The consumer discretionary sector has performed strongly this year. The S&P 500 Consumer discretionary sector has returned 21.1% year to date while the S&P 500 has returned 16.7% in that time. Similarly, the MSCI World Consumer Discretionary index has returned 9.6% YTD and the MSCI World has returned 9.7% over the same time period.

Consumer discretionary stocks typically include companies that sell nonessential products and services, such as luxury retail. This is unlike consumer staples, which include goods such as food and drinks, which people buy regardless of the market conditions.

It follows therefore, that consumer discretionary goods tend to pull back when markets are not doing well, and times are harder. So, if wages go down, then demand for consumer discretionary goods typically falls too.

Which has not been the case this year.

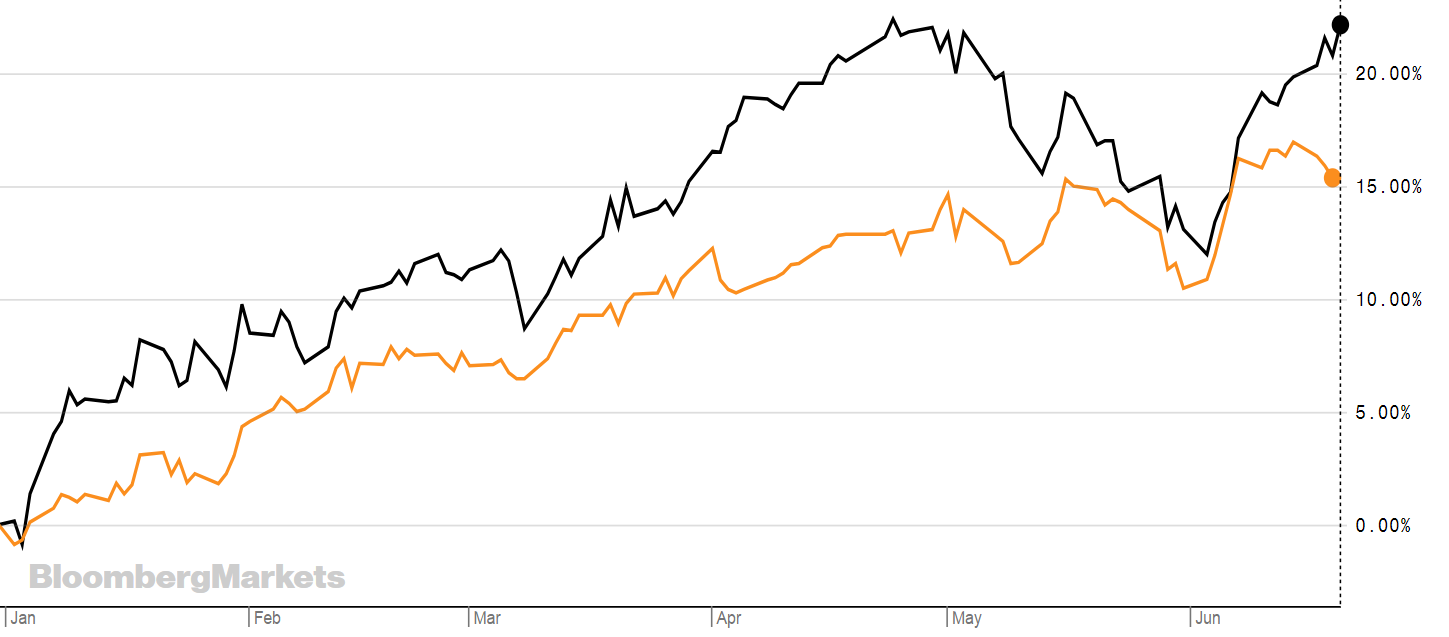

For example, the iShares Consumer Discretionary ETF (IUCD) has returned 22.2% so far this year, while the iShares consumer staples ETF (IUCS) is up 15.4%. The graph below shows IUCD in black and IUCS in orange.

Source: Bloomberg

The reason for consumer discretionary doing well is largely down to strong earnings growth.

