Key points:

Having sat on the sidelines for more than a decade, Vanguard is entering the ESG space.

The timing owes to Donald Trump's election victory, but also to the niche hitting scale.

Vanguard's entry raises the likelihood of fee cuts, in a niche overdue a fee war.

ESG ETFs get more attention than they deserve.

They are a media favourite and receive a lot of headlines, despite making up less than 0.2% of the global ETF market. They're an ETF provider favourite too and receive lots of special listing, (we've seen more than 20 get listed this year) despite there being only a handful of profitable ones in existence.

But amid the crazed rush into ESG, one famous player has been a notable holdout: Vanguard. Where its competitors have rushed in headlong and invented new products - like State Street's women's rights ETF (SHE) and BlackRock's Low Carbon ETF (CRBN) - Vanguard has calmly sat on the sidelines. But now at long last, the alpha male in the passive jungle is making its move.

Vanguard lists four new ESG funds

Vanguard has listed two new ESG ETFs in the US and Australia the past month. Both weed out the familiar corporate baddies of weapons, tobacco, gambling, alcohol and porn (as well as some others). Once the exclusions are made, the funds are then market weighted.

Vanguard Ethically Conscious International Shares Index Fund and ETF (VESG:AU)

Vanguard Ethically Conscious Global Aggregate Bond Index Fund (VEFI:AU)

Vanguard ESG U.S. Stock ETF (ESGV:US)

Vanguard ESG International Stock ETF (VSGX:US)

As far as ESG funds go these listings are pretty familiar: many providers have products quite similar.

But with the sudden listings comes the obvious question: why now?

Vanguard is conservative on new product listings

As a general rule, Vanguard lists fewer ETFs than its competitors. (With the exception of Charles Schwab). The company's staff say they're only interested in listing new ETFs where there is clear demand either in the advisor market or among institutional investors (superannuation in Australia). They do not want funds being forced to close due to lack of interest and take every precaution to ensure new funds will attract good money.

Vanguard has also been quite conservative when it comes to embracing new ideas. The company joined the ETF party late (held back by Jack Bogle's personal dislike of trading, it would appear). Vanguard also joined smart beta late and its research remains quite critical of non-market weighted indexes. If the entry into the ESG market does seem delayed, it is in fitting with Vanguard's conservative approach to product innovation.

So what might be behind the timing and change of heart?

