European ETF issuers are shutting ETFs at a record pace this year highlighting just how hard it is for ETF issuers to sell new ideas to the market.

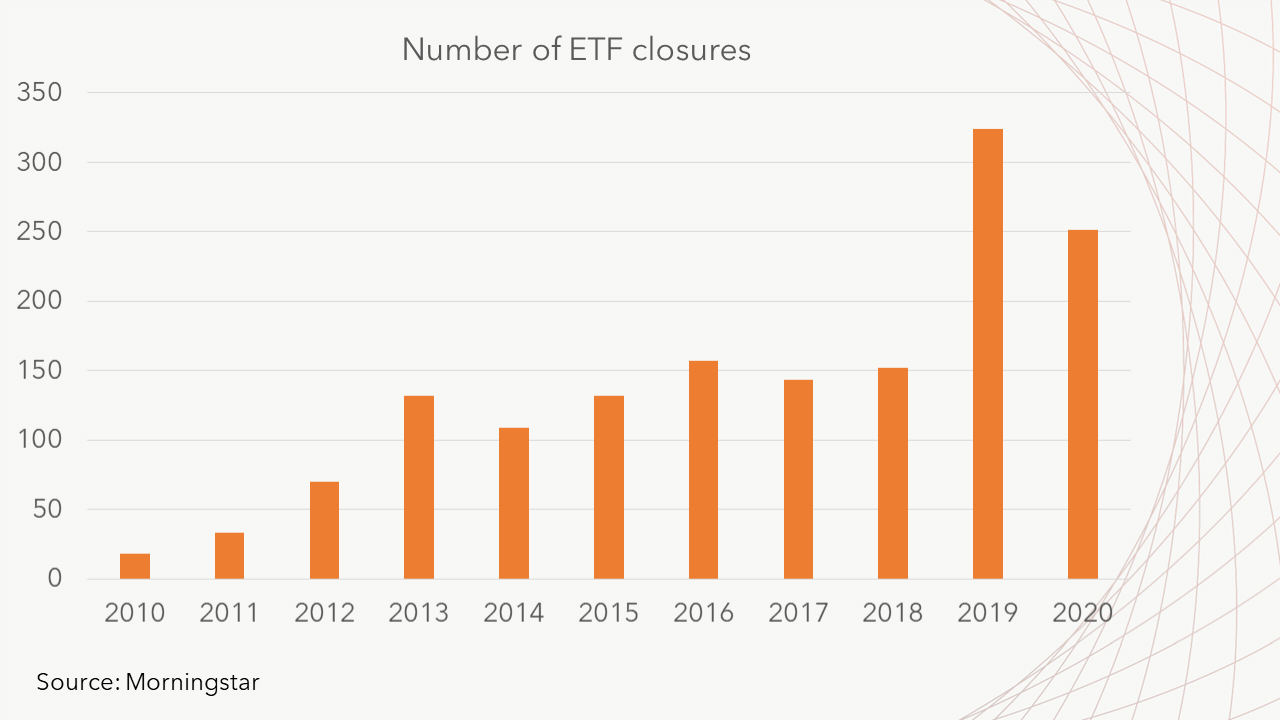

According to data from Morningstar, some 286 ETFs were closed in 2019 with a further 223 shut during the first eight months of this year. With a monthly average rate of 28 closures, this figure to climb to a record high of 334 by the end of the year.

On top of this, some 90% of the 509 ETFs closed in the past 20 months were due to products failing to attract assets.

Where ETF issuers have had success over the years is in the market-cap space with products such as the $25bn iShares Core MSCI World UCITS ETF or the $24bn Vanguard S&P 500 UCITS ETF continuing to gather significant flows.

However, this segment of the ecosystem has become saturated due to the huge number of ETFs tracking flagship indices.

As a result, new market cap-weighted ETFs have struggled to capture significant flows. Highlighting this, both Lyxor and JP Morgan Asset Management’s US equity ETFs have under $100m assets under management (AUM) despite being the cheapest on the European market at 0.04%.

In response, ETF issuers have moved away from market cap in recent years to other more esoteric parts of the market however they have struggled to capture flows.

There is a similar picture in the US. According to data from Bloomberg Intelligence, just under 33% of all existing ETFs were launched in the past three years but they total approximately $2 of every $100 invested.

With low barriers to entry but high barriers to success, this makes the European ETF market far more of a challenge than first meets the eye.

BMO Global Asset Management found this out the hard way after the Canadian bank called time on its European ETF operation in November 2019, just four years after entering the space. Its 13-strong range had over €600m AUM however just four ETFs had over €50m with two surpassing €100m.

ETF closures

In addition to core equity and fixed income ETFs leading the way in terms of AUM, gold ETPs are also popular among investors. The Invesco Physical Gold ETC (SLGD), for example, has grown to $14.3bn assets under management (AUM) following price rallies and inflows in 2020 which has enabled Invesco to cut the fee of ETP twice in 2020 from 0.24% to 0.15%.

Issuers have been able to reduce the costs of some of their leading products to become even more competitive, however, they have also had to close a number of ETFs in recent years as they struggle to gain any traction with European investors.

