While markets and financial returns are hard to predict, investors can control costs. These costs, including expense ratios, transaction costs and sales charges, can significantly erode returns.

Is an ultra-low expense ratio the end of the story? Or should investors consider factors beyond price when evaluating an index fund manager?

Some investors believe that index funds and ETFs are differentiated only by their fees. However, over the last few years, the industry has seen a meaningful fall in index fund expense ratios. As a result, fee differences that once heavily influenced a fund’s relative performance are now nearly immaterial. In today’s low-cost environment, where some index fund and ETF expense ratios are approaching 0%, a one to two basis points (bps) charge has a negligible impact on performance.

Investors must therefore look beyond expense ratios to evaluate investment options. They need to consider a broader set of complex factors, such as organisational incentives, portfolio management capabilities, securities lending practices, pricing policies and scale.

At low fee levels, performance differences depend more on less visible and complex elements of index fund management. Investors must carefully evaluate these elements to ensure a fund closely mirrors the risk and return characteristics of its benchmark index.

This paper explains three key criteria investors should consider when selecting an index fund manager: incentive alignment, portfolio management and securities lending. We present a decision-making framework that is applicable to the most popular, broad-based equity and fixed income index funds and ETFs available (Figure 1).

Incentive alignment

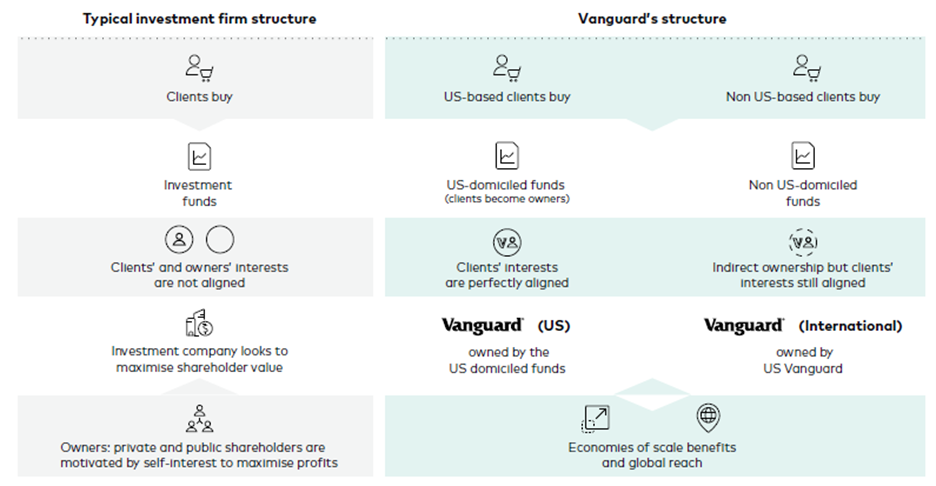

Index fund managers come in all shapes and sizes. The differences matter, particularly an asset manager’s ownership structure and philosophy, as this determines the incentives that drive the firm’s business strategy.

We believe that a mutually owned asset manager, such as Vanguard or a similarly structured firm, is well positioned to prioritise a client’s interests over those of the firm itself. This benefits fund investors. The framework below illustrates this point.

Figure 1: Framework for choosing an index fund manager

Note: A typical fund management company is owned by either public or private shareholders, rather than by the funds they manage. This company structure prioritises maximising profit for the owners, often resulting in higher management fees to boost profits. By contrast, Vanguard in the US operates under a different and distinctive model where the funds themselves own the Vanguard management company. This unique arrangement eliminates conflicts of interest of the Vanguard management company with those of the funds’ investors. This incentivises Vanguard to keep fees as low as possible, benefiting investors by allowing them to retain more of the funds’ return. While Vanguard in Europe is not directly owned by Vanguard funds, it is wholly owned by Vanguard Group. This ensures that the client-first philosophy is maintained, prioritising clients’ interests by delivering value to investors.