Donald Trump's election helps

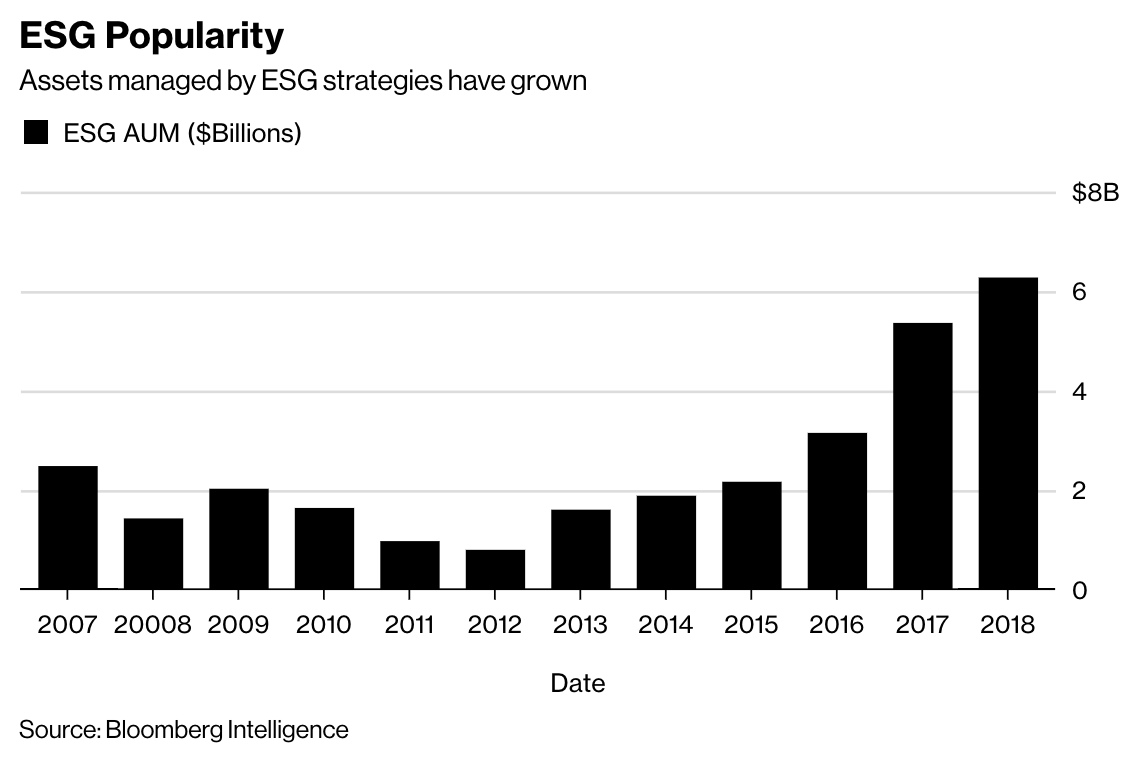

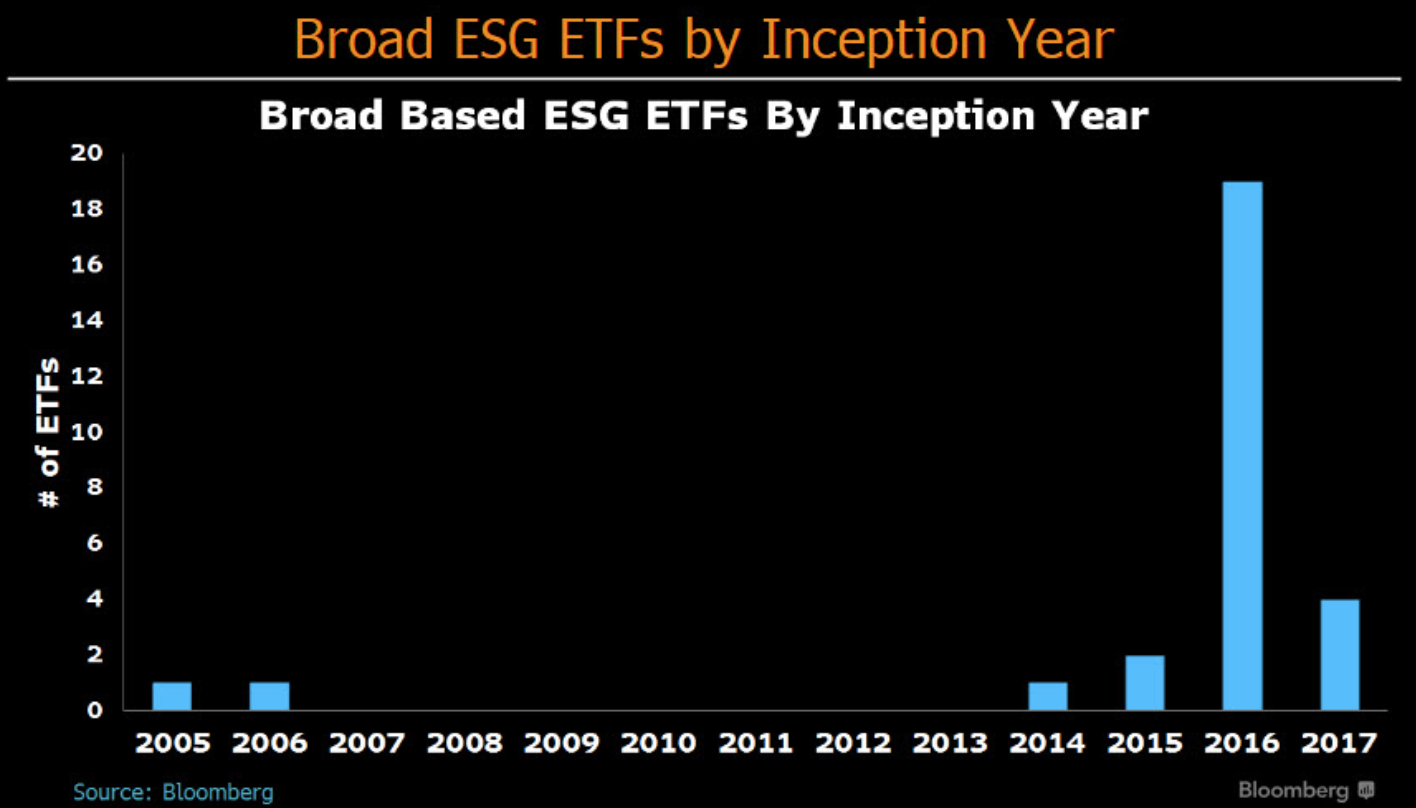

Part of the reason one suspects is the election of Donald Trump. This may sound like a kiss-off statement, but the rise of ESG correlates closely with Trump's election victory - and not just with Vanguard's listings.

As the data shows, money flowing into ESG ETFs was flat from 2008 to 2015 while Obama was in office. So too were the number of new ESG ETFs listed on global exchanges. Yet in 2016, the year of Trump's election, all the numbers lift off. More money than ever before started gushing into ESG funds while more ESG products hit the exchanges, particularly in the US.

This is not to suggest that Vanguard - or any other ETF provider - has a political agenda in listing ESG funds. Nor is it to suggest that the ETF industry tilts towards any political party. But given how sharply ESG got going in 2016 and given that ESG, to all appearances at least, is tied up in political undercurrents - the timing looks more than coincidental.

The niche is scaling, especially in Australia

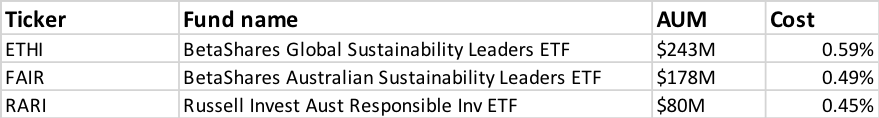

Another part of the reason may be that ESG funds have only recently started to achieve any real scale. In Australia, both BetaShares and Russell's ESG funds have been blooming and are now solidly profitable.

