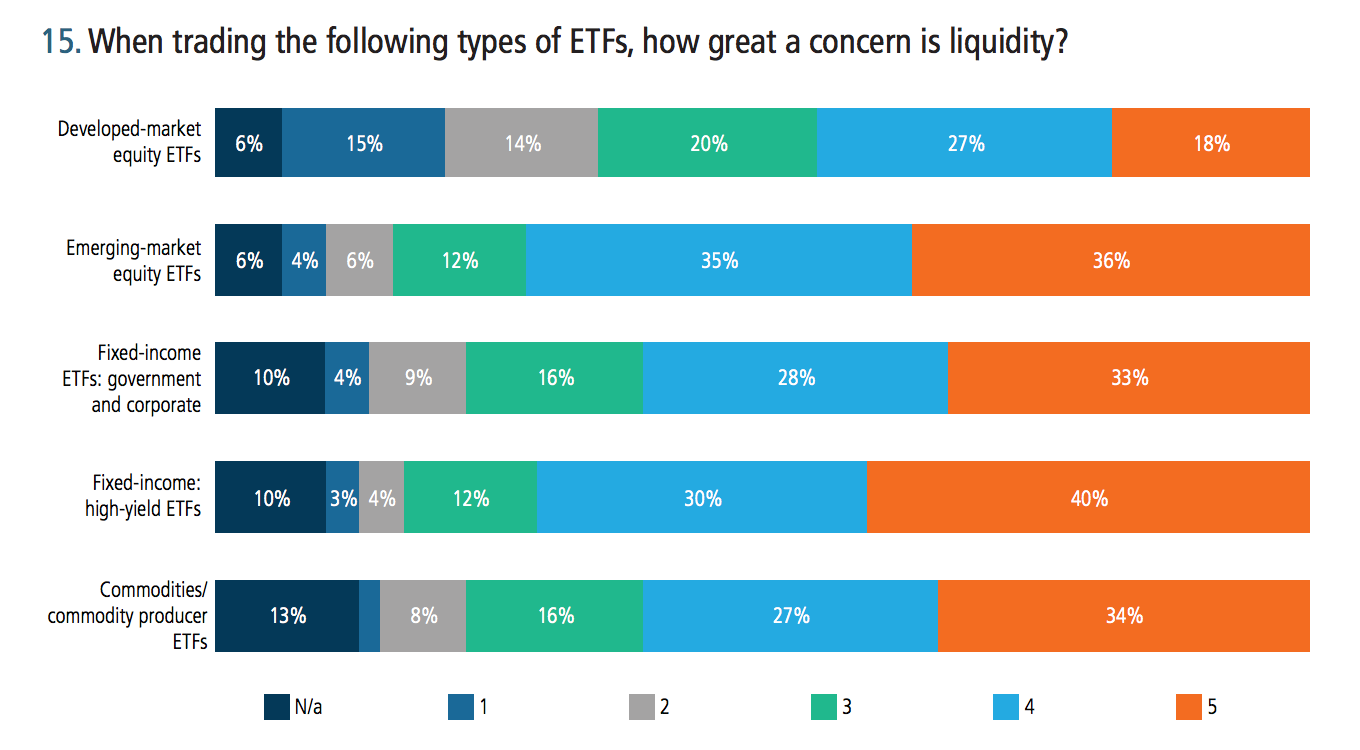

"Emerging markets and high-yield ETFs are areas where concerns around liquidity are highest, with 70% of respondents rating their level of concern as [important or very important]," the survey found.

Risk pricing (including block trades) was the preferred execution style among traders, with 41% of respondents using it the most. The more American and larger the institution, the more they preferred risk pricing.

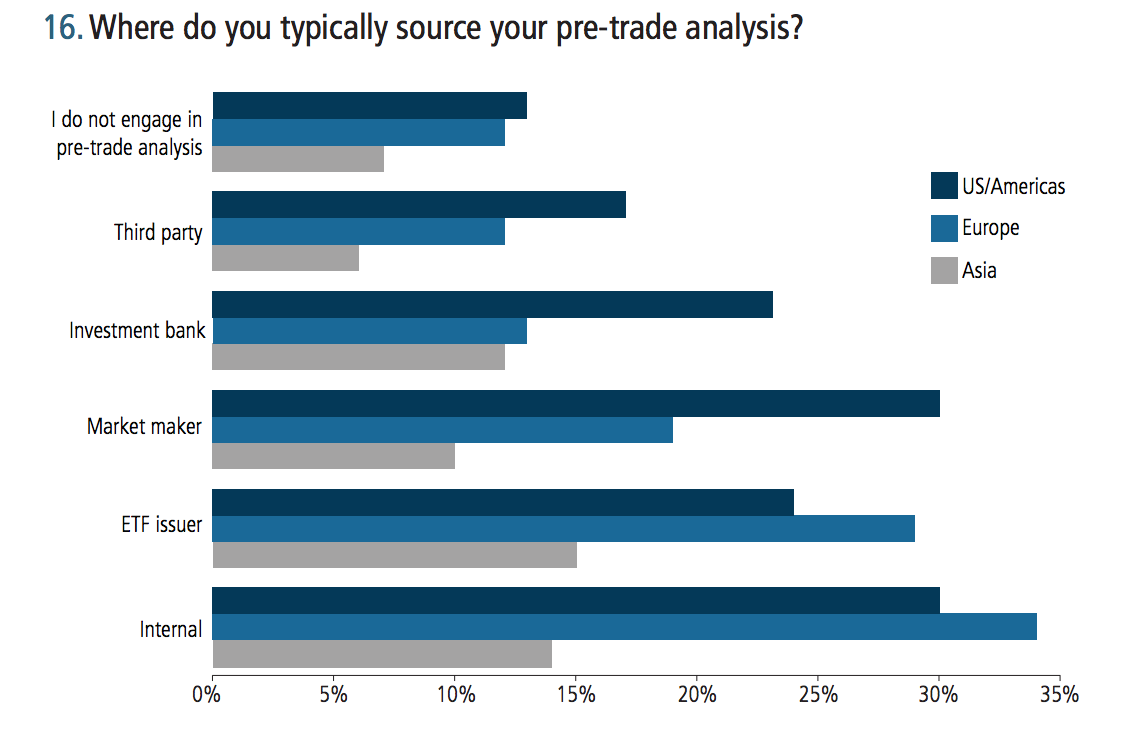

But preferred trading partners differed around the world. Brokers, independent market makers and investment banks were used relatively evenly in the US and Europe. Asian traders, however, strongly preferred investment banks.

Going forward, independent market makers will become the preferred trading partners, the report suggested, as they better understand complex and illiquid ETFs.

"As investors seek to bolster allocations to more complex ETFs tracking less liquid underlyings, the capabilities of market makers are coming into greater focus."

"Key advantages include a willingness to commit firm capital, their investment in trading technology and a concentrated focus on ETFs," the report said.

Most institutions used average daily volume to assess liquidity and used total AUM and bid-ask spreads as secondary criteria.