Source: Vanguard.

The Vanguard difference

Vanguard is owned by the people who invest in our funds*. The value and strength of this ownership structure is that it aligns with our clients’ interests of long-term perspective and low costs.

This is a philosophy that has helped millions of people around the world to achieve their goals with low-cost, uncomplicated investments. It’s what we stand for: value to investors.

Cost management incentives

Asset managers deduct the costs, typically expressed as an expense ratio, of an index fund from the fund’s total assets under management. This reduces the fund’s return. While charges across the industry have fallen meaningfully over the last decade, an investor that selects an index fund solely to save two bps a year, for example, may be pursuing a false economy. Other fund costs that affect a fund’s performance may exceed the perceived headline saving.

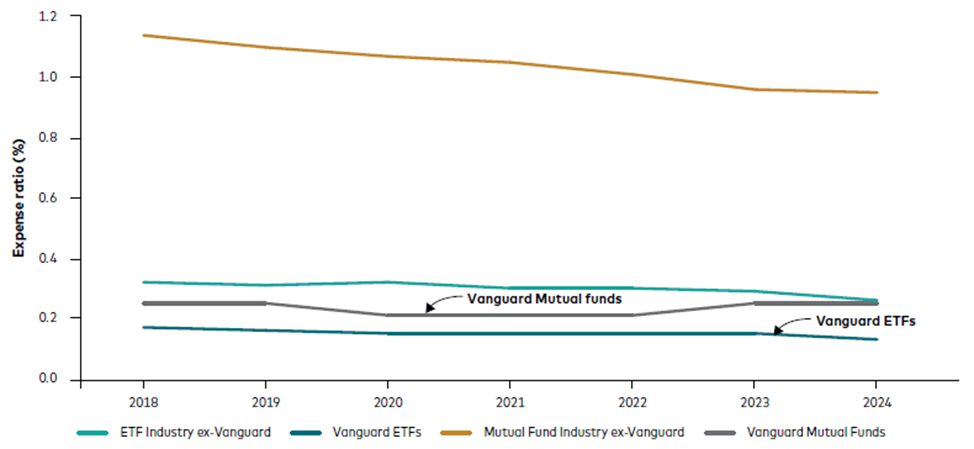

Investors should look for asset managers with a proven track record of disciplined expense management. Gaining insight into how an asset manager achieved a fund’s performance can help investors understand how well the asset manager’s interests align with those of their clients. For example, consistency with fees over time builds confidence that fees will at least remain stable or even decrease. By contrast, if fees fluctuate frequently, it could indicate that the asset manager’s primary business strategy is to gain market share through selective price competition. Figure 2 shows how fees have fallen over the last few years in Europe.

Figure 2: Index fund expense ratios (OCF** ) across the industry have converged

Historical expense ratios: Europe-domiciled mutual funds and ETFs, 2018-2024

Source: Morningstar, 31 January 2018 to 31 December 2024.

In upcoming articles, we will explore the other sections of our Beyond expense ratios paper, namely portfolio management and securities lending.

*The Vanguard Group, Inc. is owned by Vanguard’s US-domiciled funds and ETFs. These funds in turn are owned by their investors. Our unique mutual ownership structure in the US, where we are owned by our clients, aligns our interests with those of our investors globally. This structure underpins our core purpose: to take a stand for all investors, treat them fairly and give them the best chance for investment success. Vanguard believes that a company should manage funds solely in the interest of its clients, which is at the heart of our client-alignment philosophy.

**OCF is the ongoing charges figure. The OCF is the annual cost of holding a fund, expressed as a percentage of a fund’s total assets. It covers the cost of managing and operating a fund. It includes fees and expenses, such as management fees, administration fees (such as custodian, legal and audit fees) and other operational expenses.

CFA is a registered trademark owned by CFA Institute.

CPA is a registered trademark owned by CPA Canada.