ETF issuers with a focus on emerging markets, fixed income and commodities saw the most inflows in Q1 as risk assets outperformed despite the challenging market environment.

According to data from ETFbook, investors poured €45bn into European-listed ETFs and ETCs in the first quarter of 2023 amid predictions of peak inflation and central banks slowing the pace of interest rate hikes.

This has driven the Nasdaq 100 into a technical bull market, up 20% since its low last December, despite the sell-off in the banking sector and warnings inflation could stay higher-for-longer.

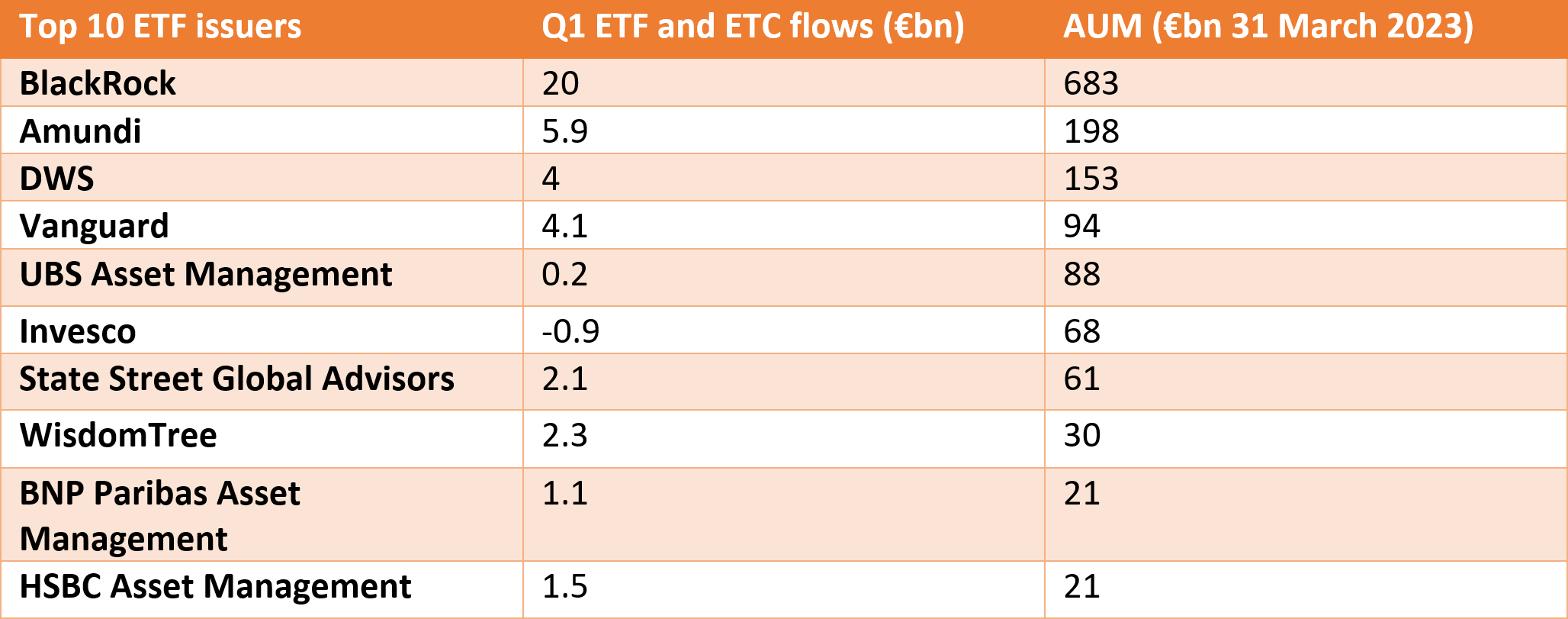

In this environment, BlackRock captured the most inflows across all ETF issuers in Europe with €20bn net new assets in the first three months of the year.

The world’s largest asset manager benefitted from the renewed demand for fixed income with the iShares $ Corp Bond UCITS ETF (LQDE) and the iShares $ Treasury Bond 0-1yr UCITS ETF (IB01) seeing a combined €1.4bn inflows.

Meanwhile, investors also eyed emerging market ETFs as a potential area of outperformance. They piled a combined €2.1bn into the iShares Core MSCI EM IMI UCITS ETF (EIMI) and the iShares MSCI China A UCITS ETF (CNYA).

Behind BlackRock, Amundi captured €5.9bn net new assets over the past three months while Vanguard and DWS saw €4.1bn and €4bn inflows, respectively.

Elsewhere, the increasing demand for commodity ETFs meant WisdomTree saw €2.3bn inflows in Q1, the fifth-highest across ETF issuers in Europe.

This was driven by inflows into the WisdomTree Brent Crude Oil ETC (BRNT) and the WisdomTree Copper ETC (COPA) which both saw €1.1bn inflows.

State Street Global Advisors (SSGA) and HSBC Asset Management also had strong quarters with €2.1bn and €1.6bn inflows, respectively.

Source: ETFbook

At the other end of the spectrum, Invesco suffered €908m outflows over the past three months, the only ETF issuer in the top 10 to see net withdrawals, as investors pulled €1.1bn from the Invesco Physical Gold ETC (SGLD).