Web 3 is the third evolution of the web. At the heart of the Web 3 philosophy is to decentralise internet infrastructure and technology while preserving individual privacy. The roots of this movement date back to the mid-1970s. Public-key cryptography was launched when declining trust in the government grew after the Watergate scandal.

At the time, cryptography was unscalable and was essentially used by governments and corporations across secure channels. The innovation behind public-key cryptography ensured confidentiality and authentication of a message in open channels. The need for privacy in the digital age was a dominant topic in the early 1990s with the launch of CypherPunk’s manifesto written by Eric Hughes and the rise of first-generation web services launched on the internet protocols suite including the HyperText Transfer Protocol (HTTP) invented by Sir Tim Berners-Lee. This cryptographic breakthrough revolutionised email and eCommerce.

Last year was nothing short of eventful, marked by countless defining moments including innovation and wider adoption of crypto assets. While 2020 was labelled as the year of institutional and corporate engagement and the dawn of decentralised finance (DeFi), the unprecedented interest in crypto last year onboarded a whole new wave of entrepreneurs and investors at a pace never seen before.

Many leapfrogged bitcoin and even ethereum, typically the traditional entry points for new crypto users — to interact with the first generation of Web 3 applications. The brain drain from tech giants and traditional banks to Web 3 is unprecedented and fuelled by the drive to build a better internet ranging from financial services, eCommerce, media, music and more.

History indicates that technological breakthroughs were invented amid public distrust but only took effect, pushing innovation forward a few years after. It is important to note that the Web 3 infrastructure has not reached escape velocity yet to attain its full potential.

