October ETF data roundup

Inflows: money flows into ETFs all across Europe

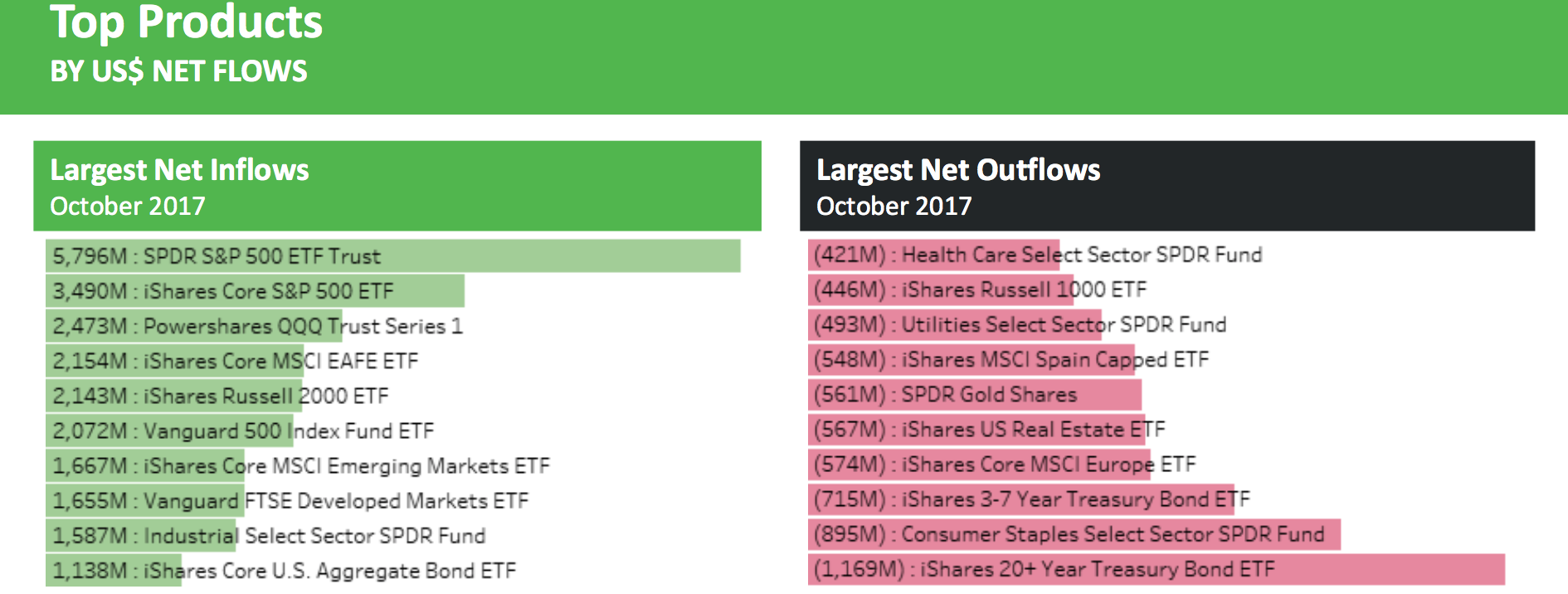

ETFs record-breaking inflow streak shows no sign of abating, with October seeing huge inflows in Europe and the US, new data by research firm Ultumus shows.

