BetaShares is listing Australia’s first green bond ETF, with seeding from Future Super, an environment-focused superannuation fund.

The BetaShares Sustainability Leaders Diversified Bond ETF (GBND), which is the company's fifth new ETF to list this week, will track an index of green bonds and bonds issued by companies and governments judged to be doing the right thing.

The index excludes the familiar corporate baddies of alcohol, porn, weapons, gambling, animal cruelty. But further excludes companies that have no women on their boards of directors as well as those that bust trade unions.

It then buys bonds that the investment committee, on which Future Super has a seat, is satisfied are not making the world a worse place. The fund also buys green bonds, which are bonds that are used to fund environmental initiatives.

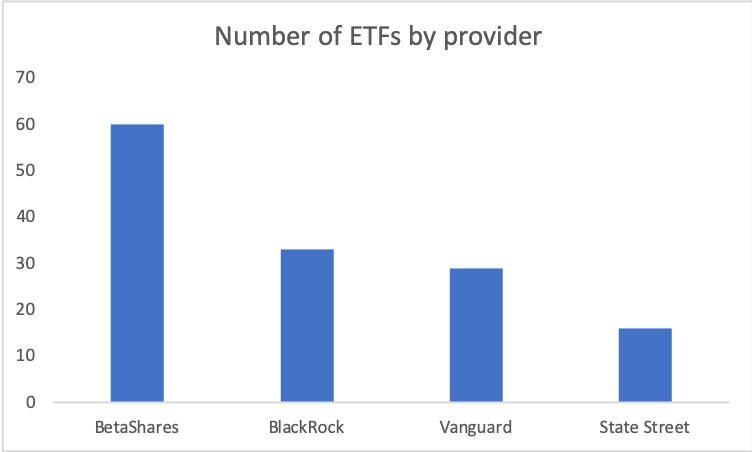

The listing follows hot on the heals of BetaShares multi-asset ETFs, which began trading this week. They bring BetaShares total number of ETFs on the Australian market up to 62 by our count, giving it a far larger fleet of ETFs than any other provider.

While Australia already has an ESG bond ETF, thanks to Vanguard. And also has ESG bond index funds, via BlackRock, BetaShares new listing is the first to provide a green bond ETF.

BetaShares lists multi-asset ETF

At this stage, it is unclear who else will sit on the investment committee, which as ultimate say on which bonds go in the fund.

Future Super have seeded previous BetaShares ESG ETFs, such as the BetaShares Australian Sustainability Leaders ETF (FAIR), which was seeded with $50 million in 2017.

BetaShares did not immediately respond to a request for comment.

Analysis – BetaShares Marvellous Medicine

BetaShares has a massive 62 ETFs trading on exchange. The average running cost for an ETF is usually said to be $150K - $200K a year. (Relatedly, breakeven assets are usually cited as $50M, depending on fees). Meaning that BetaShares spends around $10 million a year just to keep all these products going. It’s a massive and impressive capital commitment.

However, a huge product fleet requires a lot of resourcing. In a recent review, Zenith, the influential research house, wondered if BetaShares should hire more staff given how quickly its offering has grown.

BetaShares lists India ETF with help of Solactive

“Zenith notes that the BetaShares product suite has expanded rapidly in recent years and while it has not presented any adverse issues to date, Zenith believes the investment team is less well-resourced compared to peers,” Zenith said.

The good news here is that BetaShares holds over $9 billion in its ETFs - an amazing achievement for a local company. So there should be enough fee revenue to add resource.