If you're an SRI investor, now is a great time to ditch gun makers. If you're a value investor, now is a great time to buy them.

Gun makers share prices have tanked since the school shooting in Florida, and gun companies are under pressure like never before.

The gun makers may well deserve the hard time they get. School shootings happen in the US like nowhere else. Their frequency very probably has something to do with the country's lax gun laws, which gun companies lobby for.

After a massacre in 1996, Australia rolled in strict gun laws. There's never been a mass shooting since. Australia's experience suggests that US gun advocates - including gun companies - who argue that gun laws won't curb mass shootings are probably incorrect.

While the high school massacre in Florida was tragic and evil - what should investors and the ETF industry make of it?

1. SRI investing is more common than you think

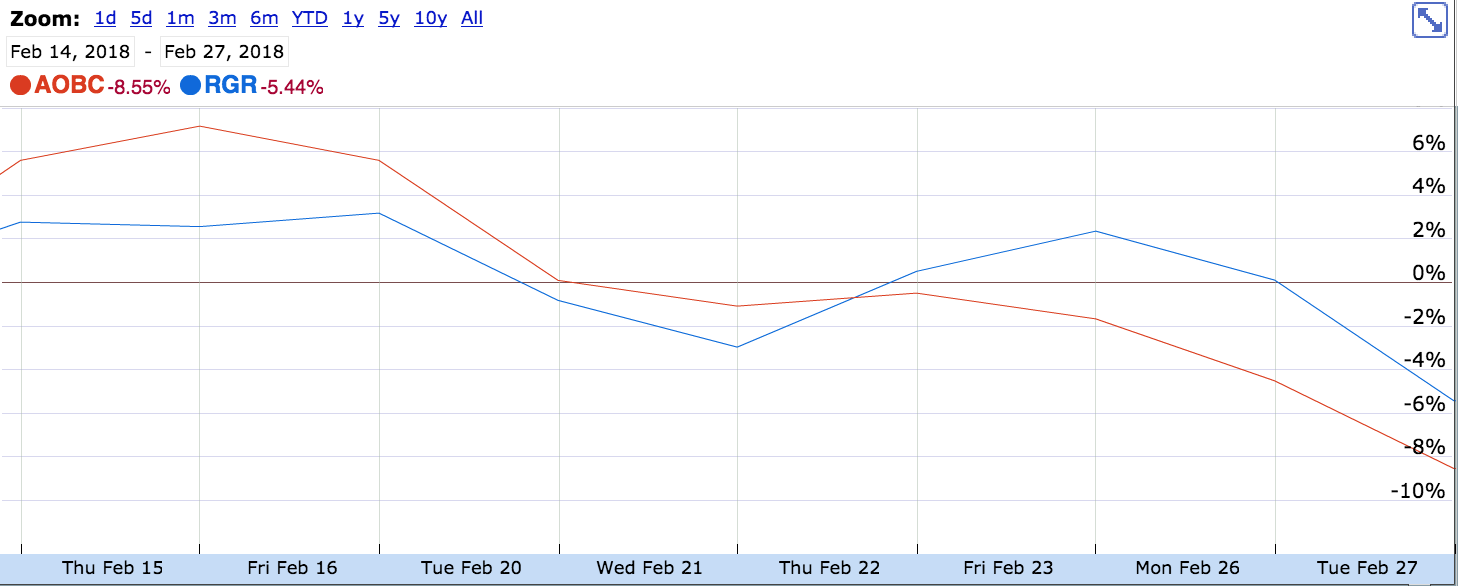

The collapsing stock prices of Storm Ruger (RGR) and the American Outdoor Brands Corp (AOBC), the two biggest publicly listed gun makers, seem to suggest that SRI investing is more prevalent than one might have thought.

[caption id="attachment_3034" align="alignnone" width="1024"] Source: Google Finance[/caption]

RGR and AOBC's nose dive appears to be, at least in part, a cry of conscience from investors rather than a response to changing fundamentals. It might be argued that investors are ditching gun companies due to fears of new gun control laws, declining sales and lower expected capital expenditure. Yet these fears - while partly true, at least for Ruger - do not quite explain the timing of the decline.

2. There's no such thing as a gun ETF

There's an ETF for everything these days - from video games to whiskey to marijuana. But interestingly there's no gun ETFs. There are ETFs with gun makers in them - for a full list

. But there are none dedicated just to guns and defense.

So if investors have a view to express on guns, ETFs do not provide a clear outlet. The nearest thing may be iShares US Aerospace & Defense ETF (ITA), although this is certainly not a gun ETF.

3. School shootings bother investors more

Past mass shootings have powered a rally for RGR and AOBC. Following the Las Vegas shooting in 2017, which left 59 dead, Ruger's stock price rose. Following the Sandy Hook school shootings in 2012, Ruger's experience a drop similar to today.

4. For value investors, gun companies are a buy

For value investors, now might be a good time to buy gun companies or ETFs that are heavy on them. Value investors like sin stocks - tobacco, alcohol, weapons and gambling - precisely for the reasons that SRI investors dislike them. As Bruce Greenwald, a professor at Columbia and grandfather of the value school of investing, says: "People have always shied away from ugly diseased opportunities. So, you can take advantage of their loss aversion."

While gun companies share prices are down now, given the history it seems unlikely that they'll be down forever. According to a Wikipedia there have been several school shootings a year in the US this decade - some of which are deadlier than others. Yet the share prices of gun makers always somehow find a way to bounce back.

But, understandably, this type of investment and the timing of it won't be for everyone. And that's probably a good thing.

Disclosure: I/we do not own, or intend to own, stocks in US gun companies.