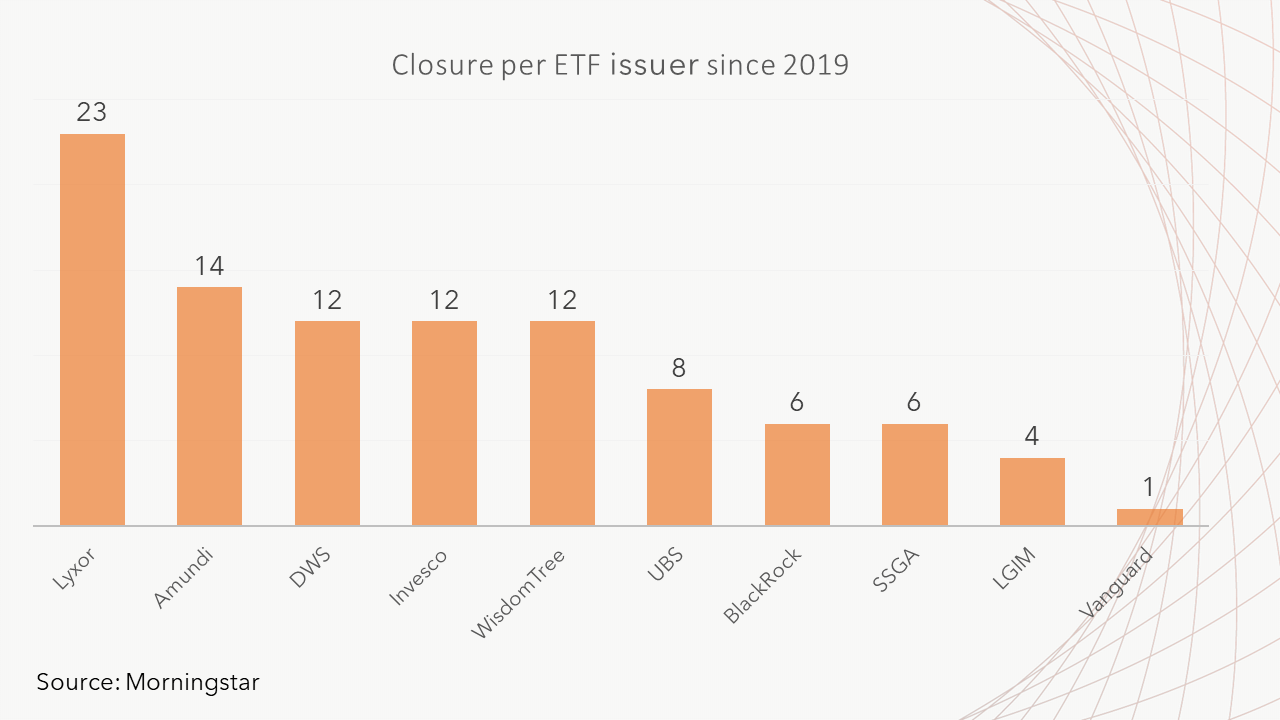

Despite Invesco being able to reduce the fee of SGLP by 9bps, the firm has also had to close 12 ETFs since the beginning of 2019. US giant BlackRock has closed 6 ETFs over the same period while Amundi, DWS and UBS closed 14, 12 and eight ETFs, respectively.

Out of the 509 closures seen since the beginning of 2019, 455 of the ETFs had less than €15m in AUM. Typically, $100m is the magic number issuers strive for so the ETFs become profitable, however, this varies depending on the TER.

European ETP closures more than double year-on-year

It is a costly task for issuers to manage ETFs as they have to pay for the listing fees on all exchanges, licensing fee to track an index and the inhouse costs of salaries, software and hardware.

In 2017, the world’s largest ETF, the SPDR S&P 500 ETF Trust had $250bn in AUM and was charging investors 0.095% in ongoing charges. However, the Motley Fool reported S&P Dow Jones Indices (SPDJI), the index provider for the S&P 500, was charging a licensing fee of $600,000 per annum plus 0.03% of the AUM.

Therefore, State Street Global Advisors was paying SPDJI $75.6m a year to track the S&P 500 and to use its name in its ETF.

ETF issuers must also pay an annual fee to list their products on exchanges, and given Europe’s consolidation issues, firms face listing each ETF on five or more exchanges to truly capture market demand.

To list on the SIX Swiss Exchange alone, for example, issuers must pay an initial $10,000 to register with the exchange and then up to $3,000 a year per product in maintenance fees.

While ETF issuers can seek competitor exchanges and index providers which offer significantly cheaper fees, they do run the risk of missing out on the institutional market as well as deterring investors who rely on recognisable brands for their investments.

Issuers will typically give two or three years to see if there is significant interest in each ETF to determine if there is potential to reach the profitable asset milestone.

The ETF industry tries to downplay the negative side of ETF closures by spotlighting the increase in efficiency by removing products which have lacked demand. But this becomes a burden for the investors that have made the decision to include the unfavourable ETF in their portfolio.

Investors are forced to withdraw their assets earlier than planned and are then forced into reallocating. This becomes an unexpected expense for investors who are faced with capital gains tax and platform costs to reallocate.

Investor due diligence required as ETF closures in Europe mount

To avoid this burden, investors have been encouraged to choose ETFs with issuers that have the deepest pockets as these firms are able to wait longer before having to throw in the towel. As a result, the big players become even more dominant in the market and causes more difficulties for the smaller players which are struggling to tread water.

In order to tackle the issue of closures, one industry source suggested to ETF Stream that regulators should give investors the options to do an in specie transfer which enables them to move to another similar ETF.

This would ensure investors do not have to pay any unexpected costs and consequently encourage them to use ETFs with smaller AUM.

Opportunities would then be made for the smaller ETF issuers which are struggling to compete against the concentrated industry leaders. BlackRock controls 46% of the entire European ETF market and if one adds the next nine issuers this figure jumps to 93%, according to data from Refinitiv.

Until this is resolved, ETF closures will likely continue with innovative strategies struggling to attract assets as well as other issuers following BMO out of the door.