European equities have had a surprisingly good run in the first five months of the year and there are even some supportive factors that could make them more attractive than at first glance.

We last wrote about European equities several months ago and the story remains largely compelling. Euro weakness, good employment levels in Europe and GDP all support European equities.

Nikki Howes, investment associate at Heartwood Group explains that the currency weakness in the euro is good news for exporters.

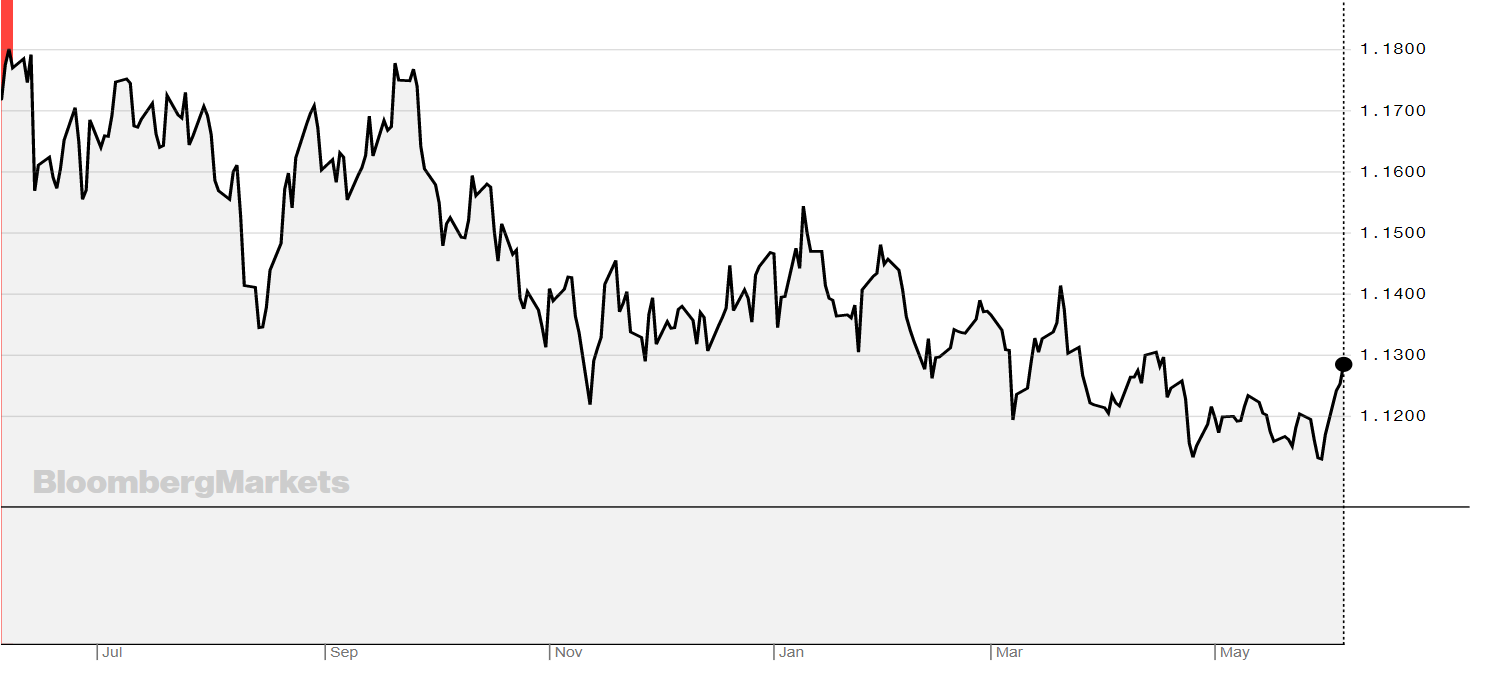

The chart below shows the EURUSD over the past year.

Source: Bloomberg

She says: "The euro has been weakening against the dollar since mid-2018. Europe exports more than it imports, meaning that its exporters can benefit from this weaker currency as it increases the value of their foreign earnings in euro terms.

"In the past, euro weakness has tended to correlate with a rising stock market in Europe, but this rise typically lags currency weakness as it takes time to show up in reported company earnings. As a result, the euro weakness experienced last year should now be good news for the stock market in the near term.

"Supportive language from the European Central Bank in March has resulted in a further drift down in the currency, which should continue to benefit European stocks.”

Other positives for Europe include low unemployment across the region backed by supporting wage growth and spending.

Unemployment in Europe is close to historic lows, putting upward pressure on wages and helping to support household spending. More importantly, the direction of travel is towards continued strengthening: unemployment has not risen once since 2014, according to the Heartwood Group report.

There are other reasons to be optimistic.

The first quarter of the year European GDP reported at a marginally better-than-expected 0.4%, while eurozone unemployment fell to a multi-year low of 7.7%.

According to James Buckley, head of pan-European equities at Barings in a note to Investment Week, European markets selling off from recent highs makes them reasonable value on a relative and absolute basis.

He says: “Greater confidence in the return of global synchronised growth is likely to be required for more value-orientated European equities to outperform global equities generally and US equities specifically…..In certain sectors, however, notably luxury consumer and selected industrial sectors, Europe does enjoy competitive advantages and these have traditionally been areas of focus for our portfolios, through names like Ferrari, Airbus and Safran in the civil aerospace sector.

“Technology, while relatively small in context of benchmark weighting, also offers opportunities for the active investor through global leaders such as ASML and Capgemini. Conversely, banks remain at best a short-term trade and within financials, we prefer insurance and speciality financials through names like AXA and Julius Baer.”

However, after last year, when European equities tanked; the EuroSTOXX 50 index fell 17% in 2018, investors should proceed with some level of caution.

