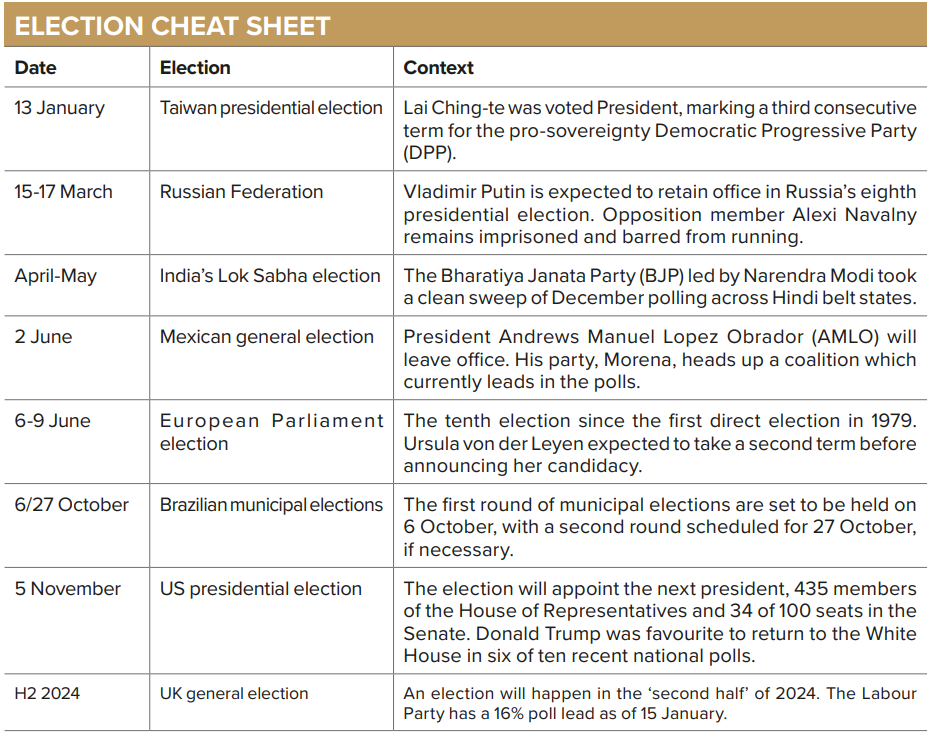

Around four billion people heading to the polls does not just mark the most active year for democracy in history, it raises questions around volatility and how this will be priced in across fixed income, safe havens, single country and sector ETFs.

Hearing about general, regional and local elections across 70 countries may initially sound broad and intangible, but eight of the 10 most populous countries being among this cohort underlines the importance of 2024 for policymaking in years to come.

Aside from what the results mean for geopolitics and the accessibility of different markets, elections themselves also create the need for fund selectors to manage risk and dispersion within their portfolios.

“Irrespective of related changes to politics and policy, significant economic trends can impact market swings, making selective diversification and targeted country selection even more important for the new year,” Marcus Weyerer, senior ETF investment strategist, EMEA and Dina Ting, head of global index portfolio management at Franklin Templeton, said.

James McManus, CIO at Nutmeg, noted almost as meaningful as who wins is the margin of victory, which dictates a government’s effectiveness.

“If the winning party fully controls the government – with a clear, working majority in the UK and taking both Houses and the White House in the US – they will have full sway to enact their legislative agenda. If power is split or there is no clear majority, we are more likely to experience a moderation of the policies of the winning party.”

Investors must also be mindful of ‘grey swans’ and allocating for uncertainties. As said by former member of the House of Representatives Heather Wilson: “The only poll that matters is the one on election day.”

Developed markets

Delving into important considerations for a handful of this year’s ballot boxes, Weyerer and Ting noted presidential election outcomes tend to have “very little impact on market moves”, though the widest range of outcomes during the election cycle tend to occur in the 12 months preceding election day.

In the US, he said markets tend to post 17% volatility in years when the incumbent retains office and 20% in years where a new party enters the White House.

However, he warned: “Given the fraught political backdrop, we may see a more nervous market than what is currently priced.”

George Granville, partner at Courtville Partners, added politics will likely exert a “gravitational pull” over monetary and fiscal policy over the coming year.