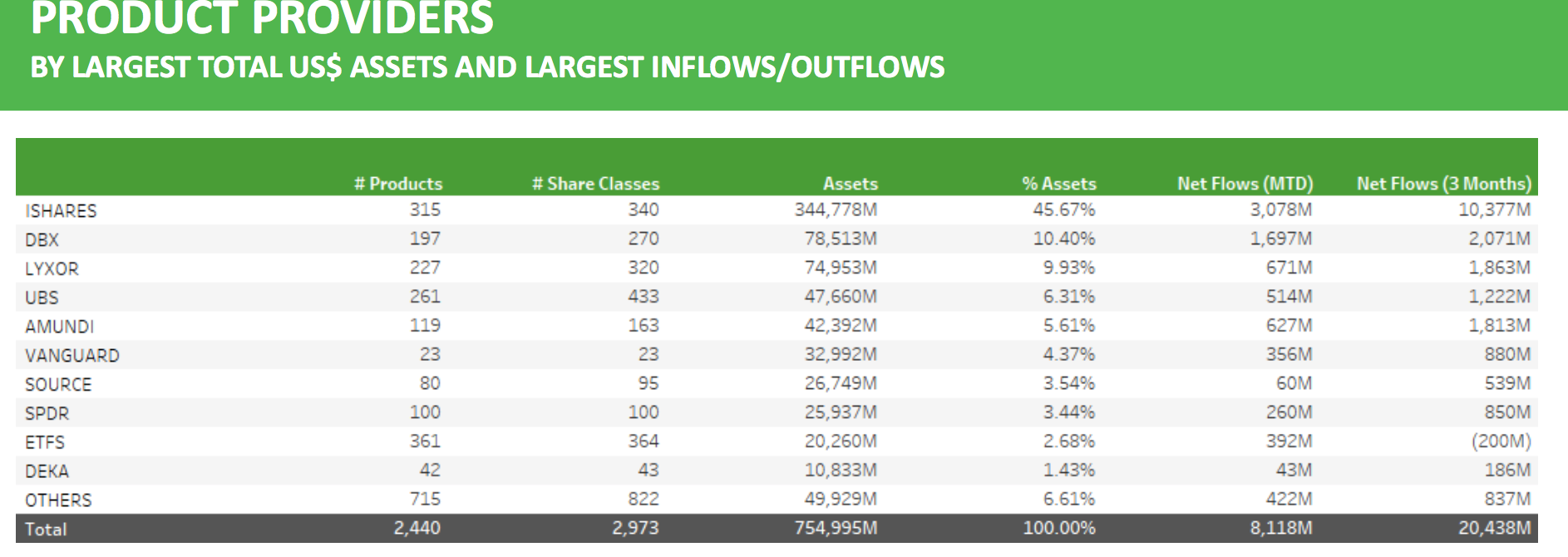

Europe: iShares continues to pull away, with 45% market share

In Europe, assets in ETFs rose 2% in October, with $8bn net inflows. Among issuers, iShares was king, with almost double assets of its nearest competitor ($3.1bn) - Deutsche Bank which saw $1.7bn - flow into its funds. October's numbers mean that iShares now has almost 46% market share in Europe, and second place is more or less tied at 10% each between Lyxor and Deutsche Bank. iShares has seen the most money flow into its funds every month in 2017.

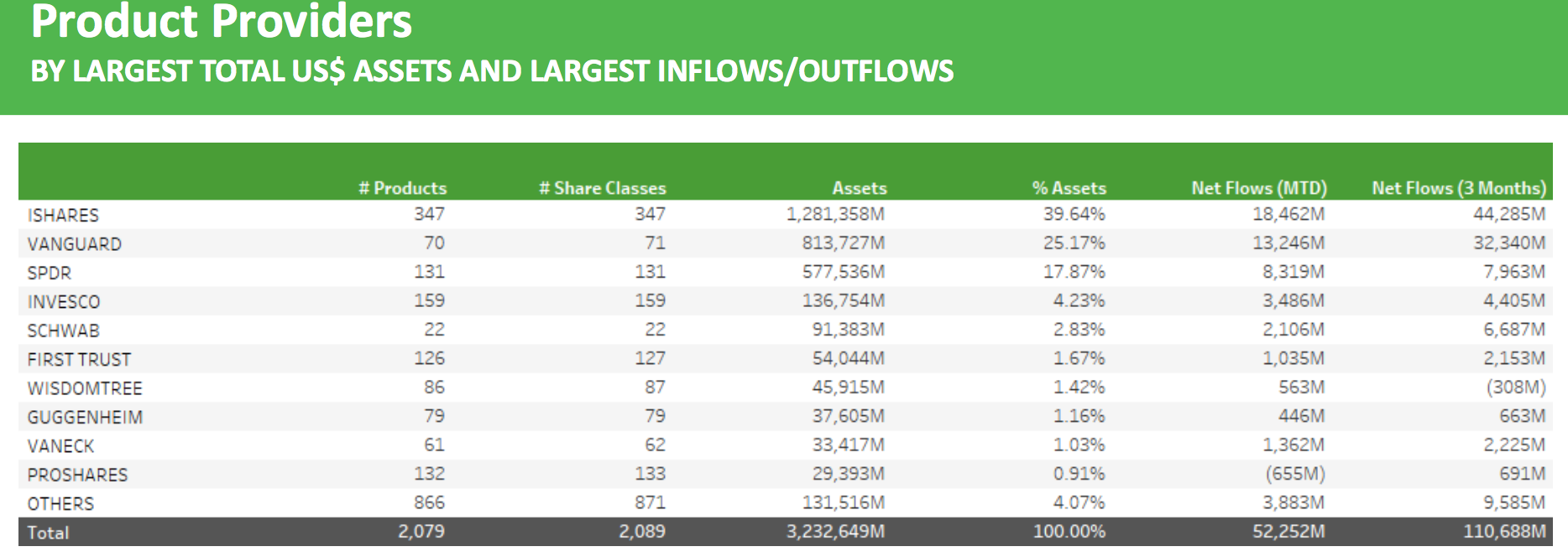

US: the big three take 82% market share

In the US, Jack Bogle's warning of an ETF "oligopoly" dominated by the "big three" seems increasingly apt.

iShares saw the most inflows in the US, with a staggering $18.5bn entering its US-domiciled ETFs. In second place was Vanguard, which saw $13bn flow in. Third place was State Street with $8.3bn.