Relatedly, institutional pickup over the last several years has also grown. In Australia, this has mostly come from superannuation funds. As Vanguard Australia's head of product Evan Reedman explained:

"Over the last several years, we have seen ESG considerations gain considerable interest globally among institutional, intermediary, and individual investors…Institutional investors currently represent the largest source of demand for ESG products, but interest is growing among intermediaries and individual clients."

Vanguard may be able to underprice its competitors

Another reason the company may be entering only now is that it is still able to underprice the competition.

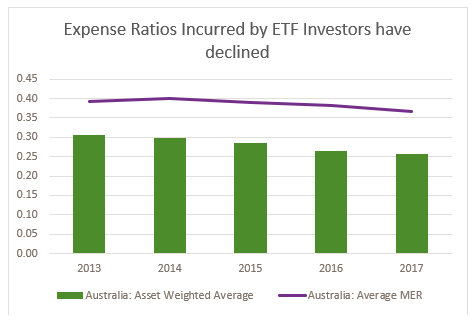

ETF fees in Australia and the US have been declining the past few years. In Australia the asset-weighted average fee fell from 0.31% in 2013 down to 0.26% in 2017. In the US it fell from 0.27% to 0.21% over the same period. Yet ESG funds have remained expensive, with the average ESG ETF costing 0.50% in both countries.

With Vanguard's entry that seems likely to change. All of the new listings charge less than 0.19%, making them the cheapest ESG funds available anywhere in the world. One final reason for the listings' timing might be that ESG is one of the few areas where underpricing still packs a mean punch.

Source: ETF Securities; ASX

***

Photo: Evan Reedman. Source: Supplied