UK gilts will soon need to face the harsh reality: the Bank of England (BoE) cannot afford to entertain a dovish stance.

Last week, the Office for Budget Responsibility revised the UK GDP forecasts for this year upwards to 0.6% from -0.2% in March. Yet, expectations for growth to remain flat in 2024 ignite bets that the Bank of England might need to step in to rescue the economy.

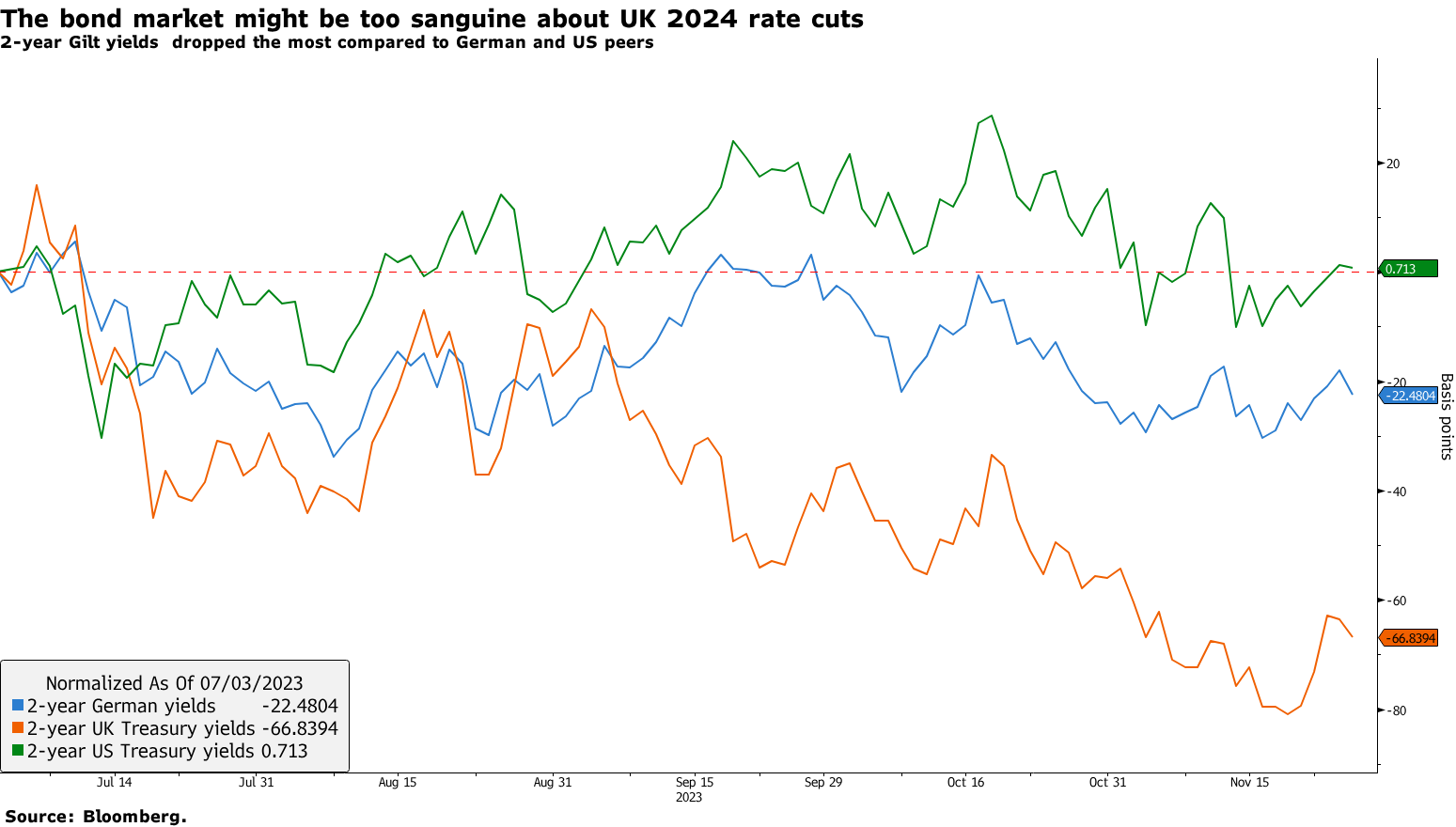

Yet, such bets might have run too far. From the beginning of July until today, two-year UK gilt yields have dropped by 65 basis points (bps), the most compared to German and US peers. Two-year yields are more closely linked to changes in monetary policies than other maturities. However, core inflation in the UK remains above 5%, services inflation is above 6% and wages are still growing by almost 8% YoY. At the same time, current inflation rates in the US and Europe are more than a percentage point below the one in the UK, indicating that the job of the BoE is far from over.

To confirm such a notion, during last week's Autumn Statement, UK Chancellor Jeremy Hunt said that inflation is expected at 2.8% by the end of next year, suggesting that reverting to the 2% inflation target might take longer than anticipated.

Let’s not forget that despite a complacent bond market, with the freshly minted £21bn stimulus package, the government is still easing the economy. Although UK elections are due on 28 January 2025, it is clear that throughout 2024, major parties will be in full general election mode, and more fiscal cannot be excluded. That is likely to be a drag on what the BoE is trying to achieve and, ultimately, on UK gilts.

Within this framework, it is unlikely that yields will continue to drop. As the bond markets reject expectations for rate cuts next year, yields will likely resume their rise across the yield curve.

The yield curve will likely remain inverted as markets contemplate what higher-for-longer monetary policies mean for the economy. Yet, long-term yields are poised to resume their rise, and 10-year UK gilt yields are likely to test resistance again at 4.63%. If they break above this level, they will likely continue their rise towards 4.73%. However, if they fail to break above this level, they might drop further between the 3.62% and 3.87% levels.

Source: Bloomberg

UK gilts are considered a safe haven for sterling investors. Therefore, while providing a guaranteed return to one portfolio, they also provide protection during a market downturn. However, depending on the investment horizon and the duration of the UK gilts, their risk-and-reward ratio may vary.

It is good to note that short-term UK gilts bring minimal duration risk while maximizing yield. Assuming a one-year holding period, two-year UK gilt yields need to rise by more than 200 basis points to provide a negative total return. As the BoE is unlikely to hike rates further, such a scenario remains unattainable. Yet, ultra-long duration instruments, such as the 30-year UK gilts, represent a directional bet on rates.

As the economy continues to cool while the BoE remains on hold, we favour a barbell strategy looking to take exposure to the front part of the yield curve for safety and the long part for protection in case of a downturn.

Althea Spinozzi is senior fixed income strategist at Saxo Bank