October's flows mean that there is now even more of a gap between the big three and other issuers, with the big three now controlling 82% of the US ETF market. The fourth biggest issuer is Invesco, which has less than one-quarter of State Street's assets.

The numbers also mean that as well as more concentrated, the US ETF market is also significantly larger than Europe's at $3.2tr in assets compared to $755bn in Europe.

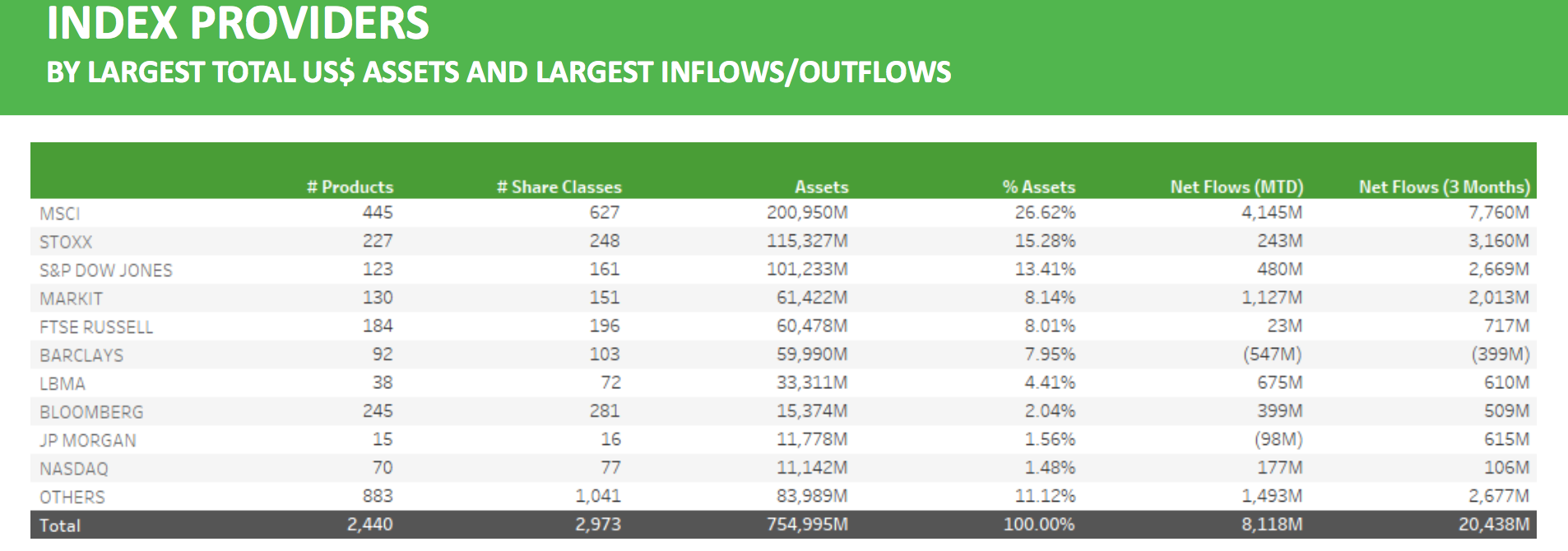

Indexes: MSCI the winner, but S&P still the biggest

Index providers are up against it these days as issuers pressure them to lower fees (if they fail to lower their fees, issuers will use in-house indexes). But MSCI emerged as the winner in this tightly fought area, with ETFs tracking its indexes seeing the largest inflows in the US and second largest in Europe.

In absolute cash terms, however, the winner was S&P, with more than $1.2tr following its indexes. This huge figure owes heavily to the popularity of the S&P500 as the world's top benchmark. The S&P500 has almost $500bn tracking it from three ETFs alone: SPY, by State Street; VOO by Vanguard; and IVV by iShares.

Delistings: no more MENU

The ETF graveyard continued to grow in October, particularly in the US. This includes a favorite of this writer, USCF Restaurant Leaders Fund with the memorable ticker MENU.