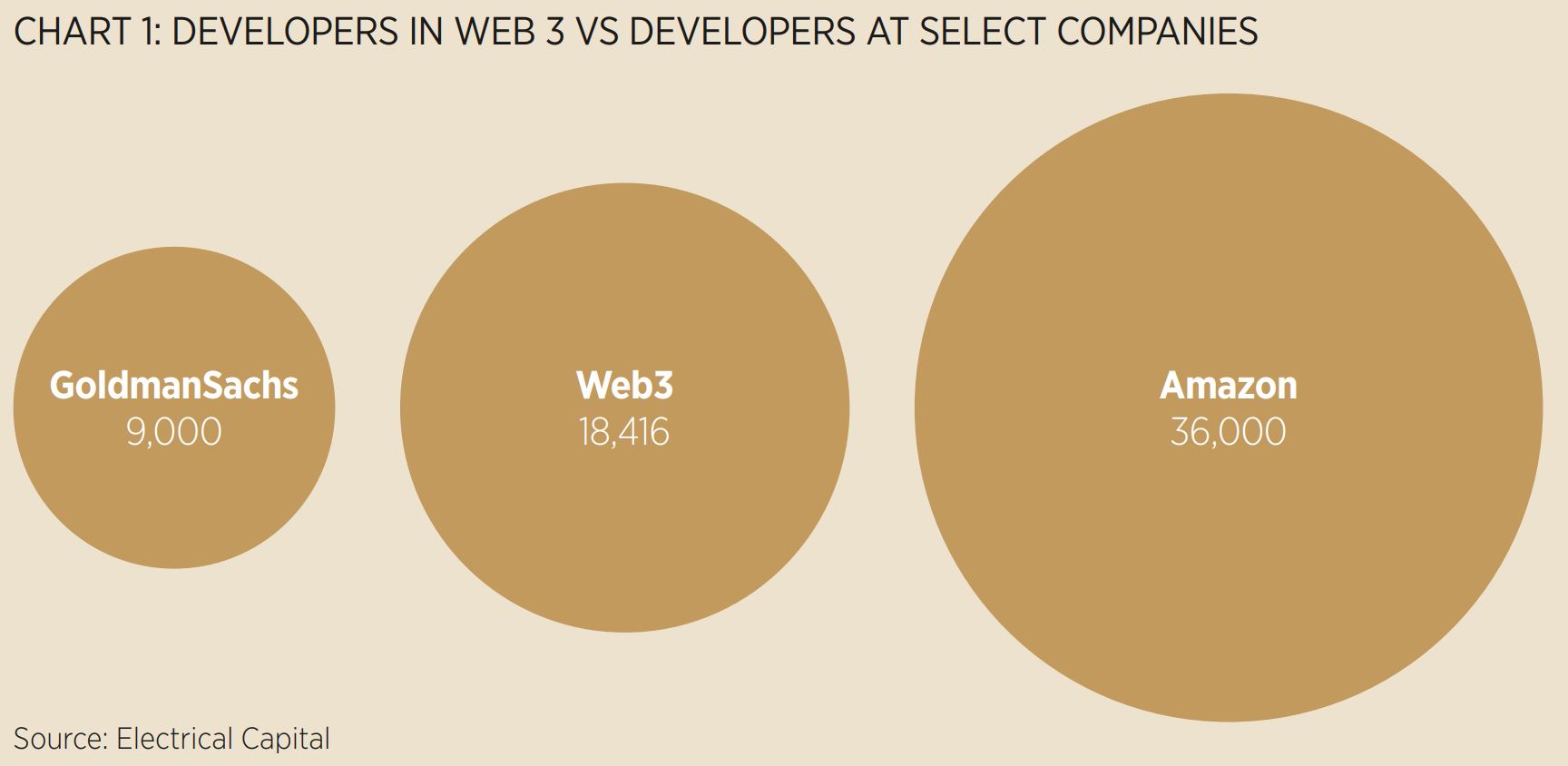

Given the current state of the whole Web 3 ecosystem, it is fair to admit that 2022 for Web 3 is comparable to what 2005 was for Web 2. We are right in the early innings of Web 3; Amazon’s number of developers is twice as large as the global crypto developer headcount (see Chart 1). Additionally, most infrastructure is still under development and significant progress, yet ready for worldwide production and mass adoption.