While he argued political pressure will not force the Federal Reserve to abandon its hawkish stance, a combination of no more rate hikes and “ultra-loose fiscal policy” means US financial conditions are as “pro-cyclical as it is possible to imagine”.

For ETF investors, former President Donald Trump’s recent polling and momentum in the caucuses will sound alarm bells ringing around the potential inflationary impact of a renewed trade war following promises of a 10% tariff on all imported goods.

His “drill baby drill” remarks also point to a gear change from subsidies and tax breaks for clean energy projects and a shift in favour of expanded oil and gas production.

In the UK, FTSE Russell warned “sizeable rate cuts” are being priced in despite resilient wage and core inflation data as well as the Bank of England’s ‘higher for longer’ messaging.

“Fiscal easing ahead of the forthcoming UK general election may also delay lower rates,” the index provider warned, as Chancellor Jeremy Hunt looks to bolster support for the Conservatives with tax cuts ahead of voters heading to the polls in H2.

Russ Mould, investment director at AJ Bell, said data since the inception of the FTSE All-Shares illustrates UK equities “may even welcome” a change of party in office, with the index posting a “double-digit” gain on average in the year following a new party taking government.

“Inflation also sorts out the real winners and losers, from the markets’ perspective, when it comes to individual prime ministers,” Mould added. “Of the 13 prime ministers since 1962, four of the best five from the very narrow perspective of stock market returns were Conservatives, once FTSE All-Share returns are measured in nominal terms.”

For Europe, the gap between now and June contains several unknowns. At the time of writing, current European Commission President Ursula von der Leyen has not announced her candidacy for a second term in office, yet polls suggest she is the frontrunner.

According to Marion Muehlberger, senior economist at Deutsche Bank, a second term for the von der Leyen ‘grand centrist coalition’ is set against the backdrop of an “increasingly fragmented” European Parliament, with right-wing and Eurosceptic groups potentially claiming 20% of seats.

Defence and implementing the EU Green Deal will also feature more prominently on the policy agenda, Muehlberger said.

Emerging markets

While the outcome of the US election will have far-reaching impacts across emerging economies, it is worth singling out a handful in focus for investors and political pundits.

First, Taiwan’s pro-sovereignty DPP led by President Lai Ching-te won a third consecutive term in office. Despite China sending 24 planes and five boats into Taiwan’s air defence identification zone following the result, further escalation has yet to materialise.

Sekar Indran, senior portfolio manager at Titan Asset Management, noted potential opportunities in the “bottoming in the semiconductor cycle” and businesses such as TSMC trading on “attractive multiples”, however, he warned tensions with China “could overshadow these fundamental tailwinds”.

In India, Weyerer and Ting suggested incumbent Prime Minister Narendra Modi is on track for a third term with “a high approval rating following a pivotal year that showcased the country’s global ascendancy”.

Indran noted India has doubled its contribution to global growth since the pandemic of a purchasing power parity basis, but an increase in private capital expenditure and household expenditure are needed to lift corporate profits and drive equity returns higher.

Turning to Latin America, Indran suggested the “immense fiscal discipline and non-interventionist approach” of President Andrés Manuel López Obrador (AMLO) should secure victory for a coalition led by his Moreno party, even after his departure.

He added ‘near-shoring’ could present a “multi-year opportunity” following two decades of “meagre growth”, though investors will be mindful of rallies in Mexican equities and the peso in 2023. AMLO’s term leaves scope for “more expansionary fiscal policy going forward”, he said.

Finally, while Brazil’s municipal elections are not expected to inspire the level unrest seen at the 2022 general election, they pose the risk of some short-term disruption to an otherwise positive outlook.

Indran noted tax reforms in 2203 would be a “large tailwind” for the economy, boosting growth and reducing litigation.

Weyerer and Ting, meanwhile, said investors may find “an attractive entry point to this bright spot among global equity markets”, with a currency trading below its 10-year median on a real effective exchange rate basis.

Overall, while asset allocation should primarily be driven by strategic rather than tactical views, the year ahead presents no shortage of potential for new flashpoints in monetary policy, geopolitics and trade, that may be worth bracing for.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.