Most money in Aussie ETFs is in Australian share ETFs. These are products that give exposure to the biggest Australian companies and aim to take the hash out of stock picking.

Two of the best in the business are the Vanguard Australian Shares Index ETF (VAS) and the VanEck Vectors Australian Equal Weight ETF (MVW). Both of which have tens of millions of dollars in monthly flows and strong investor followings.

But what are the important differences between the two? And what should investors considering MVW and VAS keep in mind when making a decision? Below we take a look.

Fund NameVanguard Australian Shares Index ETFVanEck Vectors Aus Equal Weight ETFAUM ($m)3550814IndexS&P/ASX 300 IndexMVIS Australia Equal Weight IndexInception date08/05/0906/03/14

Investment Strategies Overview

Market weight or equal weight?

MVW and VAS have very different investment strategies.

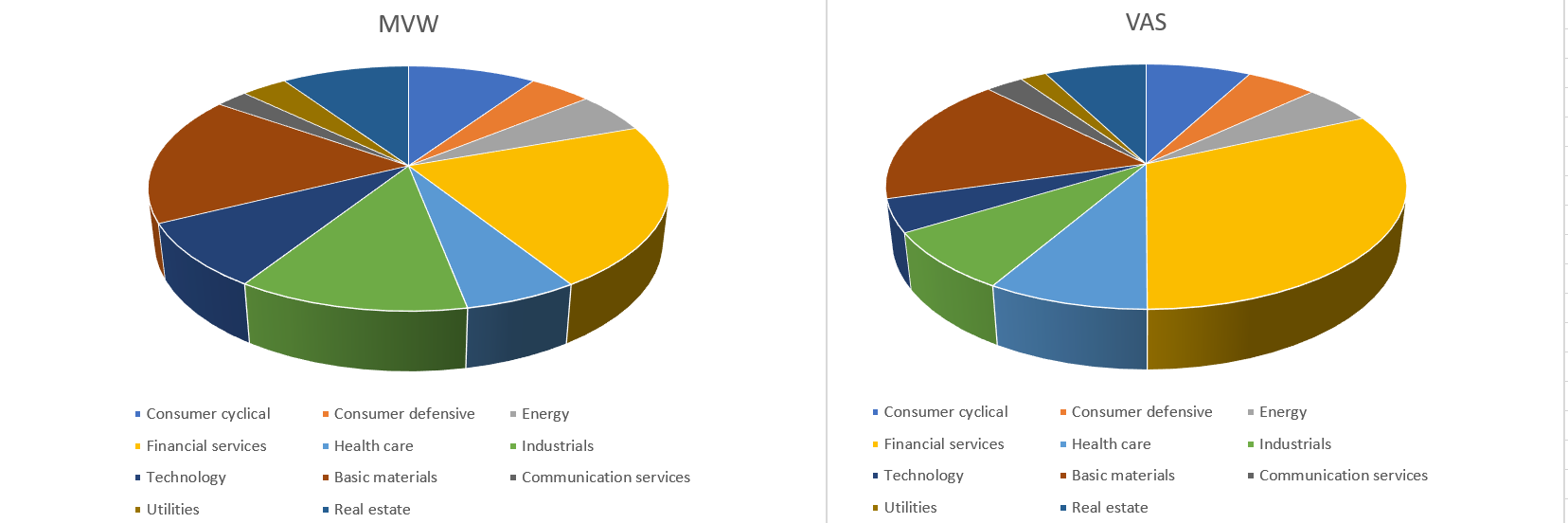

VAS is the closest thing on the Australian market to a purely passive ETF. It buys 300 publicly listed companies judged by index provider S&P to be representative of the total Australian equity market. It then weights them by size, giving investors cheap access to the market capitalization rate. As it buys the nearest thing to the total market, the fund has very low turnover and is tax efficient from a franking perspective. VAS also runs a unique securities lending programme. Thanks to Vanguard’s mutual structure, almost all the games of this lending are passed on to investors in the form of a higher yield.

MVW has a very different investment strategy, and takes an equal weight approach. This means MVW buys the same dollar amount of every company in its index. The approach gives mid-caps a much larger foot print than in a market weighted benchmark, while lowering blow up risk for single stocks. Equal weighting also reduces concentration in the big five banks, which dominate the Aussie equity market, but correspondingly lowers franking and yield. Rebalancings cook-in a contrarian take: each quarter the fund is selling winners and buying losers. MVW only invests in the most liquid 75 to 80 stocks on the ASX to keep rebalancing costs down.

Cost and tradability

VAS is cheaper with more efficient trading

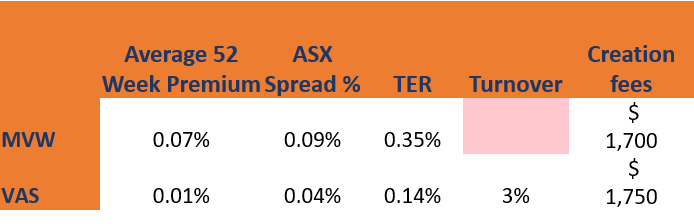

In TER terms, VAS has a clear edge, charging 14 basis points to MVW's 35 bps. Vanguard also has a very strong track record of lowing fees. VanEck has a modest track record of cutting fees in the US, but not in Australia.