A note from SeekingAlpha states: “Consumer strength is growing due to labor market health. That strength is showing up in the earnings expectations of Consumer Discretionary stocks more so than Consumer Staples stocks. Because of this, I am targeting the Consumer Discretionary Sector for the Technical Investor Portfolio."

The note adds: “The Consumer Discretionary sector has been a market leader all year. The sector has returned 8% since the first of June and nearly 29% since the December 2018 lows where the broad market S&P 500 has only risen 6.6% and 23.8% during the same periods. This strength is due to the earnings growth outlook despite the unknown future impact of trade wars and tariffs. In an earnings-driven market, it makes sense to follow the sectors expected to grow their earnings.”

Despite the strong performance this year consumer discretionary did not escape the volatility seen in May this year.

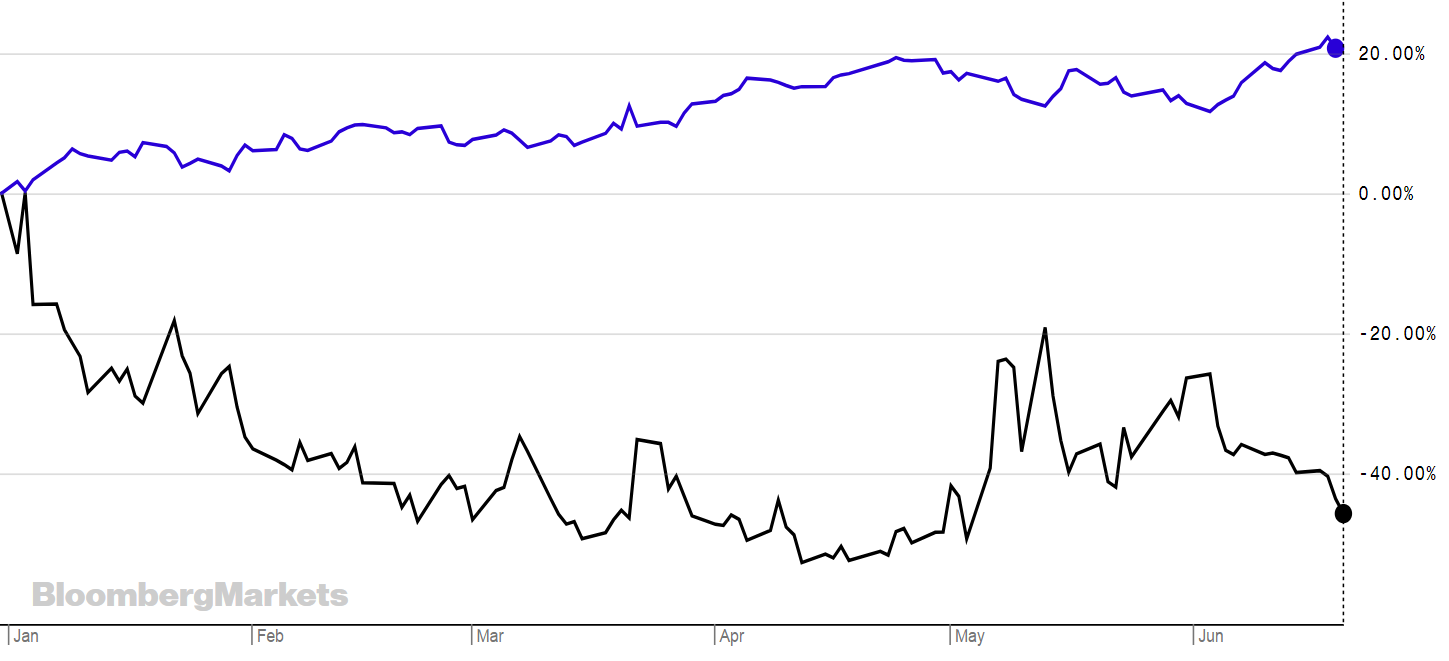

The chart below shows the VIX’ performance this year against Xtrackers MSCI USA Consumer Discretionary UCITS ETF (XSCD) – one of the best performing ETFs this year. While XSCD shows a downward trending line, it ties in with the spikes of volatility seen in the VIX.