Ethereum the dominant platform

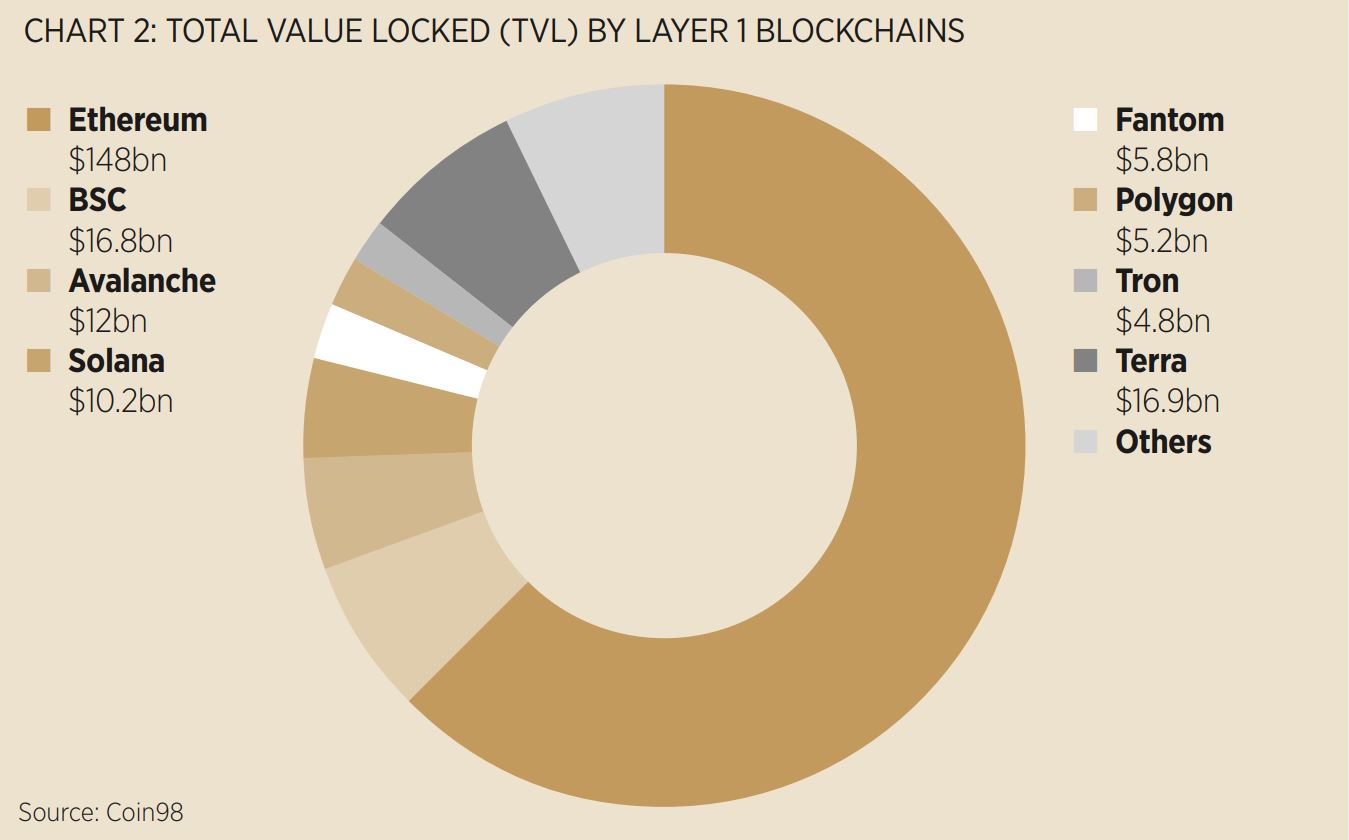

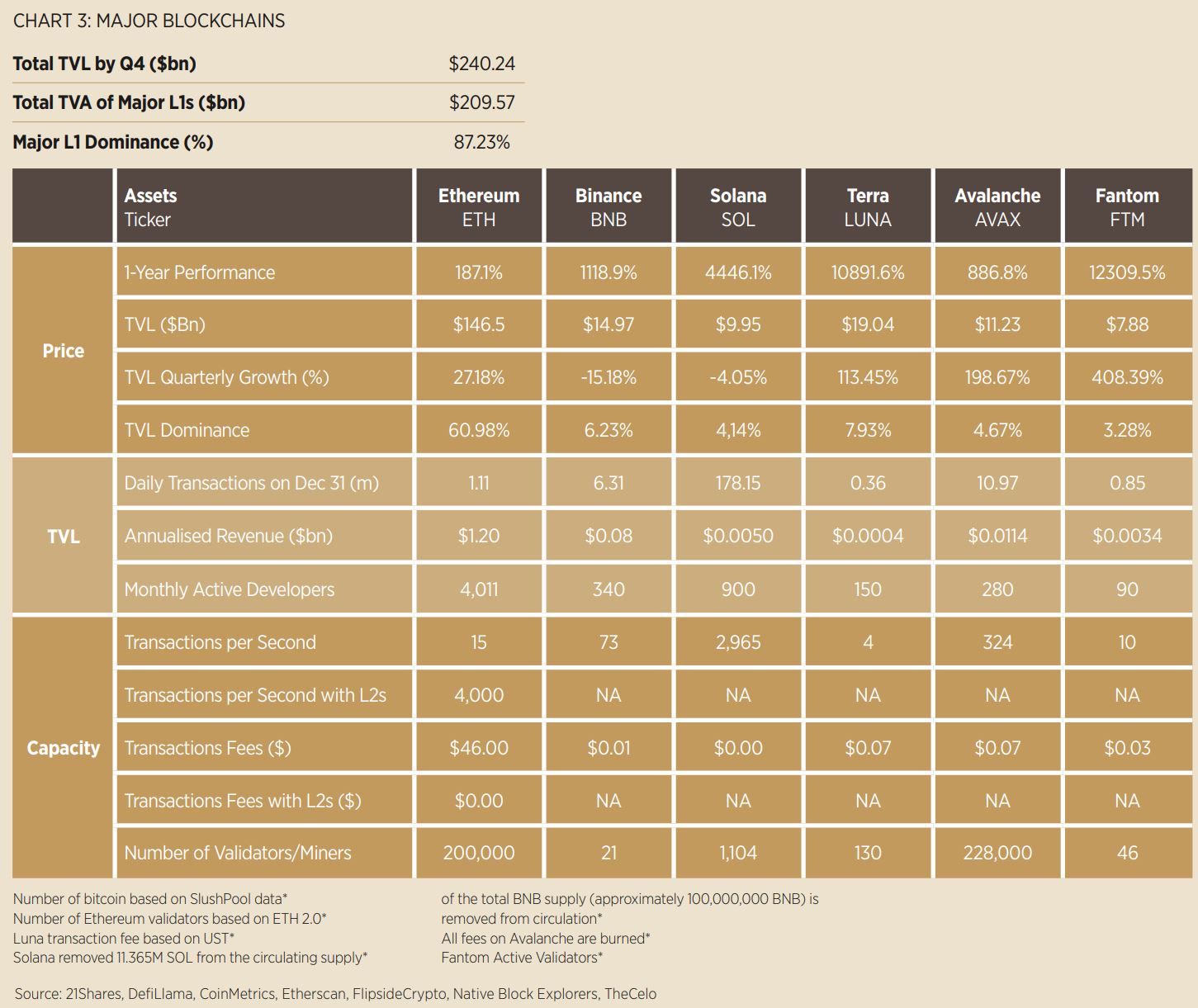

Ethereum is by far the most dominant settlement layer to build Web 3 apps processing over 1.2 million transactions daily and collecting approximately $10bn annualised revenue or 11x bitcoin’s total revenue worth around $960m. Ethereum’s developer base grew by 42% in 2021. At the start of 2021, ethereum accounted for 97% of the total market share in DeFi. It dropped to 60% as of mid-January but ethereum remains 8x larger than terra (TVL), the second-largest DeFi ecosystem amounting to $17bn in TVL (see table 2).

However, ethereum has become the victim of its own success over the past year, leading to this sharp decline in market share. Growing network activity transpired into higher transaction fees, pricing out microtransactions, and day-to-day payments. The average cost on ethereum is $46 per transaction while the base layer processes 12 to 40 transactions per second, depending on the smart-contract complexity and the network usage.

Other ecosystems entered the market as cheaper and faster alternatives. According to Electric Capital, solana, NEAR, binance smart chain, avalanche and terra are growing faster than ethereum did at similar points in its history. As adoption continues to grow, ethereum competitors will likely face network issues.

More significant usage could cause outages and higher transaction fees. For example, polygon, solana and harmony already experience network outages due to spam transactions. Additionally, most of ethereum’s competitors launched with insider ownership of around 40% such as solana, avalanche and celo while others approached the 60% mark like flow.

Blockchains need to scale

Rollups and sharding are currently the main solutions to securely scale blockchains to process millions of transactions per second in the long run while remaining decentralised, neutral and trustless. Ethereum is the epicentre of blockchain scalability solutions with the most comprehensive roadmap of which the R&D will likely benefit other ecosystems.

Polygon in the first half of 2022 will be the largest beneficiary of migrated ethereum-based applications until other scaling solutions mature. Crypto users’ favourite apps will mostly be accessible on polygon, as ethereum has become unusable for day-to-day operations.

Interoperability protocols such as cosmos and polkadot will play a key role in this multi-chain future with the rise of new blockchains. It is hard to overstate how significant those technological breakthroughs are to build a robust infrastructure for Web 3. However, it is also important to note that these are complex technologies and will take time to materialise and mature 2-3 years at least. Terra, the second-largest DeFi ecosystem in the world ($14bn), joined cosmos in October. As such, cosmos might continue to be miles ahead of polkadot on the interoperability vertical.

