The Financial Conduct Authority (FCA) has proposed a raft of fresh measures in a bid to clamp down on fund greenwashing.

The UK regulator has suggested several new measures including sustainable investment labels and consumer-facing disclosures to boost consumer trust, making the key sustainability features of a product much clearer under its Sustainable Disclosure Regulation (SDR).

It will also look to introduce detailed disclosures such as pre-contractual disclosures, ongoing sustainability information and a sustainability entity report for institutional investors.

Asset managers will also be restricted in the use of certain sustainability-related terms in product names and marketing materials, unless it uses a sustainable investment label, while product distributors will also ensure the information is available to consumers.

In addition, the FCA wants to introduce a blanket ‘anti-greenwashing’ rule for all regulated firms to ensure sustainability-related claims must be clear, fair and not misleading.

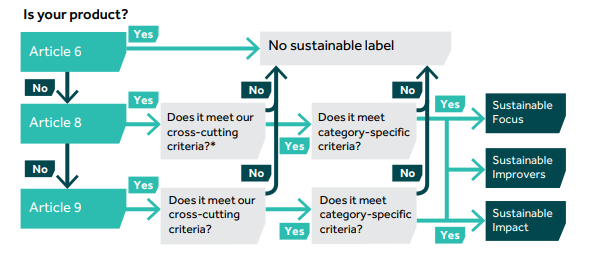

Regarding the sustainable investment labels, the FCA has proposed three names based on the objective they are seeking to achieve, these are ‘sustainable focus’, ‘sustainable improvers’ and ‘sustainable impact’, with funds needing to prove they meet the criteria for each one.

Last November, the regulator announced these labels would be called ‘transitioning’, ‘aligned’ and ‘impact’.

The new proposals lean into the labelling of ESG products, exactly what the European Commission was trying to avoid with the Sustainable Finance Disclosure Regulation’s (SFDR) Articles 6, 8 and 9, which have become de facto labels since their introduction in March last year.

Source: FCA

Disclosures will also differ, with the FCA’s proposals requiring “more granular information” despite not requiring funds to disclose “do no significant harm” – a key element to SFDR which the FCA deems “too restrictive at this stage”.

In September, research by Morningstar found 23% of funds labelled Article 8 under SFDR did not meet the index provider’s criteria of an ESG fund.

Sacha Sadan, director of ESG at the FCA, said: “Greenwashing misleads consumers and erodes trust in all ESG products. Consumers must be confident when products claim to be sustainable that they actually are. Our proposed rules will help consumers and firms build trust in this sector.

“This supports investment in solutions to some of the world’s biggest ESG challenges. This places the UK at the forefront of sustainable investment internationally. We are raising the bar by setting robust regulatory standards to protect consumers in line with our wider FCA strategy.”

Commenting on the proposals, Becky O'Connor, head of pensions and savings at interactive investor said: "The proposals are a necessary and positive intervention in the market for green and sustainable financial products.

"Investors who want to make their money make a difference need to be able to trust that the investment they are buying actually does what it says on the tin. With so many different and often conflicting rating systems and definitions currently floating around, it can be hard to know what investments are truly helping the planet and easy to lose faith in the whole idea of sustainable investment.

"The FCA's measures should go a long way to restoring faith and eliminating exaggerated and downright misleading marketing of financial products. Moves towards official definitions and labels are a welcome development."

The regulator has been turning the screw on asset managers’ sustainability credentials in recent months.

In a Dear CEO letter published in September, it said misleading construction of ESG benchmarks had the potential to create a “trust deficit” for investors of sustainable ETFs.

ESG regulation across Europe is also coming to an inflection point, ahead of the arrival of SFDR ‘level 2’ requirements in January.

Related articles