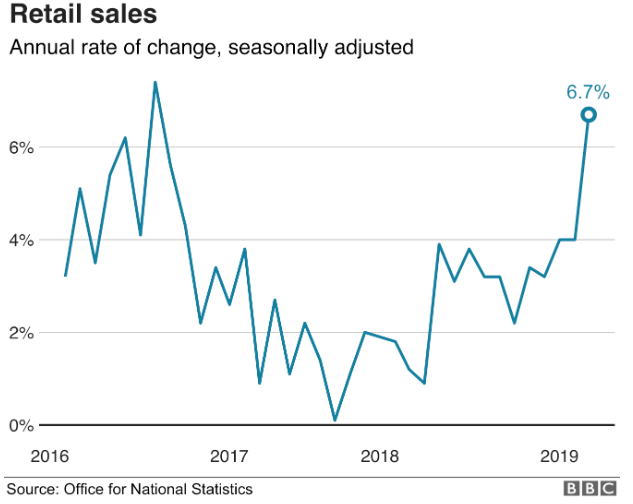

The ‘beast from the east’ hit the UK 14 months ago and resulted in a fall in shoppers hitting the high street. With no repeat in snow storms this year and a milder March, retail sales saw a jump with a year-on-year growth of 6.7%, according to the Office for National Statistics, the highest recording since October 2016.

Food stores recorded an annual rise of 3.3% with clothing and footwear stores seeing 7.1% increase from the previous year. The only shops to struggle last month were department stores which fell 0.3% with the likes of Debenhams entering administration in the last few weeks.

2018 faced the worst foot traffic for Christmas shopping in a decade which saw the sectors’ ETFs drop significantly like the rest of the equity market.

As a result of shoppers being more carefree with their debit cards in Q1 2019, both consumer staples and consumer discretionary ETFs have been offering attractive returns. The SPDR MSCI Europe Consumer Staples ETF (CSTP) produced returns of 16.9% over the Q1 period. Similarly, the SPDR MSCI Europe Consumer Discretionary ETF (CDIS) produced 15.9% for the same period.

CSTP holdings include Nestle (coffee, chocolate and pet food), British American Tobacco (cigarettes) and L'Oreal (body care) and CDIS holdings include Adidas (sportswear) and car manufacturers BMW and Volkswagen.