Source: Bloomberg

The performance of consumer discretionary sector however, tells us that the economy is in reasonably good shape, earnings growth is good and – as Seeking Alpha points out – is likely to continue.

“The earnings outlook for the Consumer Discretionary sector is not what I would call robust this year, but it is market leading and supported by labor trends. The sector is looking at 6.6% EPS growth for 2019, enough for third ranking among the 11 S&P 500 sectors, and the growth is expected to accelerate next year. The only negative is that earnings growth is expected to contract in the second quarter, but that is easy to overlook, while 2020 EPS growth is estimated to top 12.5%.”

Access is available through ETFs listed on the London Stock Exchange and there are several on offer covering various regions. All of which have done well.

The European coverage has seen returns over 19%, while globally and the US around 20% YTD.

ETF.com wrote in April that “Economic growth in the U.S. may be slowing, but it will still outpace the growth rate seen in other developed foreign markets.

“To investors, that means looking toward U.S. sectors filled with companies that generate the majority of their revenue domestically rather than from foreign economies. One such sector is consumer discretionary. The U.S. economy does not rely on exports nearly as much as other developed economies. For example, the U.S. only derives about 12% of GDP from exports, while countries like Germany (46%), and China (20%) rely far more on the health of foreign economies.”

One of the cheapest ETFs on offer that also tracks the US market is Invesco’s Consumer Discretionary S&P US Select Sector UCITS ETF. It comes in two currency denominations and follows the S&P Select Sector Capped 20% (Consumer Discretionary) Net Total Return Index. It has returned 21.7% YTD.

The index works by imposing capped weights on the index constituents from the consumer discretionary sector. According to S&P the weight of each stock is based on its float-adjusted market cap but is modified such that no stock has a weight over 20% of the index as of each rebalancing.

A non-exhaustive list of the ETFs available focusing on the consumer discretionary sector is below with performance listed YTD at the time of writing.

CDIS

CD6

DISG

DISW

XUCD

TER:0.12%

XDWC

TER:0.3%

XSCD

TER:0.12%

XLYS

XLYP

IUCD

ICDU

SXLY

WCOD

ETFYTD RTNTERINDEXSPDR MSCI Europe Consumer Discretionary UCITS ETF19.10%0.3%MSCI Europe Consumer Discretionary IndexAmundi ETF MSCI Europe Consumer Discretionary UCITS ETF18.63%0.25%MSCI Europe Consumer Discretionary IndexLyxor MSCI World Consumer Discretionary TR UCITS ETF18.37%0.30%MSCI World Consumer Discretionary TRN indexLyxor MSCI World Consumer Discretionary TR UCITS ETF17.00%0.30%MSCI World Consumer Discretionary TRN indexXtrackers MSCI USA Consumer Dcretionary UCITS ETF20.38%M’ment fee:0.02%MSCI USA Consumer Discretionary Net Total Return USD IndexXtrackers MSCI World Consumer Discretionary UCITS ETF16.89%M’ment fee:0.15%MSCI World Consumer Discretionary Net Total Return IndexXtrackers MSCI USA Consumer Discretionary UCITS ETF21.78%M’ment fee:0.02%MSCI USA Consumer Discretionary Net Total Return USD IndexInvesco Consumer Discretionary S&P US Select Sector UCITS ETF21.79%0.14%S&P Select Sector Capped 20% (Consumer Discretionary) Net Total Return IndexInvesco Consumer Discretionary S&P US Select Sector UCITS ETF21.74%0.14%S&P Select Sector Capped 20% (Consumer Discretionary) Net Total Return IndexiShares S&P 500 Consumer Discretionary Sector UCITS ETF22.15%0.15%S&P 500 Consumer Discretionary Sector IndexiShares S&P 500 Consumer Discretionary Sector UCITS ETF23.05%0.15%S&P 500 Consumer Discretionary Sector IndexSPDR S&P U.S. Consumer Discretionary Select Sector UCITS ETF22.05%0.15%The fund's objective is to track the performance of large sized U.S. consumer discretionary companies in the S&P 500 IndexSPDR MSCI World Consumer Discretionary UCITS ETF16.80%0.30%MSCI World Consumer Discretionary Net Total Return Index