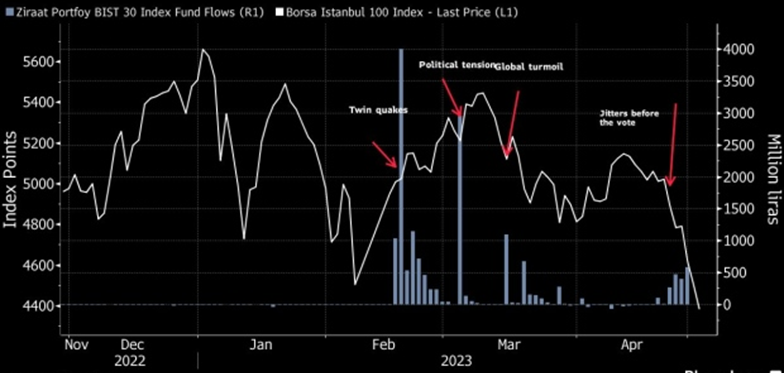

A programme by the Turkish government to funnel $1bn into domestic equity ETFs has failed to pump the breaks on the continued stock market decline amid monetary policy uncertainty and natural disaster disruption.

The campaign led by the Turkey Wealth Fund (TWF) began in February, with the sovereign fund investing in ETFs issued by Ziraat Portfoy, the asset management division of state lender T.C. Ziraat Bankasi A.S., Bloomberg reported.

However, the investment has failed to have a significant impact as retail investors – who previously invested heavily in domestic equities – are increasingly moving to lira-denominated deposits as the Turkish authorities and banks try to prevent further devaluation of the country’s currency.

Turkey’s BIST 100 index is now down 21.8% so far this year, as at 5 May, after rallying as much as 170.9% in 2022 as ETFs tracking the country’s equity market dominated the winner’s circle in Europe during a volatile year.

Source: Bloomberg

Last year’s outperformance came as the country’s central bank slashed interest rates from 19% in late 2021 to 8.5% last year despite year-on-year inflation soaring to 84.4% last November.

This saw retail investors pile into stocks to protect their savings, with the number of trading accounts increasing 32% in 2022, according to Turkey’s Central Securities Depository, as the lira collapsed 36.5% against the US dollar in a year.

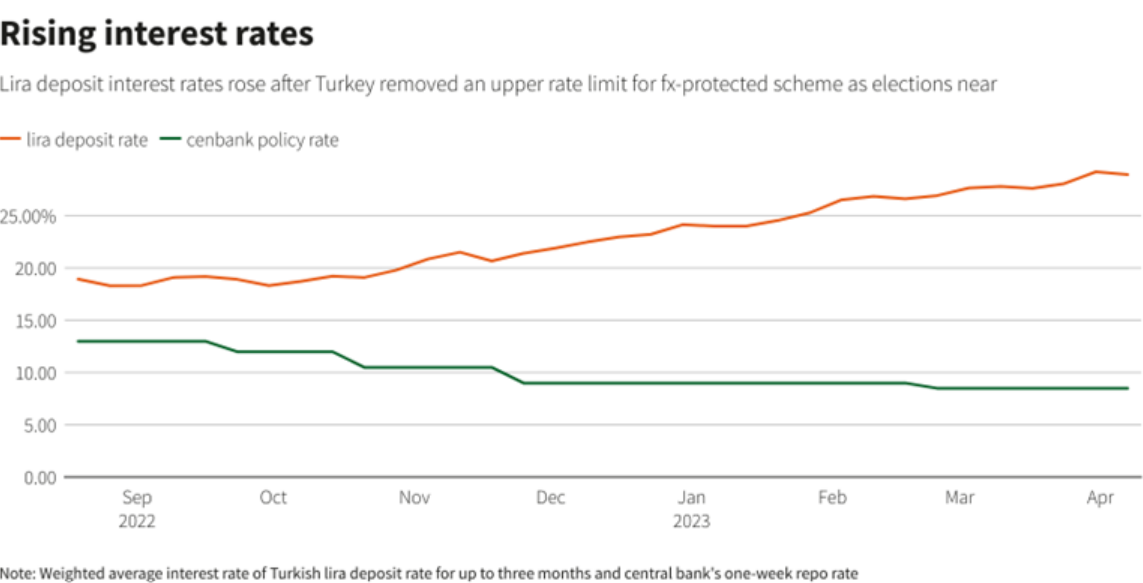

This trend has swiftly reversed so far this year as the central bank increased the ratio of deposits banks must hold in lira to a target level of 60% while also being encouraged to convert foreign to domestic currency on their books.

Over the past six months, central bank data revealed deposit rates rose 10% to 29% while rates on accounts intended to shield users against lira depreciation doubled to over 20%.

Source: Turkey’s central bank, Reuters

Mehmet Gerz, CIO at Ata Portfoy, told Bloomberg: “With deposit rates rising, both FX-protected lira deposits and other time-deposit instruments have become safer and alternative investment tools for locals.”

The country’s equity market also suffered following the earthquakes that struck Turkey and neighbouring Syria in February, which claimed the lives of at least 20,000 people.

The BIST 100 index fell 16% within three trading sessions, prompting BlackRock, Amundi and HSBC Asset Management to halt primary market trading on their Turkey ETFs.

Average daily trading volumes of the country’s equities have dropped to $2.5bn in recent months, almost half the six-month average, according to Borsa Istanbul data.

Regardless of who wins the Turkish Presidential election on 14 May, the consensus expectation is the country will begin to move towards more orthodox monetary policy.

Foreign investors have pulled their money from Turkey in recent years, with overseas ownership of Turkish stocks falling to 29% from 60% in 2019. However, JP Morgan strategists predict this number rising to 50% would represent a $20bn foreign inflow to the market.

The TWF’s effort to inspire an equity market resurgence with its ETF investments may have fallen flat while authorities were also attempting to stimy the devaluation of the lira ahead of the upcoming election.

Elsewhere, sovereign ETF purchases have proven more impactful such as Japan where its central bank buys Topix-indexed equity ETFs at a rate of up to $110bn per year.

However, the effect of such activities has not always been positive. The Bank of Japan announced on 19 March 2021 that it would stop buying ETFs tracking the Nikkei 225 index for the first time in a decade, a decision that saw the index decline 6.1% in a day.

Looking ahead, it will be interesting to see how much sovereign policymakers continue to look towards wrapped structures to affect seismic change on broad market exposures – and to what extent these policies have the desired effect.