A decisive 86% of asset managers rely on the Sustainable Finance Disclosure Regulation (SFDR) to define sustainable investment, according to a recent survey from EY, which is problematic given the regulation itself has yet to draw clear boundaries on what can and cannot be considered sustainable.

The survey of 22 asset managers, with $37trn assets under management (AUM), found the vast majority rely on the EU’s sustainable reporting and categorisation framework to set the parameters of sustainable investment they apply in their own internal policies.

In fact, just 60% of firms surveyed, including 11 managing more than $1trn, had articulated their own stance on the scope of activities they considered to be sustainable while just 45% had articulated which activities they deemed unsustainable, the survey said.

Reliance on a prominent ESG framework from an international regulator such as the EU, rather than one from a private organisation, is a justifiable approach for many fund providers, especially after Brown Brothers Harriman’s annual ETF survey found SFDR is the main tool used by European investors when assessing ESG ETFs.

However, this creates a dilemma when the European Securities and Markets Authority (ESMA) has yet to define what it deems to be sustainable under Article 2 of SFDR.

Because of the lack of clear definition, ESG ETFs housing over €50bn have been voluntarily downgraded from ‘dark green’ Article 9 to ‘light green’ Article 8 ahead of the incoming ‘level 2’ in January 2023, after the European Commission did not clarify whether Paris-Aligned Benchmark (PAB) and Climate Transition Benchmark (CTB) funds automatically fulfil necessary sustainability criteria.

“As European regulators aim to make the presentation of ESG considerations more uniform and comparable, the asset management industry is facing challenges in implementing SFDR,” EY said. “This is due to limited implementation guidance on the regulatory technical standards and varying interpretations across the market on defining a sustainable investment and managing sustainability risks effectively.”

How do existing ESG funds stack up against SFDR?

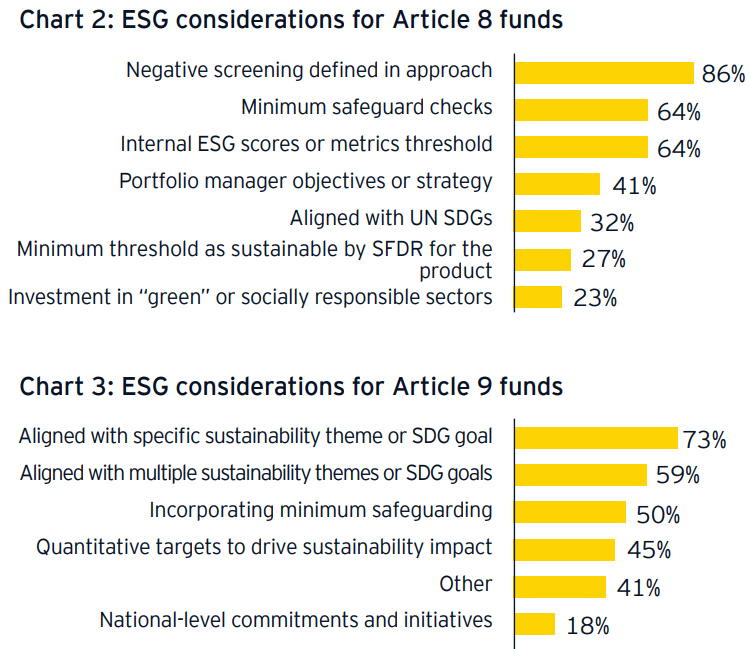

The survey also found 86% of respondents rely on economic activity classification – or how companies’ businesses are treated by ESG frameworks – when considering whether a company can be viewed as a sustainable investment, however, EY warned this “alone is not sufficient to define a sustainable investment”.

In an effort to use a combination of criteria to determine the sustainability of an investment, some 73% use sustainability indicators and thresholds while 59% consider companies’ commitment to and disclosure against the UN’s Sustainable Development Goals (SDG).

Another issue to consider is asset managers’ views on different categories of SFDR. The survey found 45% of firms expect at least 90% of a fund’s assets will need to have a sustainable objective to align with Article 9 while only 23% expect to define a threshold below 80%.

EY said thematic investment has been the most popular approach for aligning funds with Article 9 criteria to-date, however, it noted there has been debate over whether a 100% sustainable investment threshold is attainable for any fund.

It then pointed to Morningstar data, which show less than 5% of Article 9 funds currently achieve at least 90% exposure to what it deemed sustainable investment exposure.

Uncertainty over the sustainability credentials of Article 8 funds is even more pronounced. In fact, the survey showed 55% of asset managers have no minimum threshold for sustainable investment within their Article 8 products, meaning these funds could have “potentially very low” ESG exposure, the survey said.

Funds within this category tend to offer sustainability methodologies ranging from negative screening, ESG scores and minimum safeguard checks which result in roughly 30% of underlying assets being aligned with sustainable investment objectives. EY suggested this creates “greenwashing risk”, given the “lack of prescriptive standards” for Article 8 funds.

Source: EY

EY concluded: “The current state of play demonstrates that challenges persist in areas of implementation including defining sustainable investment definitions, ESG data, EU taxonomy alignment and the classification of Article 8 products.

“However, the survey also highlights industry progress in developing sustainable investment considerations, the standards for Article 9 products, the adoption of PAIs and the setting of ESG ambitions.”

Related articles