VanEck is set overhaul its video gaming ETF by adding sustainable metrics after shareholders voted to change out its current benchmark for an ESG equivalent.

Effective 16 December, the $463m VanEck Video Gaming and eSports UCITS ETF (ESPO) will start tracking the MarketVector Global Video Gaming & eSports ESG index instead of the MVIS Global Video Gaming & eSports index.

ESPO’s incoming index excludes companies with what the ISS deems “very severe” violations of social norms, companies not covered by ISS data and those with any revenue exposure to controversial weapons or more than 5% revenue exposure to civilian firearms, tobacco, traditional energy and military equipment.

Incorporating these ESG criteria means ESPO will be upgraded to Article 8 under the Sustainable Finance Disclosure Regulation (SFDR).

Launched in July, the new benchmark captures 25 companies deriving at least 50% of revenue from video gaming and esports, with a market cap of at least $150m, three-month average daily trading volume of at least $1m, at least 250,000 shares traded per month, capped at 8% per constituent.

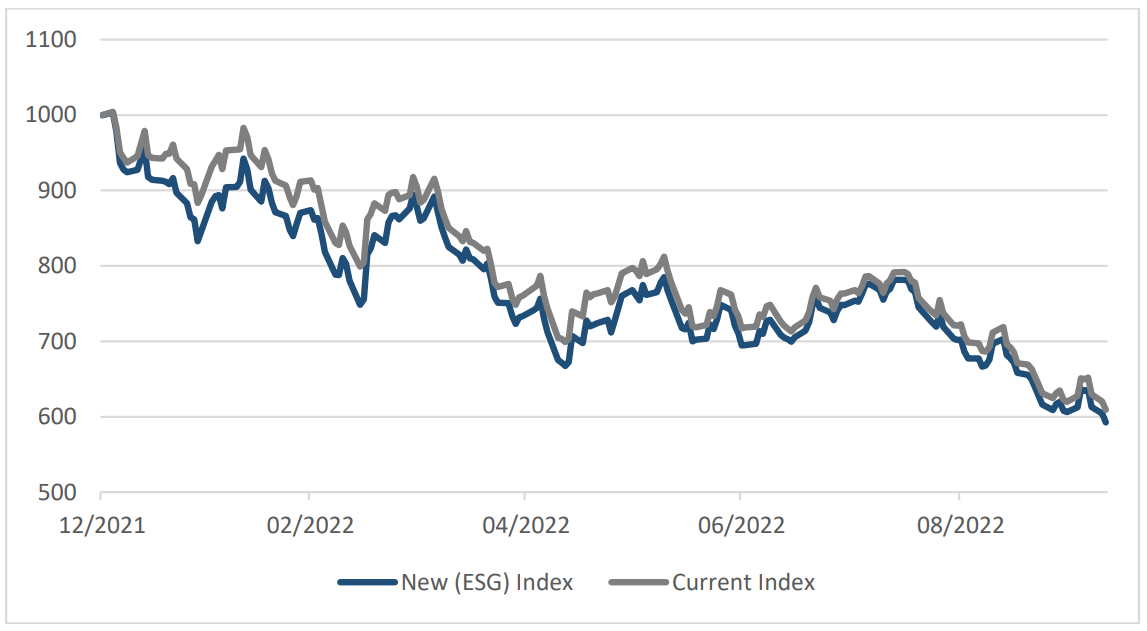

Source: VanEck

The ESG index and its outgoing vanilla equivalent share the same top 10 holdings and have a returns correlation of 98.8% but the non-ESG benchmark has “slightly outperformed” so far in 2022.

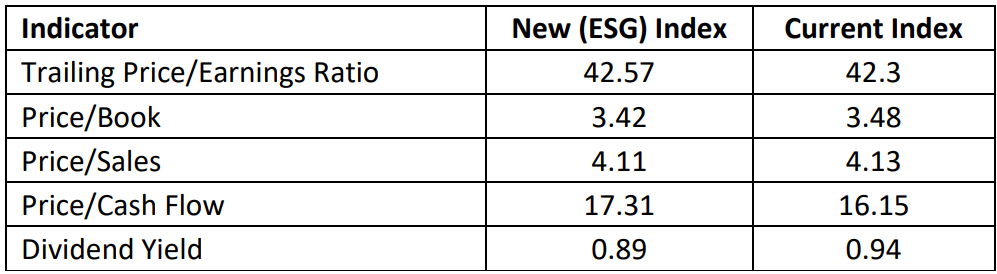

The two indices have comparable fundamental characteristics, though there are some notable changes to ESPO’s company roster. While weightings to GameStop (3.7%), Krafton (2.7%) and Kakao Games (0.8%) will be added, Ubisoft (2.2%), CD Projekt Red (2.7%) and Netmarble (0.6%) face deletion.

Source: VanEck

In a shareholder circular, VanEck said it proposed the overhaul as part of what it sees as the secular shift to ESG-aligned funds.

“VanEck experiences an increasing demand for sustainable investment solutions and we expect that the demand for the funds incorporating ESG criteria will substantially increase going forward whereas the demand for the funds that do not incorporate ESG considerations in portfolio construction process will lag,” the firm said.

ESPO is just the latest VanEck ETF to undergo an ESG makeover. Over the past year, the firm has overhauled its US wide moat equity, euro corporate bond, Europe equal-weight, semiconductor, hydrogen and three multi-asset ETFs.

Related articles