Vanguard Australia has radically increased the costs of buying and selling its unlisted funds, in a sign of the far-reaching effects that the coronavirus is having on financial services.

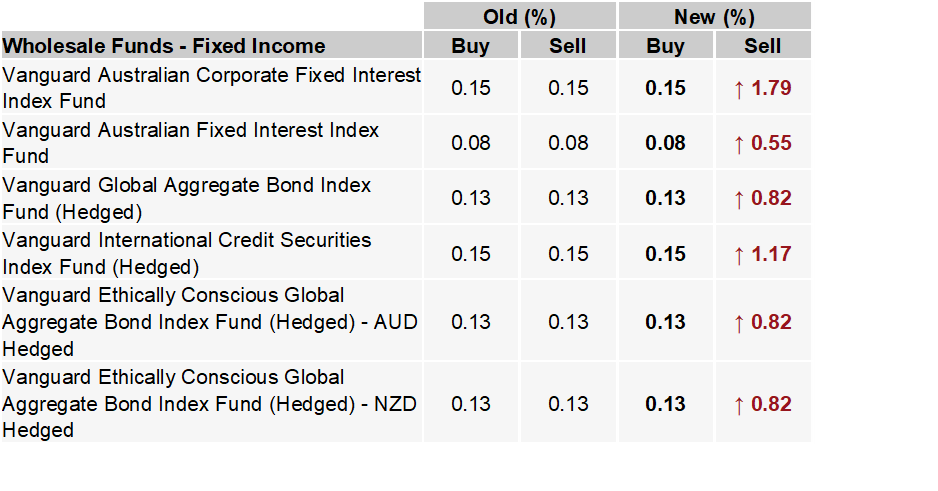

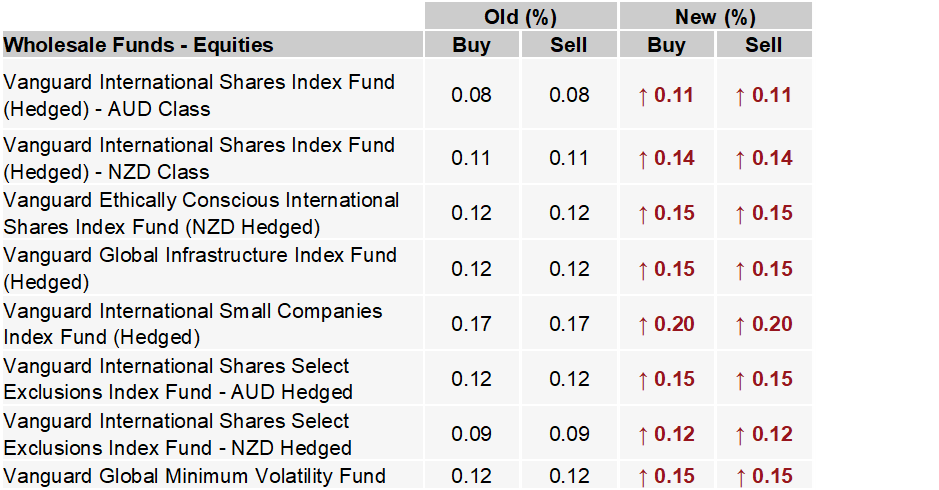

The cost of selling some of its bond funds have increased nearly 2%, which equates to almost six months’ worth of yield on some of the funds.

The increased costs have been caused by the panic selling that has hit global bond markets.

Vanguard explained: “When investors [buy and sell] Vanguard managed funds there are transaction costs known as buy/sell spreads. The [spreads] reflect the transaction [costs that come from buying] and selling assets within the funds. Vanguard does not profit from these spreads.

The volatility in investment markets has increased dramatically following the [coronavirus].

This has been the case particularly in [bond] markets, where trading costs have risen significantly. In addition, funds [using] currency hedging have also been impacted with an increase in foreign exchange transaction costs.”

ETF discount concerns bubble to the surface

ETF providers do not charge investors spreads when they buy and sell ETFs on the ASX – meaning Vanguard’s ETF clients will not be directly affected. This is because ETF providers outsource the job of getting investors in and out of ETFs to specialised traders known as “market makers”.

However Vanguard’s ETFs – and its bond ETFs in particular – have been hard hit by discounts, which amount to something similar to wider spreads.

Vanguard's ETFs are built as share classes of its existing wholesale funds.

Vanguard's wholesale funds cater to a different type of client than its ETFs. Whereas Vanguard's ETF buyers are advisors or self-directed investors, Vanguard's wholesale funds - which often come with buy-in minimums of $500,000 - mostly target institutional investors.