Introduction

Index providers play a crucial role in the ETF industry by creating and calculating indices designed to measure the performance of different asset classes.

Because the majority of ETFs are rules-based instruments, they track indices such as the S&P 500 or MSCI World which offer exposure to a particular segment of the market.

It is the role of the index provider to select securities that are included in the index as well as determine the weighting methodology for the resulting basket of securities.

This selection process is based on several factors including market cap, liquidity and sector with index providers responsible for calculating the benchmark daily, rebalancing on set dates and removing any securities that no longer meet an index’s rules.

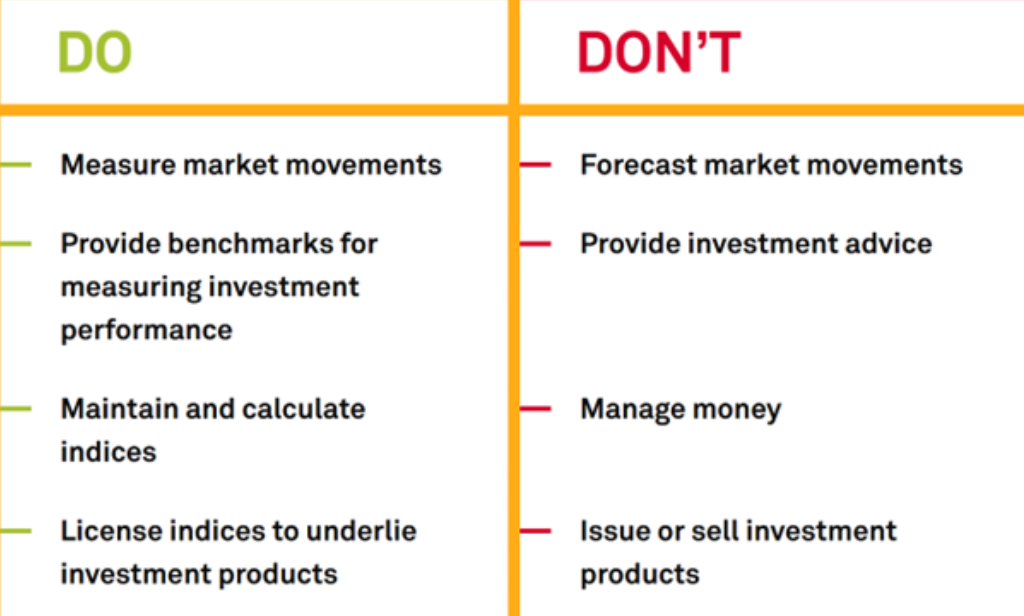

Chart 1: What do index providers do?

Source: S&P Dow Jones Indices

Reliable indexing

To ensure the accurate maintenance of an index, providers are also responsible for tracking corporate actions including mergers, stock splits and dividend payments.

Ensuring indices are calculated accurately is vital, not just to the functioning of ETFs, but to the entire financial ecosystem.

Investors and other financial professionals across the globe rely on indices for real-time information about performance and use index data as inputs for investment and economic decisions.

Increasingly, index providers work closely with ETF issuers to develop custom indices that enable issuers to differentiate from their rivals.

This can be for a specific segment of the market an ETF issuer wants to offer investors exposure to or a different index methodology.

Custom indexing

The introduction of self-indexing has been one way ETF issuers have looked to avoid index providers’ high license fees.

This process of creating and designing an index ‘in-house’ instead of licensing an external benchmark is another way for ETF issuers to differentiate from rivals.

The ‘Big Four’ of Bloomberg, FTSE Russell, MSCI and SPDJI are the most dominant players within the indexing space, however, incumbents such as Solactive and Qontigo are looking to disrupt the industry.

As the ETF industry continues to grow, the role of index providers will become even more important. Creating reliable and accurate indices that can cope with the trillions of dollars that flow into ETFs will be essential for the industry’s development over the next decade.

Key takeaways

Index providers design and maintain indices tracked by most ETFs, selecting and weighting securities based on market factors like market cap and liquidity

They calculate daily index values, handle rebalancing and update for corporate actions like mergers or dividends, fostering trust in the financial system

They collaborate with ETF issuers on custom indices and face challenges from new players, driving dynamism in the market