Things to be aware of include potential auto tariffs, which pose risks to growth. This has arisen from President Trump's trade war discussions that have included threats over auto tariffs.

However, as Howes points out, Europe has been quick to note that it would retaliate, and in any case there appears to be little support in US Congress for the tariffs. “However, risks remain for the European auto sector, particularly with an unpredictable president who has made no bones about his dislike of Europe’s trade surplus with the US.”

The impact of Brexit also still remains unknown and the EU block remains the UK’s largest trading partner. Until it is clear how Brexit will proceed there are risks associated with it.

If you want exposure to European equities then there are several ETFs on the London Stock Exchange that track the EuroSTOXX index. There is also the THINK European Equity ETF (TEGB), which tracks the Solactive European Equity Index, which offers exposure to stocks from developed European markets that have been selected on size and liquidity.

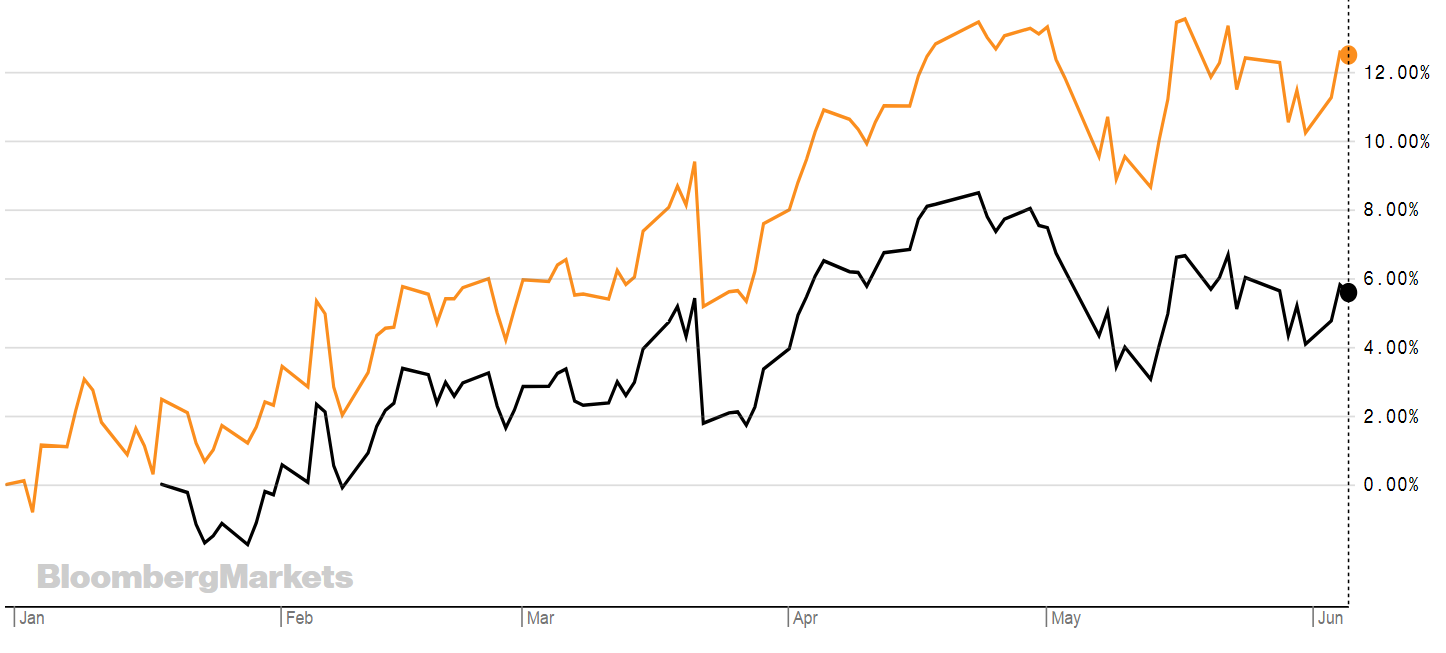

This ETF has not done as well as some of the EuroSTOXX ETFs. See the table below that pits TEGB against Lyxor’s Euro Stoxx ETF (MSED). Both are in GBP so there is no discrepancy on currency.

Source: Bloomberg

While the TEGB only launched this year there is still a discrepancy in returns.

Another strongly performing ETF this year is Franklin LibertyQ’s European dividend ETF (FLEQ), which launched in September last year, has returned nearly 13% YTD. It tracks an index that gives access to high quality large and mid-capitalisation stocks with high and persistent dividend income in developed countries in Europe.

We list some of the newer (and non EuroSTOXX) ETFs below.

TEET

TEGB

FLXD (£)

FREQ (£)

FRXD (€)

FLEQ (€)

ETFYTD RTNTERINDEXThink European Equity UCITS ETF-0.53% (3month)0.20%Solactive European Equity Index, which offers exposure to stocks from developed European markets that have been selected on size and liquidityThink European Equity UCITS ETF3.39% (3 month)0.20Solactive European Equity Index, which offers exposure to stocks from developed European markets that have been selected on size and liquidityFranklin LibertyQ European Dividend UCITS ETF7.41%0.25%The LibertyQ European Dividend (Net Return) Index which gives exposure to high quality large and mid-capitalisation stocks with high and persistent dividend income in developed countries in EuropeFranklin LibertyQ European Dividend UCITS ETF10.81%0.25%The LibertyQ European Dividend (Net Return) IndexFranklin LibertyQ European Dividend UCITS ETF9.45%0.25%The LibertyQ European Dividend (Net Return) IndexFranklin LibertyQ European Dividend UCITS ETF12.91%0.25% The LibertyQ European Dividend (Net Return) Index