The month of February saw the largest inflows for the US funds market in the last 12 months with $53.5bn, according to Morningstar's latest Fund Flows Commentary report. Passive funds collected $42.2bn, significantly higher than active funds which had inflows worth $11.4bn, only the fifth month active funds have seen flows in excess of $10bn in the past three years.

The asset manager which received the biggest inflows for the month was Vanguard by a significant margin. With total net flows in excess of $20.5bn for both active and passive funds, Vanguard shadowed iShares, SPDR and Invesco which had combined inflows of only $10.4bn.

Asset ManagerActive ($m)Passive ($m)February Total ($m)Vanguard3,57116,97720,548Fidelity3109,1629,472iShares3626,8057,168American Funds3,505-3,505Dimensional Fund Advisors2,914502,964PIMCO2,1911592,351SPDR State Street1091,7701,879T. Rowe Price1,421881,509Invesco-8512,1721,321Franklin Templeton-1,30297-1,204

Morningstar ranked the 10 largest asset managers by total assets under management. Second to Vanguard's $20bn worth of inflows was Fidelity with $9.5bn, $9.2bn of which came from passive funds. iShares and State Street broke in to the top 10 with inflows worth $7.2bn and $1.9bn, respectively, both heavily contributed by their respective passive funds. Franklin Templeton was the only top-10 firm to see negative flows for the month, with outflows of $1,204.

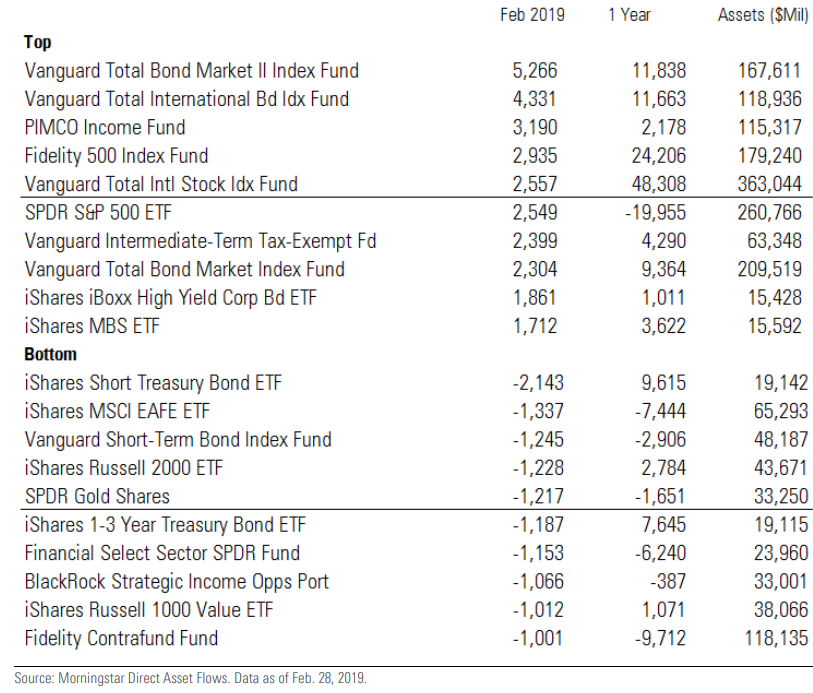

Morningstar also reported the top 10 funds which saw the largest inflows and outflows for the period. Vanguard owns three out of the top five index funds with the largest inflows for February, contributing $12.5bn to its total inflows. The SPDR S&P 500 ETF (SPY), the largest ETF on the list in terms of assets under management, pulled in $2.6bn for the month which added to its $260.8bn total AUM.

On the other end of the spectrum, iShares has five ETFs appear in the 10 largest outflows, summing up to $6.9bn. Only one ETF saw outflows in excess of £2bn, which was the iShares Short Treasury Bond ETF which lost $2.1bn.