As we grapple with a growing number of both stand-alone and interlinked environmental crises including climate-change-induced natural disasters, loss of biodiversity or resource depletion, the need for more sustainable ways of investing is becoming increasingly apparent. It is crucial not to be complacent. We believe that those in the finance sector have an important role to play in the coming years to work on climate-change mitigation – and adaptation – and the journey towards a net-zero economy.

Fortunately, the growth of the sustainable finance market makes it not only possible but fairly easy for investors to take action. The availability of an increasingly diverse universe of green bonds means that a competitive investment return may be achieved while at the same time having a positive impact on the environment. Moreover, it is our view that now could be a good time to increase exposure to this dynamic sector.

What are green bonds and why are they important?

Green bonds are mostly structured as use of proceeds (UoP) instruments, where an issuer must guarantee what projects will be financed via the sale of the bond. This can include a wide variety of projects that aim to solve some of the environmental issues mentioned above, making UoP instruments an excellent way for investors to see the direct impact their capital allocation is having. To provide an example, a category within green issuance that has been gathering focus is biodiversity. In 2022, we saw 60 bonds issued with the UoP specified as biodiversity protection projects¹.

This is a growing concern among investors, since achieving a net-zero economy is not possible without safeguarding forests, water sources, air quality and biodiversity-sensitive areas.

It is our view that sustainable investing is the future of our industry and that we need to look ahead to understand the real-world impacts of our investment decisions. A growing number of investors want to put pressure on companies and governments by not only demanding change but also by offering to provide capital for solutions that aim to pick up the pace of environmental progress.

This should result in a rapidly expanding green bond market, one that we want to help shape.