VAS has the edge in other cost variables too, like tradability and efficiency.

MVW has an average premium of 7 basis points. However the premium is not stable and can sometimes be a discount. This means investors run the risk of buying in at a premium then selling at a discount, adding to total cost. MVW also has an average 9 basis point spread.

VAS has a negligible 52 week premium that’s very stable and has some of the lowest secondary market spreads of any ETF. Meaning investors pay less to get in and out.

Block Trading

Investors considering block trading MVW and VAS (from what we understand, there have been relatively few) should keep in mind the VAS comes with a fat tail of less liquid small caps which can add to the cost of financing a creation basket. MVW shapes its basket based on liquidity, which should allow for cheaper block trades. Investors considering block trades should contact the issuers capital markets desks for a transaction cost analysis.

Performance

MVW has been a strong performer

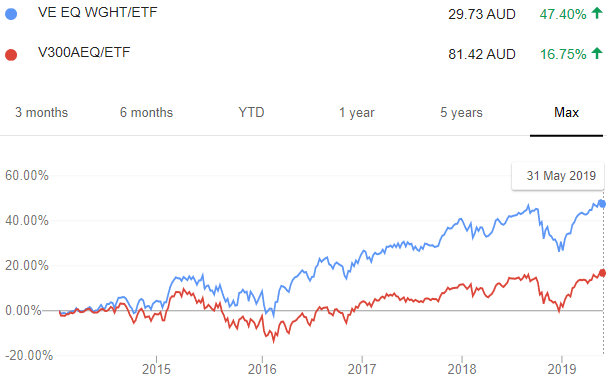

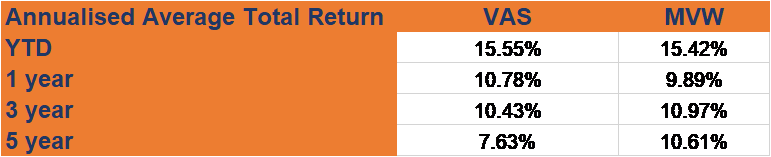

Looking on a price return basis, MVW has comfortably outperformed VAS, providing a return well beyond the broad market benchmark tracked by VAS. This type of consistent outperformance by a rules-based fund is rare. Were MVW provided by an active manager one suspects they’d be on the front cover of the AFR.

Related article: VanEck's equal weight gambit

Looking on a total return basis however and the performance stats narrow. MVW has still beaten VAS over the past 5 years (and comfortably, too) but the difference is closer in recent years.

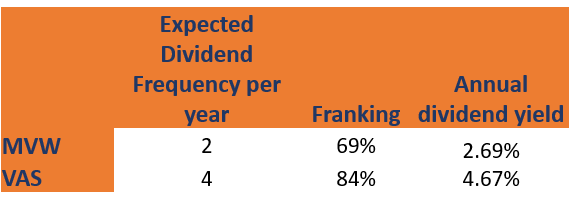

Dividends

VAS provides better dividends

For income-minded investors, VAS is a higher yielding fund and provides better franking. VAS’s superior dividends owe to the big five banks, which made up almost 30% of its weight. For those reinvesting dividends via DRPs note a subtle and very clever move from VanEck: the unit cost of MVW is $29, compared to the $82 of VAS. This low unit price reduces cash drag and allows better compounding.

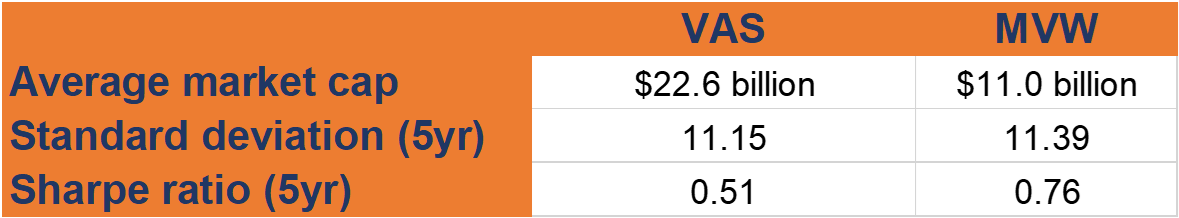

Risk

In theory, MVW should be the riskier product as its equal weighting creates a size effect. This is reflected in its lower median market capitalisation. However, looking at standard deviation, the most popular measure of risk, there seems to be little difference between the two. While MVW has the better Sharpe ratio due to its superior return. On a sector basis, MVW provides better diversification as it waters down the banks and tilts away from financials.

Conclusion

MVW and VAS are two of the best Aussie share ETFs on the market; many would argue that they’re the two best. Both have strong track records and have outperformed most active managers the past five years.

To make some conclusions, income-minded investors, or those simply wishing to make the most of the ‘arithmetic of active management’, would perhaps be better off with VAS. Those with less faith in the banks and miners, those wanting something near mid-cap exposure, or those wanting an alternative play on Aussie equities will be better served by MVW.

Long-term buy-and-hold investors should be mindful of MVW’s 20 basis point extra fee, which is charged every year and compounds.