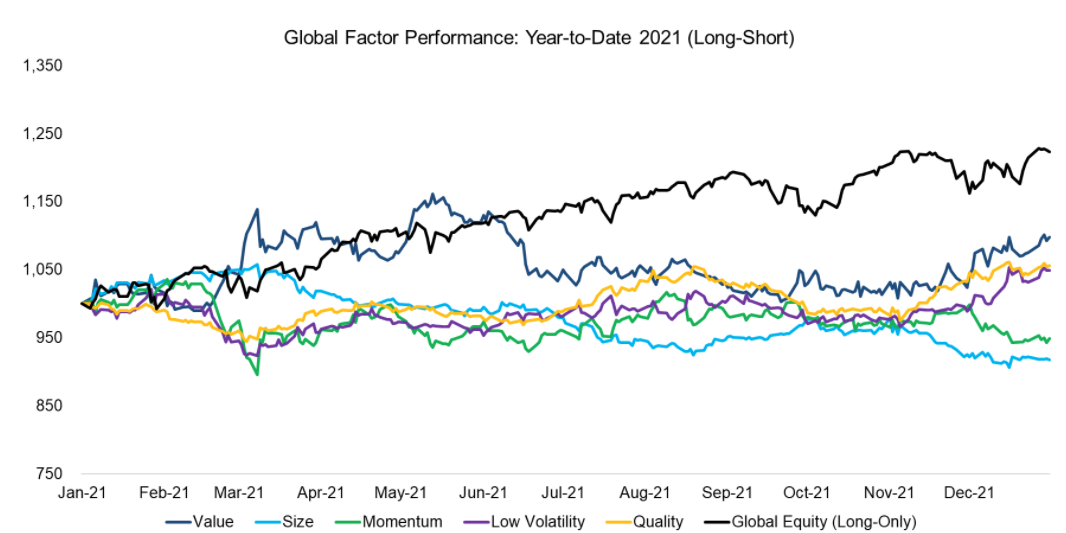

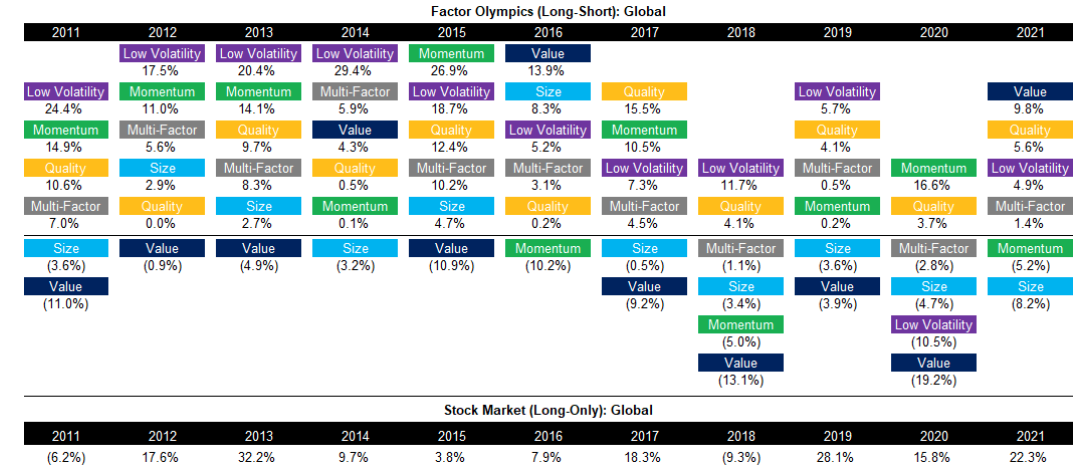

Value made a rare outing at the top of the performance charts in 2021 as cyclical stocks returned to favour, capping a moderate year for traditional factors which saw a relatively low return spread.

According to research conducted by FactorResearch, which constructed global and beta-neutral factor indices, value posted returns of 9.8% last year, making it just the third time in the last decade it has not been the worst performing factor.

Value knocked momentum of the top spot, with the latter’s returns swinging from 16.6% in 2020 to 5.2% last year, having dominated performance for much of the last decade.

However, it has been argued momentum ETFs are doomed to hindsight trading, missing out on the recovery trade that came to dominate the first half of the year, as global economies opened up across the globe.

For example, the iShares Edge MSCI USA Momentum Factor UCITS ETF (IUMF) and its US counterpart only started mirroring the cyclical sector trade halfway through the year, around six months after ‘old economy’ equities began their recovery.

Source: FactorResearch

Surprisingly, quality (5.6%) and low volatility (4.9%) – usually negatively correlated to value – were the second and third best performing factors in 2021.

Nicolas Rabener, founder and CEO of FactorResearch, said: “The triumvirate of momentum, low volatility and quality factors dominated the previous decade.

“However, in 2021, the factor performance was different as momentum was replaced by the value factor which is unusual given that cheap stocks are typically negatively correlated to high quality and low volatile stocks.”

Conversely, size failed to match the positive returns posted by value stocks returning -8.2% last year with the two normally moving in the same direction.

“It is interesting to note that small caps have underperformed, which is unusual given that the size and value factors usually move in tandem.

“[Value and size] behaved substantially differently in 2021 as cheap stocks generated the highest and small caps the lowest excess returns.”

The two factors top and tailed performance in a moderate year where returns of factors ranged between 10% and -10%.

Source: FactorResearch

In fact, the performance of an equally weighted multi-factor portfolio was negative at the end of Q3 and turned “slightly positive” as value, quality and low volatility all rallied in Q4.

Rabener added there has been a change in the investment sentiment that is reflected in the factor rotation from momentum to value stocks.

“Equity markets finished strong in 2021, but the performance was generated by a few stocks rather than the majority. In contrast, many COVID-19 darlings like Zoom, Peloton, or DocuSign are significantly below their highs.

“Although it would be desirable for investors to start paying more attention to financing profitable ventures compared to investing in exciting but flawed business models, a factor or sector rotation sometimes heralds a market correction. The more excessive the party has been, the worse the hangover tends to be.”

Related articles