Passive US equity funds reached $4.3trn at the end of April, equalling that of its active counterpart, according to Morningstar’s US fund flow commentary.

In the US, the gap between active and passive narrowed even more as passive US equity funds received $39bn in new cash for April while active funds saw outflows of more than $22bn. If we extend the current total assets by a couple more decimal places, active funds remain just ahead by $6bn. Morningstar says the flows for May will almost certainly show passive US equity funds overtake active.

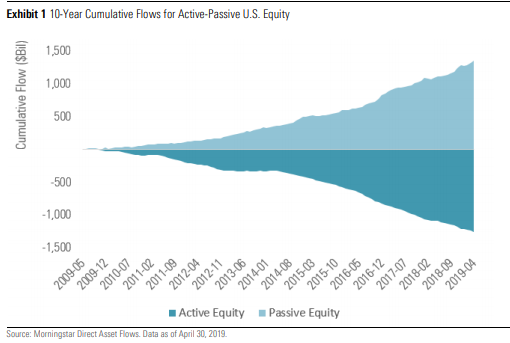

The growth within the US equity group remains underwhelming, however. The inflows into passive funds are largely matched by the outflows of active funds, suggesting the asset class has only collected $86bn in new money for both active and passive funds over the last 10 years.

The SPDR S&P 500 ETF (SPY) had the largest inflows of any funds in April, pulling in $5bn. A second S&P 500 ETF appeared in the top 10, the iShares Core S&P 500 ETF which attracted $2,6bn. SPDR State Street and iShares’ US passive inflows for April were $7.2bn and $8.1bn, respectively, with Vanguard receiving $6.3bn.

It was Fidelity Investments which topped the charts, receiving $31bn in passive funds. This followed the ETF issuer expanding its commission-free ETF platform in February this year. In tandem with its significantly large passive inflows for the month, Fidelity's active funds suffered $2.8bn worth of outflows.