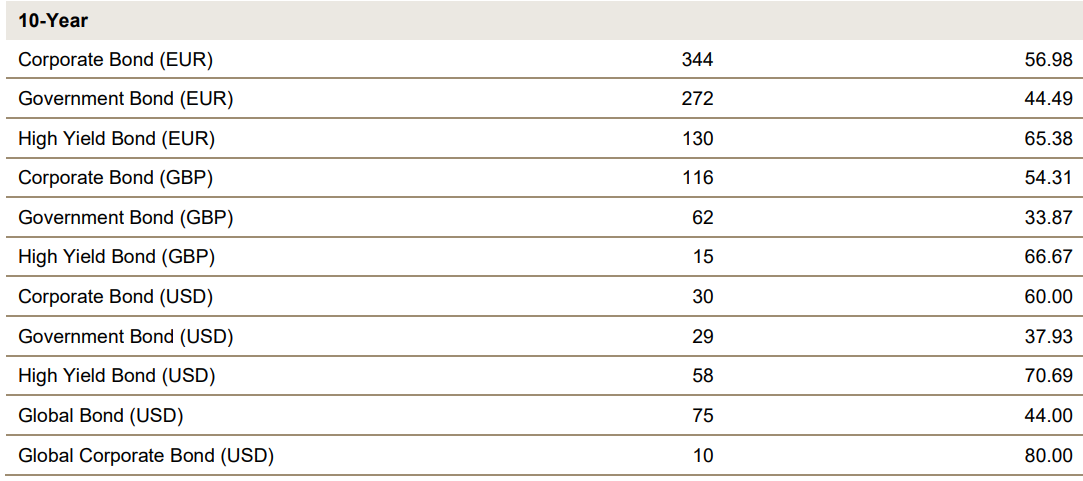

Less than half of all European, UK and US government bond funds survived the decade to the end of 2022, illustrating the difficulty active fixed income managers faced when trying to outperform during the period of historically low interest rates.

According to the S&P Dow Jones Indices’ inaugural SPIVA Europe scorecard for fixed income, only 44.5% of the 262 euro government bond, 33.9% of the 62 sterling denominated government bond and 37.9% of the US dollar denominated government bond funds in 2012 survived until the end of 2022.

Survivorship of European fixed income funds (%)

Source: SPIVA Europe scorecard 2022

Government bond funds were also the least able to outperform their benchmarks over the period, with 88.2%, 96.8% and 96.6% being outperformed by their respective S&P iBoxx indices.

Incidentally the fixed income exposure least addressed by funds in Europe – US dollar-denominated global corporates – saw 80% of its 10-strong cohort survive the decade, with 30% outperforming their benchmark, the highest of any fixed income exposure.

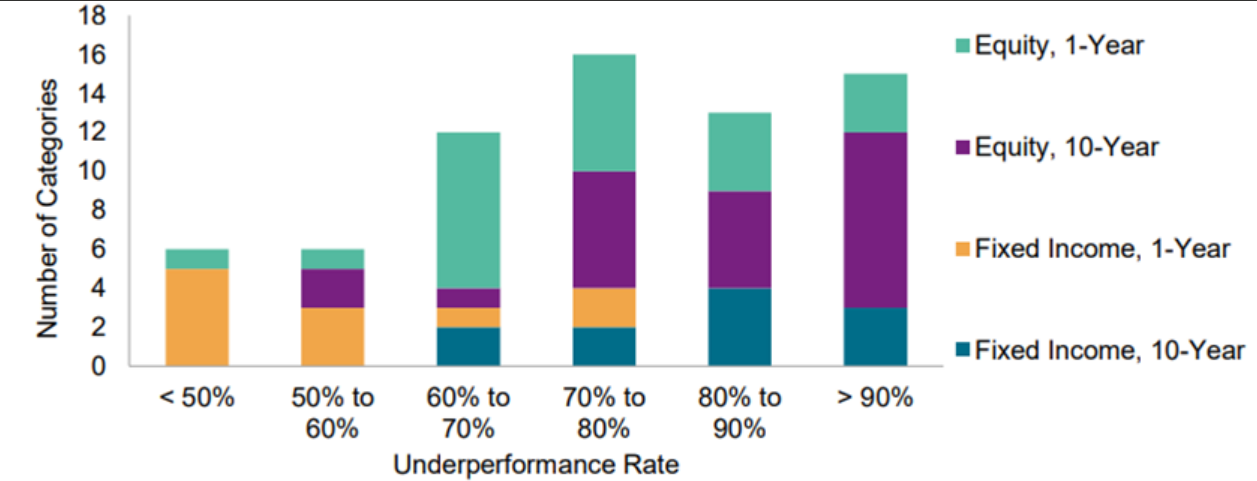

This trend of underperformance and low survivorship chimes with similar observations in equity funds reported by ETF Stream last year, with the 2021 SPIVA Europe scorecard revealing half of all global equity funds in Europe had been shut with at least nine out of 10 failing to outperform.

However, a changing monetary policy and yield backdrop in 2022 upset the patterns of the past decade in fixed income.

While sterling high yield bond funds saw a considerable 76.9% of their cohort underperform in 2022, only 23.5%, 41.9% and 39.1% of previously ailed euro, sterling and dollar denominated government bond funds underperformed their benchmarks.

Despite this uptick in performance, a notable 13% of the 23 US dollar-denominated government bond funds closed through the year.

“It was a challenging year for active managers in European equities, with the pan-European equity category recording its highest annual underperformance rate since the SPIVA Europe scorecard’s inception in 2014,” the report said.

“Fixed income managers had a better year in relative terms, with the majority outperforming in five of 11 categories over the one-year horizon.

“Across both asset classes, however, underperformance rates increased to a similarly high average over a 10-year horizon.”

Distribution of equity and fixed income underperformance rates

Source: S&P DJI, Morningstar, Bloomberg