Environmental and social governance (ESG) ETFs are promoting unemployment and winner takes all capitalism, a challenging new report has found.

ESG ETFs have outperformed in recent years, leading many ethical investors to feel validated. You can be virtuous and get rich playing the stock market at the same time, recent numbers seem to suggest.

But much of the outperformance of ESG has come from betting on companies that kill jobs, a new review by Vincent Deluard, head of macroeconomic research at INTL FCStone, has found.

This bias against jobs stems from the negative screens that ESG ETFs often use. One example is labour standards screens that require things like equal pay for women or fair treatment of trade unions.

While the ideals are noble, the labour screens that ETFs use are more likely to exclude big employers, the study found. This is because companies with more employees are more likely to have labour issues and pay gaps. As such, the net result of ESG screening can be that job-rich companies are removed from ESG ETFs. Meanwhile, companies that create no jobs at all - and by extension, no jobs for women, and no trade unions - make the cut, because there are no labour issues.

Is passive really aligned on ESG?

Another example is carbon intensity screens. These screens tend to exclude ‘old economy’ manufacturing businesses, like companies that run large factories. Factories produce more carbon dioxide than the air-conditioned corporate offices used in services industries. But these old manufacturing businesses tend to employ more people per unit of output.

Deluard explained: “Companies with no employees do not have strikes or problems with their unions. There is no gender pay gap when production is completed by robots and algorithms. Biotech labs where a handful of PhDs strive to find the next blockbuster molecule have no carbon footprint.”

It is largely because of this – betting against jobs – that ESG ETFs have done so well during the coronavirus. The coronavirus hit airlines, retail and manufacturing businesses the hardest. These industries employ more people and are also more likely to be removed or watered down by ESG filters.

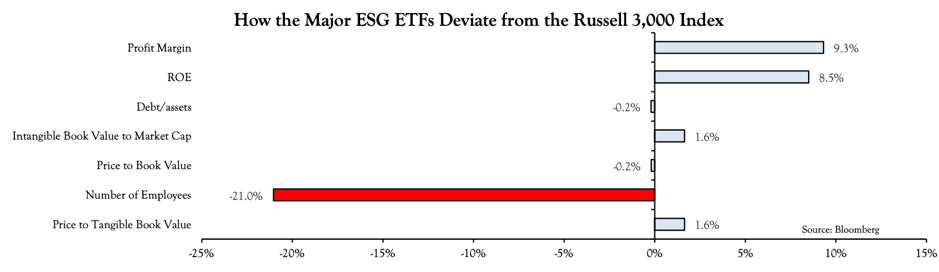

The study took the ten largest ESG ETFs listed on American exchanges. It then looked at the companies these ETFs held, and the weights in which they held them, and compared them to the US share market as a whole.

Old media companies: market cap per employee

EmployeesMarket Cap ($M)Market cap per employee ($M)New York Times45006,500.01.4News Corp230007,100.00.3ViacomCBS2399013,800.00.6Comcast190000182,250.01.0

Source: ETF Stream

It found that ESG ETFs usually buy more technology and healthcare companies, in spite of index providers efforts to remove any strong bets on sectors. They also tend to buy more ‘quality’ companies – which are businesses with less debt and higher profit margins. These sectors – and these types of companies – have done very well the past decade.

But the study found the biggest difference by far between ESG ETFs and the market was that they invested in companies that created less jobs.

New media companies by market cap per employee

EmployeesMarket Cap ($M)Market cap per employee ($M)Facebook4500068,254.01.5Twitter460026,000.05.7Google119000968,050.08.1

Source: ETF Stream

"Sure, qualities like strong margins, profitability, and balance sheet strength were helpful in 2020," he concluded.

"But by and large, the best strategy would have been to do exactly what ESG ETFs unconsciously do: sell companies with lots of employees, and buy ones with lots of robots, patents, and intellectual property."

"ESG criteria effectively screen out companies with a lot of employees...the average company in the ESG basket has 20% fewer employees than normal."

If the study's findings are accurate, it is hard to say conclusively if ESG ETFs really are more “social” – the ‘S’ in ESG – than regular old total stock market ETFs. As many people regard full employment as a crucial social outcome.

Facebook dumped as ESG grows muscle

More fundamentally, Deluard argued that ESG ETFs could be helping to promote a kind of post-employment capitalism. By sending more money towards job-killing companies, ESG ETFs help raise their share prices. This then makes it easier for them to grow.

“ESG investing unintendedly spreads the greatest illnesses of post-industrial economies: winner takes-all capitalism, monopolistic concentration, and the disappearance of jobs for normal people," he wrote.

"As Saint Augustine observed in the 5th century in “the City of God”, the physical world is messy, chaotic, and sinful. ESG’s insistence of virtue is ultimately orthogonal with humans’ fallen nature. Only angels and robots never sin. ESG investors unwillingly pave the way for a perfect world which has no place for humans."

***

Image: The Temptation of Christ on the Mountain, by Duccio di Buoninsegna. The medievals saw ethical investing as an oxymoron.

Sign up to ETF Stream’s weekly email here