Potential threats

Web 3 will need a robust infrastructure and fully-fledged decentralised app development platforms such as Pocket Network to avoid Web 3 applications falling prey to random outages and leaked data occurring on centralised services such as Infura.

Additionally, operating systems still represent one of the strongest censors in the Web 3 stack as Google, Apple and Microsoft own this vertical. Therefore, alternative operating systems will be essential to keep an eye on this decade.

Major trends

Daily trading volumes of decentralised exchanges doubled in the last year to reach over $100bn in December. Despite this, the lack of liquidity is still painfully evident when trading long-tail and pre-price discovery assets. Last year was exciting for crypto-native derivatives: the growth of DeFi 2.0 through self-repaying loans, tokenised volatility, composable yield tranches and staked derivatives. The significance of Ethereum Name Service (ENS), as a protocol to provide the world’s decentralised identity as a public good for Web 3 was finally realised in 2021. In the coming months, we can expect access to on-chain credit, public storage, messaging and decentralised credentials to take a solid hold.

One of the most prominent narratives for 2022 is the growth of stablecoin adoption. We saw unparalleled growth in 2021, with the supply surging by 388%, from $29bn to $140bn. With regulators hovering over Tether for USDT and Circle, the company behind USDC, the demand for a decentralised stablecoin has never been more apparent.

The DeFi sector is not immune to hacks – particularly unaudited code. DeFi protocols have already seen a record number of exploits this year, totalling $680m. The support of forensic research has been essential to retrieving funds.

DeFi is still early in the adoption lifecycle, similar to the early years of crypto exchanges in 2011. The silver lining is Goldman Sachs estimated that only 0.54% of crypto-asset transactions are related to illicit activities.

NFTs the catalyst

The explosive resurgence and recognition of crypto-native art collections, music, and games (NFTs) have given a new face to this industry and attracted new cohorts of builders including illustrators, musicians, game developers, photographers, movie producers, fashion designers and 3D artists. The number of daily NFT users, especially for art and collectables, has increased significantly from 10,000 to over 40,000 in 2021.

However, the main issue NFTs create is exacerbating wealth inequality. Bots and blue-chip NFT owners such as Bored Apes are becoming the new accredited investors of this industry and are offered VIP access to the minting phase of upcoming NFT drops.

Play-to-earn games at the moment are DeFi applications in disguise. These games are generally more appealing to DeFi users who enjoy a gamified experience and not necessarily to full-hearted gaming fans. AAA games take several years to develop and might not launch in 2022.

Music NFTs will be one of the most engaging verticals. According to American musician and author, Mikel Jollett: “One million streams on Spotify nets $3,000. Of this, 84% goes to the label (if the artist is on a major, 50% if indie) and a whopping $480 goes to the artist.” With music NFTs, fans will own songs through royalty-backed NFTs.

Sleeping giant of the Web 3 stack

The data infrastructure is arguably one of the space’s most overlooked sectors:

Chainlink’s role has now evolved way beyond facilitating decentralised price feeds. The network’s growing repository of decentralised services has transformed it into a critical piece of the infrastructure layer that will be heavily responsible for the growth and evolution of the Web 3 stack.

Filecoin and Arweave encompass the decentralised storage industry and nourish a truly censorship-resistant layer underpinning the growth of the Web 3 ecosystem.

One last word on regulation

Concerns about unclear definitions of financial terminologies like “securities,” have been the core of that discord, raising question marks on whether the SEC holds all the tools to handle decentralised financial (DeFi) products. We gathered insights from a series of anonymous polls surveying allegedly people working in the US-based DeFi space.

The findings were as follows. A little more than 75% of respondents perceive the regulatory environment in the US negatively, pushing nearly half of them to likely move headquarters abroad next year by more than 60% chance. The majority of the respondents were split between Switzerland and Canada as their next offshoring destinations.

Conclusion

This thesis has outlined the latent potential in Web 3 as an emerging industry. We believe crypto will continue to present one of the most lucrative investment opportunities over the next decade as it continues to disrupt traditional internet services ranging from financial services, e-commerce, art, games and cloud storage.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.