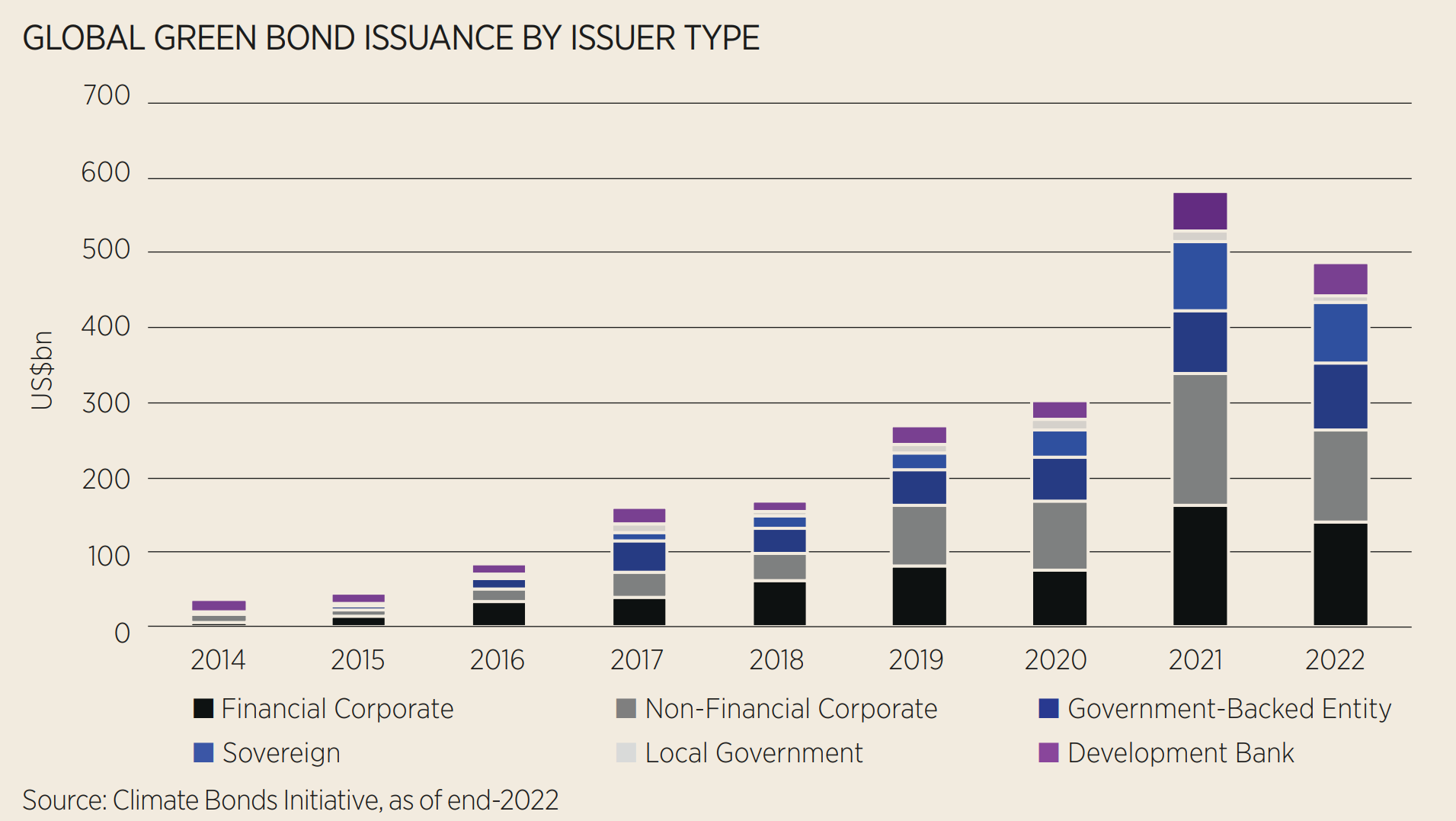

However, 2022 was a difficult year, with geopolitical uncertainty, surging inflation and rising interest rates curbing new issuance of green bonds. After incredibly strong growth in previous years, with the market growing from approximately $37bn in 2014 to nearly $582bn in 2021, 2022 saw a 16% year-over-year drop in issuance.

Nonetheless, sustainable bonds still comprised around 5% of total debt volumes that year, implying that the slowdown witnessed was not idiosyncratic but rather part of a wider headwind affecting global fixed income².

Diversification benefits

Although local governments, sovereigns and government-backed entities already accounted for 37% of issuance in 2022, the market is becoming even more diversified, with non-financial corporates making up a quarter of the past year’s supply³.

The chart below highlights the development of global green bond issuance from 2014 to 2022.

A more varied issuer base, with a wide and growing universe of securities from which to choose, means that investors can raise their exposure to the market without having also to increase their concentration risk. While diversification cannot assure a profit or protect against loss, we believe that the benefits of diversification, coupled with strong security selection, are key when aiming for above-benchmark returns across a full market cycle.

Even though there is a growing variety of securities available, some caution is needed. For not all bonds share the same green credentials. A ‘strong’ green bond is one where the issuer guarantees that proceeds will go only to eligible green projects with positive environmental goals. Crucially, neither the projects nor the issuer can cause any significant harm. For example, there may be safeguards in place to ensure that the construction of a renewable energy plant will not lead to a loss in biodiversity.

It is also imperative that the issuer is credible within the ESG space. We would not want to invest in a green bond that looks robust itself, but that on further inspection has been issued by a company deriving the majority of its revenues from, say, mining thermal coal. We at Franklin Templeton Fixed Income are very thorough with regard to our sustainable investments – robust research and regular engagement with issuers are key to finding what we believe to be the best opportunities in the market.

Why now?

Headline inflation across the eurozone has been declining, while the economic backdrop has been deteriorating. As a result, we can expect a more dovish attitude from the European Central Bank in the months ahead; this should help support fixed income asset classes as a whole, and most importantly those with longer-duration profiles.

Such a backdrop should help foster growing investor interest in green bonds and provide a technical tailwind for the sector.

David Zahn is head of sustainable investing and European fixed income at Franklin Templeton Fixed Income

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full magazine, click here.

1, 2, 3 Climate Bonds Initiative, as of May 2023, Green Bond

Important legal information: This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the economist and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton ("FT") has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL, Tel +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.