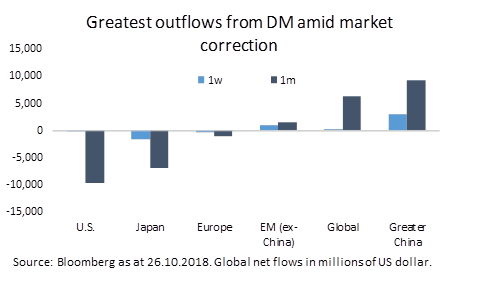

Markets had a rocky October and amidst all the action, you may have missed an interesting shift. Investors took money out of developed markets such as the US and Europe and put money into emerging markets - especially China.

You can see that in this chart from BMO Global Asset Management:

Morgane Delledonne, ETF Investment Strategist at BMO, reckons that this switch is being driven by the lower valuation offered by emerging market equities. In other words, emerging markets equities look cheap at first glance. And they look all the cheaper when you remember that China and India should be the engines of global growth in the medium and long term.

That said, there's always a reason, or reasons, for a lower valuation. With emerging markets, the current cheapness is mainly driven by concerns about a trade war, rising interest rates, and debt levels in China.

I'm not going to dig further into this debate in this article. You can read more in The Case for Emerging Markets and Time to get into emerging markets?

Instead, I'm assuming you've decided to invest in emerging markets and are trying to figure out how to do it. With that in mind, I'm going to highlight four ETFs for you to consider.

iShares Core MSCI EM IMI UCITS ETF USD (GBP) EMIM

This ETF gives you pretty broad exposure to emerging markets at a cheap price. The annual charge is 0.18%, which is cheaper than all its emerging market peers. It's also large with well over nine billion dollars under management. That means it's probably pretty liquid and the spread shouldn't be too big. The ETF tracks the MSCI Emerging Markets Investable Market Index, which includes around 5% in small-cap stocks. (The pure MSCI Emerging Markets Index doesn't have the smallcap exposure.)

There is a potential problem though. You might think the ETF is overexposed to China. Here's the geographical breakdown of the ETF:

Top ten countries

Country% of ETFChina28.4South Korea14.6Taiwan12.3India9.0Brazil7.3South Africa6.2Russia3.5Mexico2.8Thailand2.7Malaysia2.6

What's more, the exposure to China is likely to rise as more Chinese 'A' shares are gradually admitted to the index. (MSCI is gradually adding more and more Chinese mainland shares to both the MSCI Emerging Markets Index and the MSCI Emerging Markets IMI index.) Peter Sleep at 7 Investment Management thinks that China might get to 45% at the end of the process.

Still, you get even more exposure to China if you invested in an ETF that tracked the rival FTSE Emerging Index as it doesn't include South Korea on the basis that South Korea is now a developed economy rather than an emerging one.

iShares MSCI EM Small Cap UCITS ETF USD (GBP) SEMS

One way to diversify away from China is to invest in this emerging markets smallcap ETF. As you can see from this table, Chinese shares only comprise 13% of the ETF while Taiwan tops the table at 19%.

Top ten countries

Country% of ETFTaiwan19.0South Korea18.5India14.5China13.0Brazil6.2South Africa5.6Thailand4.3Malaysia3.5Mexico3.0Indonesia2.4

The ETF tracks the MSCI EM Small Cap index and there are around 1750 stocks in the index. The largest have a market value of around $1.5 billion and the smallest are only at the $25 million mark. Perhaps the biggest weakness here is the annual charge at 0.74%.

WisdomTree Emerging Markets Equity Income UCITS ETF DEMD

This ETF comprises the stocks that pay the highest dividends in the main emerging markets. (That comes to about 30% of the dividend-paying stocks.) These stocks comprise the WisdomTree Emerging Markets High Dividend Index.

Unsurprisingly, the main attraction of this ETF is that pays an attractive dividend of over 4%. That compares to zero dividend for the EMIM ETF at the top of this article.

Top ten countries

Country% of ETFTaiwan25.0China21.6Russia16.5South Africa7.7Hong Kong5.7Brazil4.2India3.5Thailand2.8Malaysia2.7Indonesia2.1

4.

iShares MSCI Brazil UCITS ETF USD IDBZ

If you want to slant your emerging markets portfolio away from China, there are a raft of single country ETFs for you to consider. In fact, the wide range of single country ETFs is one of the most attractive things about the funds. ETFs make it easy for retail investors to invest cheaply in a particular country or asset.

You might be surprised by my choice of Brazil. After all, the country suffered a serious recession in 2015/6 and its recovery since then has been slow. On top of that, it's just elected a Trump-style populist as President - Jair Bolsonaro. However, if you're prepared to look past Bolsonaro's pretty horrible political views, the country is worth considering. Don't forget that the US stock market has performed well under Trump, and the same thing may happen in Brazil. What's more, Bolsonaro may be able to push through some much-needed pension reforms, and his economic management couldn't really be much worse than his recent predecessors.

Two caveats though: firstly, unlike most markets, the Brazilian stock market performed well in October in anticipation of Bolsonaro's eventual victory. So Brazilian share prices may already reflect a lot of the potential upside here. Secondly, there's the risk that Bolsonaro's regime goes completely off the rails and proves damaging for Brazilian business.

This ETF tracks the MSCI Brazil index which comprises 54 large and mid cap Brazilian stocks. They make up around 85% of the whole Brazil market.

Top 5 sectors

Sector% of ETFFinancials33.8Materials21.7Energy13.6Consumer Staples12.0Industrials5.3

You can see from the above table the ETF is highly concentrated in financials as well as resources (materials and energy combined.) That concentration raises the risk here - along with the risk of just investing in one country.

The annual charge is on the high side at 0.74% but you'd expect that for a single country ETF.

Asia excluding China

If I was going to highlight a fifth ETF, I'd love to go for an ETF that covered Asia but excluded China. After all, there are plenty of other fast-growing economies in South Asia. Sadly though, there are no such ETFs with the appropriate UCITS status for European investors. Peter Sleep thinks they will come, so let's hope we don't have to wait too long.

For more ETF ideas, read Five top UK ETFs, Five top Japan ETFs and Five top fixed income ETFs.